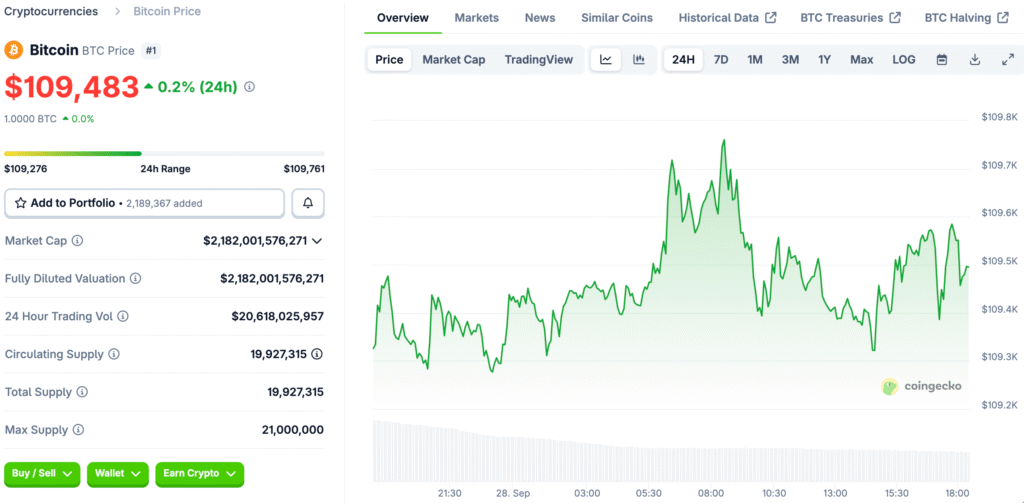

Bitcoin Prices Quickly Break Important Support Levels

Traders were surprised when Bitcoin’s price fell below $109,000 because they thought there would be stronger support near previous resistance areas. The sharp drop caused a lot of leveraged positions to be liquidated, which made the market more volatile during important trading sessions this week.

Sellers took control of the early Asian sessions, pushing Bitcoin prices down hard. Later, spot buyers tried to stabilize the markets. Data showed that big companies were putting more pressure on the market to sell, which could mean that prices will keep going down unless demand picks up a lot in the next few sessions.

Data Reveals Spot Buyers’ Increasing Accumulation Efforts

Even though the market was going down, spot buyers started to increase the size of their purchases, which showed that they were confident in the current price levels. When Bitcoin briefly hit $108,865, accumulation sped up a lot. This caused several major bids to go off at the same time on several exchanges.

The way the spot market is changing right now could mean that a short-term floor is forming around current levels. Futures trading is still the most common type of trading, but spot buyers are becoming more interested again, which could help stabilize the market.

Liquidation Heatmaps Show Bearish Risks Persisting

Hyblock’s liquidation heatmap data shows that there are a lot of liquidations happening between $111,000 and $107,000. This puts leveraged longs at a lot of risk of losing money. Bears are still targeting these clusters in an effort to force cascading liquidations by selling aggressively.

When dominant sellers take advantage of liquidity pockets, these kinds of patterns often happen before long downward moves. Traders who are watching these levels are expecting possible stop runs that could push Bitcoin even lower if the momentum keeps going.

Recommended Article: Bitcoin Price Holds $111K As Bears Dominate Market Sentiment

Institutional Futures Activity Overwhelms Retail Spot Demand

Perpetual futures markets are still the main reason for daily price changes, and institutional investors are much more common than retail investors. Big companies that own between $1,000 and $10 million are still putting pressure on the market to sell, making it hard for small investors to buy.

Retail traders, who usually only hold positions worth between $100 and $1,000, are stepping in at lower levels but still feel overwhelmed. This imbalance keeps the market volatile, which makes it hard to make short-term reversals without coordinated buying support from institutions.

The Bid-Ask Ratio Shows Bullish Pressure Coming Up

The bid-ask ratio is one important sign of optimism. It recently moved back toward buyers after a long period of selling pressure. A positive ratio means that there are more buy orders than sell orders. This means that demand is higher at the current price levels.

This bullish shift is similar to what happened earlier in September, just before a big price rise. Traders see this as an early sign that people in the spot market are trying to buy up selling and take back control.

Volume Delta Charts Show More Buyers Are Active

Anchored cumulative volume delta charts show that buy volume has been rising during recent dips, which confirms that aggressive buyers are buying near important support levels. When Bitcoin prices fell to around $110,553, there was a lot of bid stacking on the spot exchange. This suggests that people were strategically accumulating.

People often buy like this before attempts to reverse the trend, especially when institutional sellers slow down their activity for a short time. Analysts are keeping a close eye on whether this momentum can last and build a solid base for another rise.

Bitcoin Could Revisit $107K If Institutional Selling Pressure Continues

Overall, the market structure shows that aggressive bears are trying to break down and strong bulls are stepping in to buy. Bears control the triggers for liquidation, and bulls rely on strong spot buying to keep the momentum going.

Bitcoin could go back to the $107,000 level if institutional sellers keep up the pressure. On the other hand, if spot accumulation picks up even more, a quick recovery like the one that happened in early September could happen quickly, catching bearish traders off guard.