Ethereum Exchange Balances Hit All-Time Lows

According to Glassnode data, the amount of Ethereum held on centralized exchanges is at its lowest level since 2016. Exchange balances are currently at 14.8 million ETH, and they are going down faster as institutions take over the accumulation trends.

Analysts say this shows a strong move toward other storage options, such as staking and cold wallets. The data shows that more institutions are interested in Ethereum and there is less pressure to sell, which sets the stage for long-term stability.

Declining Balances Reflect Ongoing Multi-Year Trend

Since mid-2020, Ethereum exchange reserves have been steadily going down, cutting the amount of available supply by almost half. This means that investors would rather use custody solutions like self-hosted wallets, staking platforms, or DeFi protocols.

Historically, when there is less supply on exchanges, it means that market sentiment is stronger and long-term price targets are higher. Market analysts think that this trend will keep going, which will keep bullish stories about Ethereum adoption and price stability going.

Net Outflows Accelerate to Multi-Year Highs

This week, CryptoQuant reports show that Ethereum net flows are at their highest level since late 2022. The 30-day moving average shows that withdrawals from centralized platforms are still going strong.

Analysts see this as a bullish sign that liquidity is low and confidence in accumulation is high. Ongoing withdrawal activity strengthens Ethereum’s shift into a digital asset that is held by institutions and generates income.

Recommended Article: BitMine Buys $1.1B Ethereum as Stock Falls After Sale

Glassnode Confirms Historic Exchange Withdrawals

According to Glassnode, there was a change of -2.18 million ETH in exchange positions on Wednesday. Over the past ten years, this steep drop has only happened five times.

These big outflows show how big Ethereum’s current accumulation wave is. Analysts say that lower exchange balances could make scarcity worse, making price changes in response to buying pressure even bigger in the future.

Corporate Treasuries Strengthen Accumulation Levels

Tom Lee’s BitMine is one of the biggest companies that has driven up demand for Ethereum in 2025. BitMine alone has more than 2% of the total amount of ETH in circulation.

According to StrategicEthReserve, 68 companies have bought 5.26 million ETH since April. This means that billions of dollars in institutional investments are being staked instead of kept on regular exchanges.

ETFs Increase Institutional Ethereum Exposure

Ethereum ETFs that are listed in the US now hold 6.75 million ETH, which is worth almost $28 billion. These items make up 5.6% of the total amount of Ethereum that is currently in circulation.

When you add in treasury holdings, institutions now own about 10% of all ETH in the world. Analysts think that ETF inflows will pick up even more as more people start using them.

Ethereum’s Wall Street Glow-Up Gains Momentum

Rachael Lucas, an analyst at BTC Markets, called Ethereum’s rapid rise in value a “Wall Street glow-up.” She talked about how treasuries, ETFs, and withdrawals from exchanges all point to long-term growth potential.

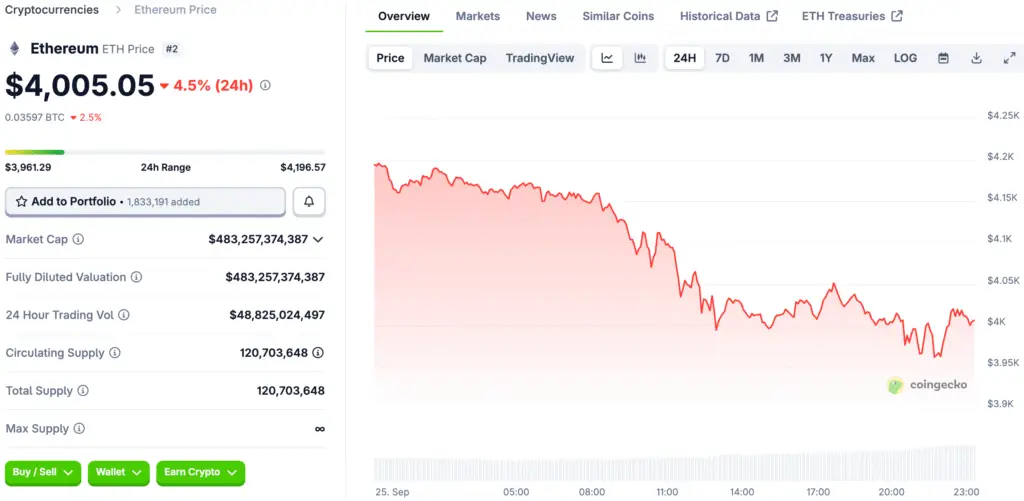

Even though the price recently dropped 11% to below $4,100, demand is still strong. Ethereum is still drawing in institutional investors, making it a key part of future digital financial systems.