Mutuum Finance Presale Momentum Gains Strength

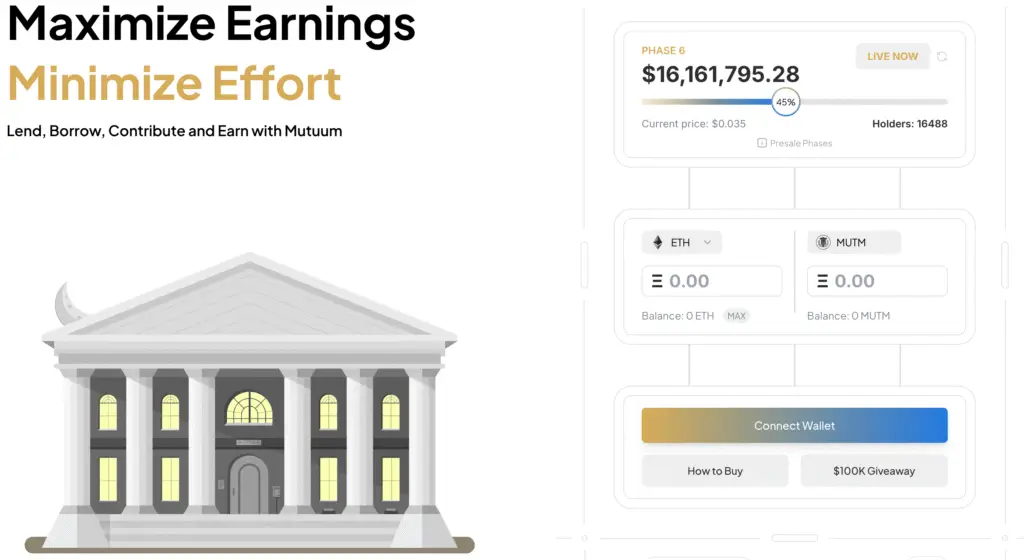

Mutuum Finance has raised more than $16 million in presale funding, which is a big deal because there is still a lot of interest from investors. The presale is now in Phase 6, and the price of the MUTM token is $0.035. Almost half of the tokens have already been sold.

More than 16,400 people have already signed up for the offering, which shows that a lot of people believe in the project’s long-term plans. The next stage is set at $0.04, so the launch price of $0.06 could be a big reward for early investors.

Development Advances Into Roadmap Phase Two

The roadmap says that Mutuum Finance has already finished its first phase, which included finishing important building blocks. The second phase of development is now underway. It focuses on smart contracts, front-end systems, and risk frameworks.

The team has made it clear that launching the token at the same time as the platform will make it more likely to be listed on exchanges. This alignment could make the MUTM token even more popular and easy to trade when the platform goes live.

Introducing Mutuum’s Lending and Borrowing Model

Mutuum Finance has created a decentralized system for lending and borrowing that gives users freedom and liquidity. Lenders put their assets into pools and get mtTokens in return. These tokens are like deposits and automatically earn interest over time.

Borrowers can get loans without having to sell their main assets. They can use assets like ETH as collateral and still be exposed to the market. This makes things more liquid and lets users keep the potential for growth in their digital assets.

Recommended Article: Mutuum Finance Plans Roadmap Update Before Platform Launch

Dual Lending Layers: P2C and P2P Flexibility

The platform has both peer-to-contract (P2C) and peer-to-peer (P2P) structures. P2C supports popular tokens like ETH and USDT through automated liquidity pools, which keep things stable and make loans happen quickly.

The P2P marketplace lets you lend higher-risk assets like SHIB or DOGE and lets you negotiate the terms of the loan. This layered design increases asset coverage while lowering the risk concentration in pooled lending markets.

Mutuum Stakers Earn Dividends as Fees Drive MUTM Token Value Up

By staking their mtTokens, participants in Mutuum Finance can lock them up for MUTM dividends, which increases the amount of money they can make. Protocol fees are used to buy MUTM from the market, which puts pressure on the price to go up.

This system directly supports the value of tokens and encourages people to stake them for a long time. It makes an ecosystem where both token stakers and liquidity providers benefit from the platform’s growth in a way that helps both.

Testnet Beta Launch On The Horizon

The roadmap includes a testnet beta phase coming up that will let users try out platform features before they are officially released. At this stage, participants can safely use the lending, borrowing, and staking features in a demo environment.

The goal of testnet participation is to help make the protocol better before it is fully released. Getting people involved in this phase will make it easier for them to use the product when it comes out.

Mutuum Finance Sets Foundation For Multi-Chain Future

Mutuum Finance is built on Ethereum, but it wants to grow into multi-chain deployment so it can reach more ecosystems. The protocol is a full borrowing and lending solution because it combines pooled lending with P2P flexibility.

Mutuum Finance is still getting a lot of attention from investors. They have raised $16 million, brought on 16,400 holders, and have a strong roadmap. Its presale success and focus on security make it look like it could become a major player in DeFi lending.