Ethereum Builds Momentum Toward Higher Targets

Ethereum is trading close to $4,513 after holding steady between support levels of $4,400 and $4,500, showing strength despite recent price swings. Analysts say that ETH needs good macroeconomic trends, more people using DeFi, and better scaling to keep going up to $7,000 or $10,000.

Momentum indicators show that bullish setups are still in place, thanks to stable trading volume. Investors think of ETH as the leader in smart contracts, but it may not grow as quickly as new opportunities like Mutuum Finance in 2025.

ETH’s Market Position Remains Strong

Ethereum is still the most important platform for smart contracts because it has more developers and institutions using it than any other platform. Its reputation as a foundational blockchain keeps long-term investors in, which means less reliance on short-term speculation.

Still, ETH returns may seem low compared to newer tokens that can grow very quickly. That comparison shows why capital is moving into presales like Mutuum Finance, which are thought to have better short-term growth potential.

Mutuum Finance Presale Momentum Builds

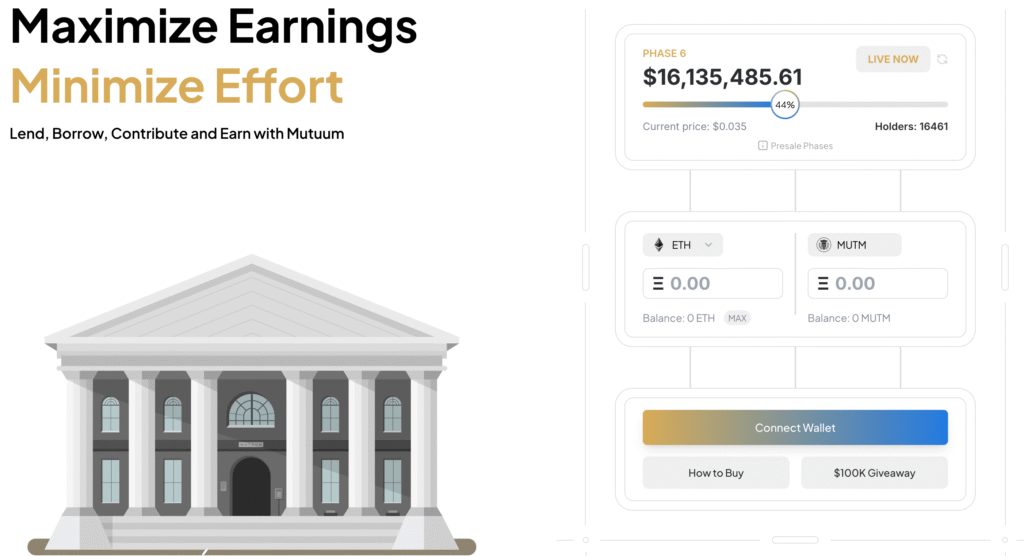

During presale Phase Six, Mutuum Finance gives early investors a discount on access. The price starts at $0.035 and goes up to $0.04. Over 16,400 people have already signed up, and more than $16 million has already been raised. This shows that demand is growing and confidence in the market is rising.

These numbers show that this project is getting a lot of interest before it goes on sale, which is unusual for early-stage projects. Analysts say that MUTM’s tokenomics, along with the excitement of investors, support predictions of huge price increases as its utility-driven ecosystem takes off after launch.

Recommended Article: XRP Eyes $8 While Mutuum Finance Sparks 8000 Percent Hype

Security Commitment Through CertiK Bug Bounty

Mutuum Finance started a Bug Bounty Program with CertiK to build trust with investors. The rewards can be as high as $50,000 USDT. White-hat hackers, developers, and researchers are welcome to look over codebases to find and fix any security holes before the software is released to the public.

The project stands out from many others that are for sale because it is open and committed to security. Rewards that are based on how serious the problem is encourage people to fix even small problems, which makes the protocol more credible among both retail and institutional investors who are getting ready for long-term use.

Dual Lending Models Offer Flexibility

Peer-to-contract and peer-to-peer lending models are both available on Mutuum Finance. The P2C model makes sure that smart contracts automatically keep an eye on the markets to find the best interest rates. This gives lenders predictable returns and quick loan execution.

The P2P system, on the other hand, connects borrowers and lenders directly. This is best for higher-risk tokens like meme coins. This two-pronged approach broadens asset coverage, allowing for more flexibility while lowering systemic risks across a range of user profiles and collateral needs.

Chainlink-Powered Price Feeds Enhance Reliability

Mutuum Finance uses Chainlink oracles to get real-time data on assets like USD, ETH, AVAX, and MATIC in order to give accurate asset valuations. The protocol also includes fallback systems, combined feeds, and on-chain sources to make it more stable in unstable situations.

These features make sure that collateral is managed well, liquidations are accurate, and risk analysis is advanced. This kind of reliability gives DeFi operations a strong base, which gives investors confidence that the platform can keep growing even when the market changes.

MUTM Positioned as Breakout Altcoin

As Ethereum tries to reach $7,000 to $10,000 milestones, Mutuum Finance wants to get investors’ attention. Before the price goes up, early adopters can buy presale tokens for $0.035. This is ahead of forecasts that say the price will go up by 43x.

MUTM has a unique mix of scalability, utility, and investor protection thanks to a $50,000 CertiK bounty, a hybrid lending architecture, and institutional-grade oracles. Analysts think that MUTM will become one of the most important DeFi projects of 2025.

Mutuum and Ethereum Offer Balance of Security and Big Upside

Ethereum gives institutions and users long-term confidence because it is widely used and has a strong network. However, prices are likely to stay stable. Mutuum Finance, on the other hand, is set up for huge growth thanks to its unique lending design and a successful presale campaign.

ETH and MUTM are two complementary opportunities. ETH is stable and slowly goes up in value, while MUTM gives you a chance to invest in high-growth stocks that may not be stable. Investors who balance both may be able to get security and the chance for big returns this cycle.