Avalanche Grows Stronger Thanks to Treasury Efforts

The Avalanche Foundation said it wants to raise $1 billion to start treasury companies that will help people buy AVAX. This move boosts long-term demand for tokens, making sure that institutions keep buying them. This gives Avalanche’s growing ecosystem structural support and boosts investor confidence.

Treasury accumulation projects show that there is a planned way to build long-term value for tokens. These efforts create buying pressure by directly buying AVAX, which may help prices move toward resistance levels. This makes both retail and institutional market participants feel more positive about the future.

Rising Odds of Spot AVAX ETF Approval

With Bitwise’s recent filing, investors started to pay more attention to the growing chances of SEC approval for spot AVAX ETFs. Other big players, like VanEck and Grayscale, have also applied, which makes it more likely that Avalanche will soon be recognized as a regulated investment vehicle.

Some analysts say that Avalanche has a lot in common with Ethereum, which already has approved funds from companies like BlackRock and Fidelity. This example makes us hopeful that regulators will treat AVAX the same way, which will create demand flows that push prices up toward bullish targets.

Stablecoin Growth Boosts Network Adoption

The supply of stablecoins in the Avalanche ecosystem grew by 32% in 30 days, reaching a circulation of about $1.9 billion. This rise shows that people are becoming more confident in the blockchain, which is in line with the growing number of integrations, such as PayPal’s PYUSD and South Korea’s KRW1 stablecoin launch.

Stablecoin liquidity directly helps DeFi adoption by encouraging users to put money into Avalanche. As the number of transactions goes up, this growth proves that AVAX is a leading blockchain network with active market participation in a wide range of decentralized apps.

Recommended Article: AVAX Supports Launch of South Korea’s First KRW1 Stablecoin

User Activity and DeFi Transactions Increase

Artemis data showed that there were more than 27 million Avalanche transactions in 30 days, with a total value of $142 billion. User adoption metrics showed a lot of growth, such as LFJ activity going up 40% in just one week, which shows that more people are using it.

The use of DeFi is still on the rise, with protocols like Pharaoh Exchange and Odos Protocol seeing big gains. DeFi Llama says that Avalanche made $708 million in 24 hours and $13.7 billion in 30 days, more than other chains like Polygon and Sui.

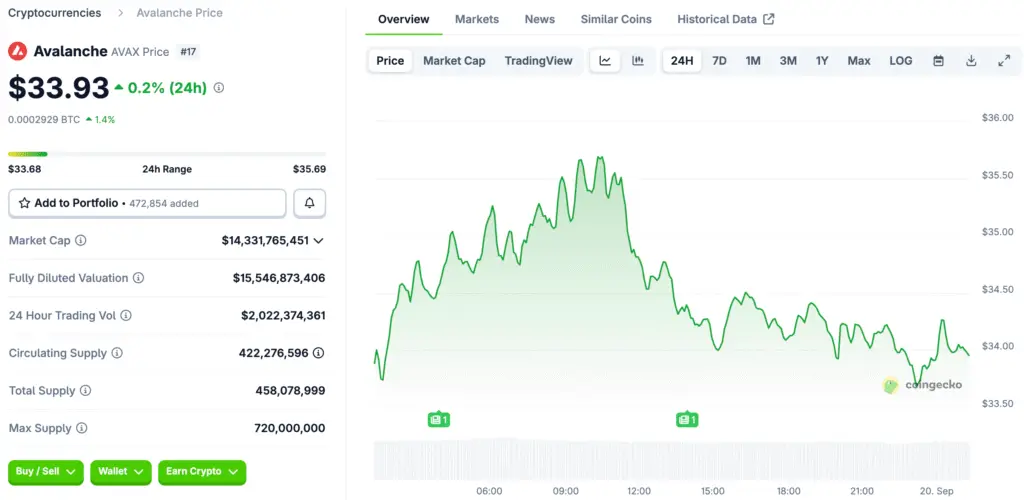

Avalanche Technicals Point to Buyers’ Control After Key $26.70 Break

Technical charts show that AVAX made a double-bottom pattern at $15.60, which means it could go back up, and it broke through neckline resistance at $26.70. The price also made a golden cross pattern, which means that the long-term trend is still going up, in line with strong fundamentals.

The Average Directional Index went up to twenty-three, and the Relative Strength Index went up to sixty-five. These indicators suggest that buyers are still in charge, which supports the idea that momentum may continue in the near future across several trading sessions.

Resistance Levels Point to $50 Target Zone

Bullish traders are looking for the next resistance level around $50, which is 45% higher than the current price of AVAX, which is above $35. Analysts stress that it’s important to keep the current momentum going, since overbought indicators could slow progress for a short time.

If the price doesn’t stay above $30, it will be hard for bullish scenarios to work. However, structural factors like ETF optimism and the growth of stablecoins support positive trends, making it likely that prices will continue to rise in the current market.

Avalanche Treasury Moves and ETF Buzz Put $50 Breakout in Sight

Avalanche’s treasury initiatives, ETF filing optimism, and growing presence in the stablecoin market all point to a strong bullish trend. These factors work together to raise AVAX’s chances of reaching and breaking through its important resistance level near $50.

Traders are still sure that technical alignment and adoption growth will keep prices going up. Avalanche could become a stronger competitor in the blockchain space and a top investment opportunity in the crypto markets if catalysts come together in the right way.