Federal Reserve Rate Cut Sparks DeFi Market Rally

The Federal Reserve cut rates by 25 basis points, the first cut of 2025, which made the US dollar weaker. This change in policy made riskier assets, like cryptocurrencies, go up because investors were looking for chances in decentralized finance protocols that offered higher returns.

The dollar’s weakness hit three-year lows, which caused money to flow into stocks, commodities, and cryptocurrencies. DeFi platforms were the main winners from the new momentum. Analysts said that Ondo, Hyperliquid, and Uniswap are three of the best projects that will do well in the new macroeconomic environment.

Ondo Finance Solidifies Position Through Tokenization Strategy

Ondo Finance is the leader in tokenized real-world assets. Thanks to a recent partnership with Ledger, you can now buy tokenized stocks and ETFs. Its platform now holds more than $1.6 billion in total value locked, making Ondo the go-to place for tokenization in DeFi.

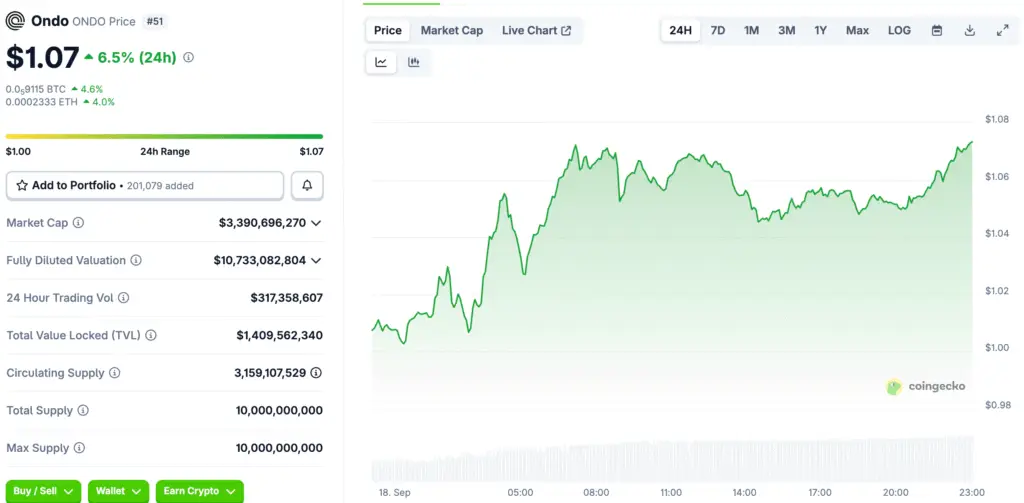

Ondo was worth $1.05, which was up 4.48% in the last 24 hours. Even though it has dropped from $2.14 highs, the momentum is still there. If adoption and inflows keep getting stronger, analysts say that supportive trends could push Ondo to retest previous highs.

Hyperliquid Rises as Demand for Perpetual Trading Grows

Hyperliquid, a decentralized perpetual futures exchange, hit record highs as leveraged trading activity rose around the world because borrowing costs fell. HYPE token traded between $54.49 and $59.39, reaching a new all-time high of $59.39 before going down a little.

The volume went over $500 million a day, which shows that more people are using it. Adding new stablecoins like USDC and USDH to the mix makes the long-term outlook better. Market watchers expect continued growth as institutions become more interested and macro trends support derivative trading on decentralized platforms.

Recommended Article: Ondo Price Breakout Targets $1.71 as Bullish Momentum Grows

Bitcoin Layer 2 Plans Open Up New Opportunities for Uniswap

Uniswap is still the best decentralized exchange, with $6 billion locked up and a daily trading volume of about $4 billion around the world. Developers are getting ready to add Bitcoin to layer two scaling. Their goal is to get more BTC liquidity and make it easier for different blockchains to work together.

The UNI token trades with support near $6.50 and resistance near $12, which shows that Bitcoin-focused developments could lead to higher prices. If the rollout goes well, it could bring back yearly highs, which would strengthen Uniswap’s position as the leader in decentralized finance innovation around the world.

Market Conditions Favor DeFi Growth After Fed Decision

Lowering interest rates makes borrowing cheaper, which makes more DeFi protocols work. Investors are turning to tokenized alternatives because traditional markets are offering lower yields. DeFi platforms that offer yield, liquidity, and derivatives are directly benefiting, with Ondo, Hyperliquid, and Uniswap getting the strongest momentum signals today.

Adoption by institutions speeds up trust. Partnerships and integrations show that more and more professionals are interested in decentralized systems for payments, trading, and tokenization. This combination of macro and technical factors makes DeFi’s story stronger as a competitive alternative in the changing global financial markets.

Analysts Point Out Possible Gains in Top DeFi Tokens

Analysts say that Ondo’s support and tokenization model, Hyperliquid’s growing perpetual market, and Uniswap’s size are all clear signs that the market is going up. If trends keep going the way they are, these platforms might do better than the market as a whole because they will get more money and more institutions will want to use them.

Momentum indicators show that strength will last. Supportive environments make investors want to buy more, expecting growth to continue along with dovish monetary policy tailwinds. Traders who want to diversify their portfolios beyond Bitcoin and Ethereum positions can now get good exposure to DeFi blue chips.

Ondo Leads DeFi’s Growth Amid Favorable Macro Trends

The growth of DeFi in global financial markets is shown by Ondo’s leadership in tokenization, Hyperliquid’s innovation, and Uniswap’s scale. These platforms are set up for long-term growth beyond speculative cycles because they have strong ecosystems, institutional integrations, and macroeconomic drivers.

The Federal Reserve’s easing acts as an accelerant. Liquidity conditions make it easier for people to get involved, which helps DeFi projects get more users and more people to use them. These changes strengthen DeFi’s position at the cutting edge of finance, giving investors one-of-a-kind chances as blockchain technology changes the way markets work.