Federal Reserve Decision Triggers Crypto Market Gains

The Federal Reserve lowered rates by twenty-five basis points, bringing the benchmark down to 4.00–4.25%. This made people feel better about cryptocurrencies in general. Chairman Jerome Powell called the move “risk management,” admitting that job growth was slowing, unemployment was rising, and overall consumer spending was slowing.

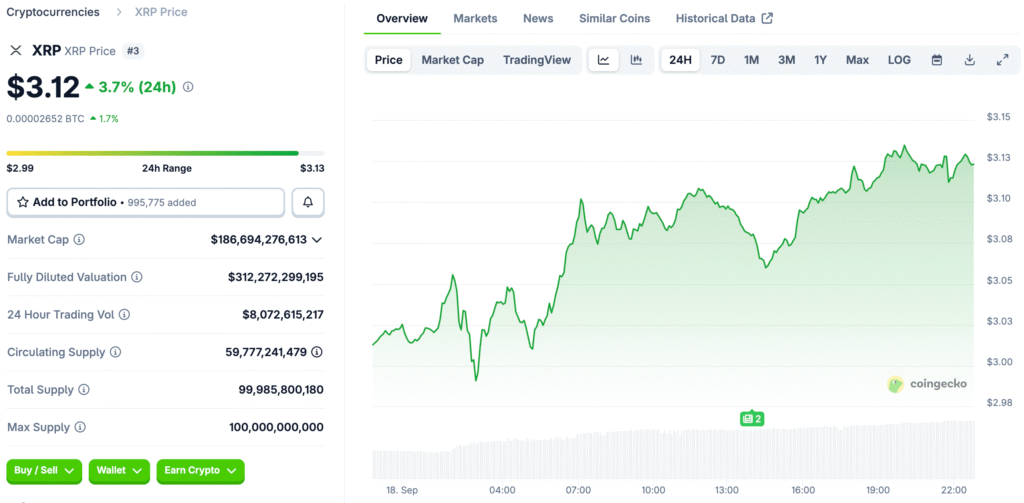

This dovish change meant that risk assets were in a good place. Cryptocurrencies like Bitcoin, Solana, and XRP all went up in value quickly, which was good news. XRP ended Wednesday at $3.08, its best performance in a week, showing that investors were excited about the return of liquidity.

XRP Price Action Reacts Positively to Monetary Policy Shift

XRP rose during the day to almost $3.13 before settling down a little near $3.06 on Thursday. Even though it went down, resilience showed that there was still strong demand. Historically, September has been a weak month, but XRP is going against the trend and has already gained eleven percent in the last few months.

Analysts say that Fed cuts lower the cost of borrowing, which makes people more likely to invest in digital assets. Better liquidity helps altcoins keep going, which is good for cryptocurrencies that focus on payments. XRP is still in a good position to break through resistance levels around $3.13 and higher in the coming weeks, as consolidation is holding near $3.

Technical Indicators Highlight Key Support and Resistance Zones

XRP finds support near $2.90, which is in line with the fifty-day exponential moving average and Fibonacci retracement levels, which help keep things stable. Around $3.13, there is short-term resistance, and between $3.60 and $3.66, there are extended zones that represent annual peak price targets.

If it doesn’t hold $2.80, it could go back down to $2.60. These levels are the same as the two hundred-day EMA, which strengthens long-term bullish positioning. Technical analysts say that any pullbacks are still chances. During consolidation periods, setups get stronger, which gives them a better chance of continuing to go up.

Recommended Article: XRP Gains Strength but Faces Hurdles on Path to Bitcoin Rival

Institutional Interest Fuels a New Era for XRP

News that institutions were starting to use XRP gave it more momentum. REX Osprey started the first US-listed spot ETFs for DOGE and XRP. CME said that it would start trading options on XRP and SOL futures on October 13, pending approval from regulators. They said this was because of strong demand growth.

These changes make it easier for investors to get involved by connecting traditional markets with crypto. ETFs give brokerage clients more ways to invest in new types of digital assets. Institutional adoption makes people more sure about XRP’s future, which leads to speculation about its wider acceptance and use in financial systems.

Risk-On Sentiment Is Supported by Broader Market Performance

The total value of all cryptocurrencies around the world went up by 2%. This was thanks to Bitcoin’s rise to $117,426, Ethereum’s rise to $4,609, and Solana’s steady rise. Altcoins joined the rally. Dogecoin and XRP both went up, showing that the digital asset markets as a whole were doing well after the policy announcement.

Analysts point out that stocks are going in different directions. While Wall Street indexes went down, cryptocurrencies went up, showing that different types of alternative investments appeal to different people. The Fed’s dovish stance made the asymmetric setup better, which made bullish scenarios across digital assets compared to traditional financial markets as a whole.

Bullish Case Builds On Rate Cuts And Institutional Growth

A dovish policy makes the bullish outlook stronger. Lower rates, along with the growth of ETFs and futures, point to a wider use of cryptocurrencies. XRP’s consolidation around $3 shows that people are buying it. If demand stays high, it could lead to breakouts that test the $3.30 intermediate resistance and the eventual $3.60–$3.66 highs.

Long-term forecasts show that it could go back to $10 if a lot of institutions use it, the rules are clear, and the economy is doing well. Until then, there is cautious hope. Investors keep a close eye on liquidity flows and policy signals to make sure that the bullish trend will continue.

A Lack of Volume Threatens XRP’s Breakout

If XRP can’t break through resistance zones, a bearish scenario will happen. If momentum slows down, the price may go back to $2.80 or $2.60. Waning oscillators and seasonal risks suggest that rallies could stop, which would create corrective phases that frustrate short-term speculators.

Skeptics say not to put too much faith in dovish stories. If the volume isn’t steady, upside targets are still open to corrections in the whole market. Bears say that macro risks, volatility, and profit taking are still big problems, which makes people less excited even though good news from institutions is coming out.