Analysts Highlight Bullish Consolidation Patterns for Cardano

Cardano’s weekly chart reveals a bullish consolidation pattern similar to past major breakouts. Analyst Dan Gambardello suggests that ADA prices are acting similarly to previous periods, suggesting an increase in strength. The Relative Strength Index shows higher lows and highs, indicating growth in strength despite broader consolidation.

Gambardello’s study also highlights the Moving Average Convergence Divergence compression as evidence of bullish energy. Sideways price movement below the 20-week moving average indicates market accumulation, as seen during bullish phases. The current consolidation is “not bad,” indicating hope despite resistance at key psychological price levels.

Cardano Struggles at the $1 Barrier Despite Momentum

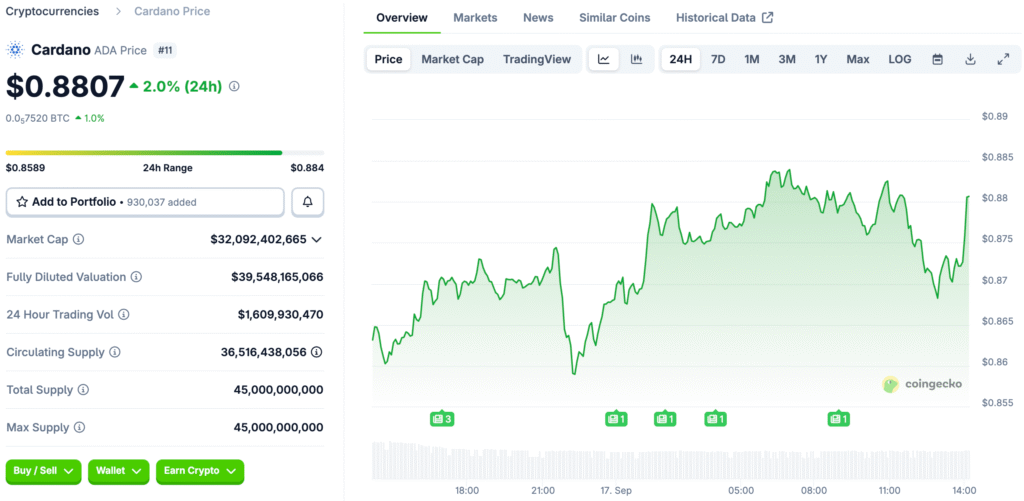

Cardano is trading near $0.87, having gained 6% in value in the past two weeks. However, ADA struggles to break past the $1 mark, which has been challenging for bulls in the past.

This resistance is a significant short-term issue for Cardano’s breakout hopes. If the consolidation pattern breaks to the downside, the price could drop to $0.64. If these levels are broken, bullish momentum may build, and prices could eventually rise to $1.50.

Gambardello Sets Ambitious $1.50 Breakout Target for ADA

Dan Gambardello predicts that ADA could rise sharply toward $1.50 if things go well, based on the ascending wedge consolidation structure on ADA charts. The wedge pattern indicates higher highs and lows, aligning with bullish consolidation phases that have historically led to big rallies.

Technical momentum indicators support this idea, suggesting explosive movement if outside factors align positively. Gambardello’s ambitious goal of $1.50 is based on real market structure, not guesses, and could surprise investors who are used to stuck trading conditions.

Recommended Article: Cardano Price Prediction Shows Breakout Potential at Support

Federal Reserve Decision Looms Over Crypto Markets

The Federal Reserve’s decision to cut interest rates on September 17 is expected to cause volatility in the cryptocurrency market. Futures markets predict a 94.2% chance of a 25-basis-point cut and a 5.8% chance of a 50-basis-point cut.

This could impact cryptocurrency prices in the coming trading sessions, as the rate cut will affect the liquidity of risk assets like Cardano, making them more sensitive to policy announcements. Analyst Ted discusses two possible Bitcoin scenarios based on Fed actions and market reactions, potentially causing more volatility and potentially speeding up breakout dynamics.

Bitcoin Scenarios Influence Broader Crypto Market Sentiment

Ted, an analyst, made two predictions about what might happen to Bitcoin after the Federal Reserve’s announcement this week. In scenario one, the price drops to $104,000 for a short time before rising to new highs thanks to stronger institutional inflows. Scenario two shows a deeper correction that aims for $92,000, including a gap fill on the Chicago Mercantile Exchange, before the market eventually recovers.

These situations have big effects on Cardano because Bitcoin and most altcoins are very similar. If Bitcoin starts to go down, it could cause people to sell ADA, which would test lower support levels before it could possibly go back up. On the other hand, bullish Bitcoin strength could speed up the upward momentum toward Cardano’s breakout targets.

Volatility Expected Regardless of Fed Outcome

Federal Reserve policy announcements can cause volatility in financial markets, particularly in cryptocurrency ecosystems. Cardano, which is below technical resistance zones, is sensitive to these macroeconomic events. Analysts predict both bullish and bearish scenarios could occur quickly after the policy announcement.

Traders should be prepared for price swings due to investor sentiment changes. Gambardello warns traders to be flexible during these volatile weeks, highlighting the unpredictable nature of macro-driven crypto price changes.

How to Invest in Cardano’s Possible Breakout Setup

As ADA stays below major resistance zones, traders need to be patient and manage their risks. Keeping an eye on support levels around $0.64 is still very important for keeping your money safe from losses. On the other hand, breakout confirmations above $1.05 could confirm bullish structures that aim for $1.50.

Long-term investors might see this period of consolidation as a chance to buy more before the price breaks out. In the past, ADA’s cycles have often rewarded people who were patient and held on through frustrating sideways trading before big rallies. Staying disciplined makes sure that investors are ready for whatever happens after the Federal Reserve makes its decision.

What to Expect from Cardano After the Fed Policy Announcement

The Federal Reserve’s monetary policy this week will have a big impact on Cardano’s short-term direction. If the outcome is dovish, it could cause rallies in all cryptocurrency markets. If it is hawkish, it could put pressure on risk assets to go down for a short time. Analysts stress the importance of staying alert in changing situations.

The bullish consolidation structure of ADA gives hope that the price will continue to rise. If breakout conditions line up with supportive macro trends, Gambardello’s $1.50 target is still possible. Overall, Cardano is still likely to be very volatile, but there are big chances for investors who are ready.