Avalanche Breaks Out Of Falling Wedge Signaling Trend Reversal Potential

Avalanche recently broke out of a falling wedge, which is a bullish pattern that suggests a reversal could happen after a long period of declines from January highs. The wedge pattern formed between two trendlines that were coming together. This showed that resistance was getting weaker and support was getting stronger as market pressures evened out.

“Breakout” means that selling momentum is slowing down, which gives bulls room to push prices higher if volume stays high and support levels stay strong. These kinds of signals often mark important turning points, making traders look for trend reversals and new bullish market phases.

RSI and MACD Indicators Confirm Bullish Momentum for Avalanche Token

The Relative Strength Index rose above fifty, which means that momentum is increasing. Traders see this as a sign that the upward trend will continue. Indicators of momentum, such as the RSI, can often confirm early on that bullish rallies may have more room to go higher.

At the same time, MACD showed a bullish crossover, with the twelve-period exponential moving average clearly moving above the twenty-six-period exponential moving average. Crossovers confirm the strength of a trend and give traders more confidence that the upside will stay strong even though there have been bearish pressures in the past.

Avalanche Aims for Key Price Targets

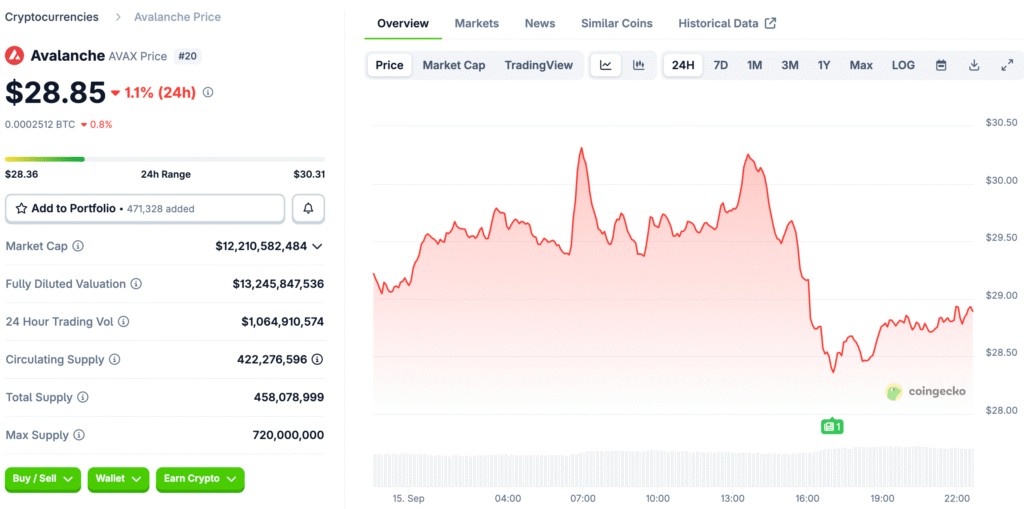

Analysts say that if momentum keeps going, the next price targets are $23.50 and then $30.42, based on Fibonacci retracements. These levels are in line with technical resistance zones, which means that traders should keep an eye on them for possible profit-taking opportunities.

If Avalanche stays above the wedge breakout level, it is likely to keep going up, which will boost investor confidence a lot. If momentum indicators match up with volume confirmation across exchanges, price appreciation may speed up.

Recommended Article: BlockDAG Presale Soars with $367M, Outshining AVAX and Tron

Awesome Oscillator Adds Confirmation Supporting Bullish Avalanche Narrative

The Awesome Oscillator recently turned positive, which supports the bullish story as momentum builds across technical indicators that support upside breakouts. AO readings often happen during breakout phases, which shows that people’s feelings about the cryptocurrency markets are changing toward renewed growth potential.

When indicators line up like this, it gives strong evidence that forecasts for higher Avalanche valuations are more reliable. Traders say that the combination of RSI, MACD, and AO is a strong signal that the market will continue to rise.

Short-Term Support Levels Critical for Sustaining Bullish Avalanche Outlook

Avalanche needs to stay above the upper trendline of the wedge in order to keep the bullish scenarios that analysts and market watchers have laid out. If the breakout doesn’t hold, the price could go back into the wedge structure, which would make investors less sure that the upward moves will last.

Support stability is what makes higher prices possible, and $15 is the key level to protect against sellers. If this happens, bullish predictions may fail, and the outlook may shift back to consolidation or deeper corrections.

Why Avalanche’s Bullish Run May Still Face a Test

Even though things are looking up, there are still risks if selling pressure comes back because of bad news about the economy or bad news about the world in general. If Avalanche doesn’t keep up with volume support, it could lead to tests on the downside, which would hurt confidence in its short-term bullish momentum.

These kinds of risks show how important risk management is, especially for traders who have to deal with unstable altcoin markets. Analysts say that being hopeful about the future of cryptocurrencies should be balanced with being aware of outside forces that could affect the markets.

Avalanche’s Resilience Is a Bullish Indicator

Avalanche’s breakout backs up the story of recovery with technical confirmation and bullish projections. If momentum stays strong, it seems possible to reach Fibonacci targets of $23.50 and $30.42 within the current cycle.

Avalanche is still in a good position to benefit from the growing use of cryptocurrencies because of institutional interest and DeFi integration. If technical signals stay the same, market participants expect stronger rallies, which will keep AVAX relevant among the top altcoins.