Dogecoin’s Breakout Signals a Major Rally

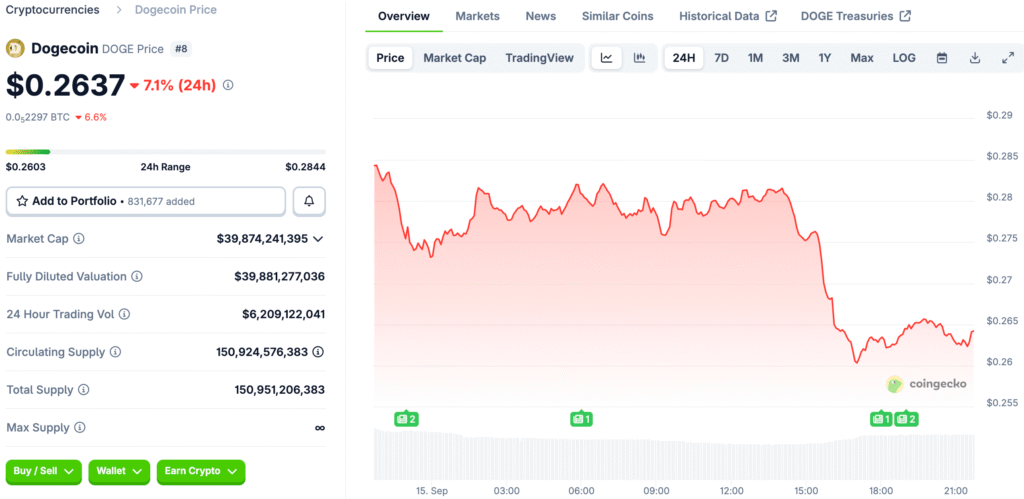

This week, Dogecoin shot up toward $0.29, making it one of its strongest rallies in months, thanks to bullish technical breakout patterns. Analysts found a symmetrical triangle breakout, and Fibonacci retracement levels show that there is more room to go up if key supports hold.

This bullish setup puts Dogecoin in a strong position to keep going up, which makes both retail and institutional investors who are looking for high-return opportunities more optimistic. In the volatile cryptocurrency market, it is still important to keep gains above important levels to confirm long-term momentum.

ETF Speculation Provides Strong Tailwinds for Dogecoin Momentum

People are feeling better about Dogecoin because of rumors about exchange-traded funds that could help people get into cryptocurrencies. Analysts say that the success of Bitcoin and Ethereum ETFs makes them hopeful that meme coins will be able to get into similar investment structures.

Traders also point to good macroeconomic trends, such as possible rate cuts by the Federal Reserve, which support risk assets and cryptocurrencies like Dogecoin. These things, along with the rising open interest in futures, make bullish predictions for Dogecoin’s path in the coming months stronger.

Corporate Accumulation Signals Growing Institutional Confidence in Dogecoin

CleanCore Solutions recently announced that it has more than five hundred million Dogecoin and plans to double that amount to one billion tokens soon. This strategy shows that more and more institutions are recognizing Dogecoin’s usefulness, making it a possible reserve and transactional asset.

Company executives talked a lot about how Dogecoin could be used for payments, staking-like products, and remittances, which helped the company position itself strategically for widespread use. This kind of accumulation shows that there is a lot of buying pressure, which will help prices keep going up in the current and future trading cycles.

Recommended Article: Dogecoin Price Hits Seven-Month High At $0.30

Technical Levels Highlight Risks and Support for Current Rally

Dogecoin is trading between $0.26 and $0.29, and analysts stress the need to protect $0.25 as a key support level in the short term. Resistance at $0.31 is still important, and a bullish confirmation needs clean closes above it and rising trading volume.

Breakdowns below important support levels could make the bullish thesis less likely to be true, which shows how important it is to manage risk carefully when the market is volatile. Uncertainty about regulations, especially when it comes to ETF approvals, could cause problems and temper overly optimistic predictions from cautious analysts.

Analysts See Possible Strong Upside After $0.35

Analysts say that if Dogecoin breaks through $0.31, the next targets could be $0.35 to $0.40, depending on how strong the volume is. Longer-term scenarios show possible moves toward $0.60, which is a sign of rising demand from businesses and institutions in markets around the world.

These kinds of situations depend a lot on the stability of the economy as a whole, clear rules, and continued institutional buying that supports ongoing accumulation trends. Investor confidence is still very important for keeping things going, especially since traders have to weigh the excitement of speculation against the risks of losing money.

Risks Remain Despite Strong Technical Setup and Growing Demand

Analysts are warning about risks like delayed ETF launches and an unclear global macroeconomic picture, even though bullish factors are all over the news. To confirm Dogecoin’s breakout path in the face of strong volatility patterns, it needs to have steady volume and steady liquidity inflows.

If support levels aren’t held, it could lead to retests of previous consolidation zones, which would make people less sure that the bullish trend will continue. Because of this, traders stress the importance of being alert, keeping an eye on on-chain activity, and institutional involvement to see how long current upward trends will last.

Dogecoin Outlook Remains Optimistic Amid ETF Hype and Accumulation

Dogecoin’s rise to $0.29 is due to a combination of bullish technical structures, ETF speculation, and aggressive corporate buying. This combination makes people feel good about Dogecoin, which is why it is one of the most closely watched assets in the current market cycles.

Short-term goals depend on successful breakouts from resistance, while long-term potential depends on more people using the service and institutions recognizing it. As momentum builds, Dogecoin continues to draw a lot of attention from investors, which strengthens its position in the quickly changing cryptocurrency markets.