Dogecoin Rises Without Elon Musk’s Help

Even though Elon Musk isn’t around, Dogecoin has gone up a lot, showing that other important fundamental factors are now driving market momentum. The rally shows that DOGE is moving beyond hype based on personalities and is getting support from institutional interest and the way the market as a whole affects investor behavior.

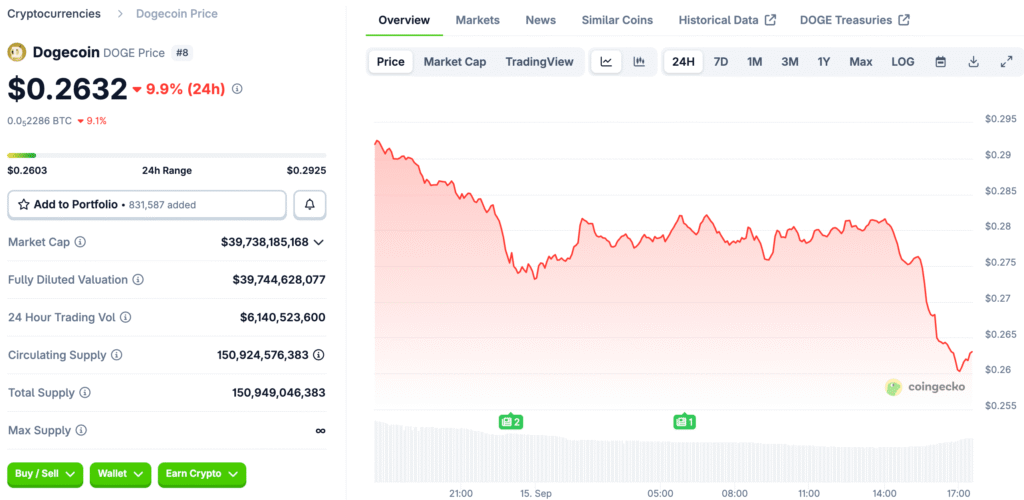

DOGE traded between $0.27 and $0.30, hitting an intraday high of $0.3070 before going back down. There is still a lot of volatility, but the overall mood seems to be getting more positive. Investors are now keeping an eye on the potential for sustained breakouts above resistance zones.

Anticipated Dogecoin ETF Spurs Market Enthusiasm

Even though the highly anticipated REX-Osprey Dogecoin ETF (DOJE) has been delayed several times in the past few weeks, people are still excited about it. Eric Balchunas from Bloomberg thinks that the listing will happen by the middle of next week and that more DOGE ETFs will probably come out in October or November.

The first ETF uses derivatives instead of direct spot holdings, but institutional wrappers may make the market more legitimate and reach more people. Investors are still wary of structural limits. But there is still hope because many products are getting ready for wider use in institutions later this year.

Corporate Treasuries Start to Build Up Dogecoin Holdings

CleanCore Solutions said it bought 500 million DOGE, with plans to buy a billion, which is about 0.33% of the total supply that is currently in circulation. The purchase is similar to MicroStrategy’s Bitcoin strategy, which makes Dogecoin a possible corporate treasury asset for diversifying the balance sheet.

BitOrigin said it had 70.5 million DOGE, which shows that companies are becoming more interested in meme coin allocations. This adoption shows that people’s views are changing. Institutional treasuries could create steady demand that lowers supply float and keeps Dogecoin’s long-term value stable.

Recommended Article: Dogecoin Price Hits Seven-Month High At $0.30

Leverage Plays Make the Dogecoin Market More Volatile

The leverage ratios on Binance and OKX show that traders are very bullish, with two to three long positions for every bearish position. There are four to five bullish bets for every short bet on DOGE price action among the best traders.

Leverage, on the other hand, adds risk because when prices drop suddenly, liquidations speed up downturns. Positions worth $29.6 million were sold off in less than 24 hours. Most of the losses came from long positions that were too big.

Analysts Split On Dogecoin Price Trajectory

Analyst CrediBULLCrypto said that DOGE is currently testing a monthly supply zone again, which means it could be rejected instead of confirming a long-term bullish breakout. He said to be patient and pointed out that crowded longs and rising liquidations could speed up the downside if the overall market mood gets worse.

On the other hand, trader Arman_Trading saw DOGE’s rise to $0.3070 and predicted that it would eventually reach higher targets around $0.32, $0.41, and even $0.70. Optimism is based on institutions using it and the treasury building up. Market resilience will determine whether things go on as planned or change.

Scenarios Show Possible Bull and Bear Outcomes

The bull case shows that demand for treasuries is going down, which is lowering the amount of money in circulation. At the same time, leveraged optimism and ETF wrappers are making the market more legitimate around the world. If these things happen, DOGE could break through resistance and turn $0.30 to $0.32 into strong support, which would push prices up even more.

The bear case focuses on ETF delays, structures that only use derivatives, crowded longs, and ongoing liquidation risks that make the market vulnerable to quick drops. If there is rejection at supply zones, DOGE could go back a long way. In these situations, it is still important to be careful in the market.

Dogecoin’s Rally Is Now Fueled by Institutions

Dogecoin’s rise this week shows that it isn’t dependent on Elon Musk. Instead, it came from institutional changes, corporate accumulation, and speculative leverage. Its strength shows how meme coins are changing in the larger cryptocurrency market.

For DOGE’s future to be bright, institutional interest, ETF launches, and treasury accumulation need to all happen at the same time as market momentum. If it works out, it could change Dogecoin’s legacy. Volatility, on the other hand, makes sure that risks and opportunities are always there.