Ondo Finance Leads a New Era of Tokenized Assets

Real-world assets are traditional securities like U.S. Treasuries and stocks that have been brought on-chain. This makes them more liquid and gives more people around the world access to financial services. Analysts say that this sector could grow to $16 trillion by 2030, which shows how much it could change the global capital markets.

Institutions like RWAs because they are ready to comply with regulations, give regulated exposure, and pay out dollar yields without relying on traditional banking intermediaries. RWAs will be important parts of the future digital financial economy because they offer stable returns and automated smart contracts. Ondo Finance is in a good position to lead this change by getting investors’ attention with new products.

Ondo’s Flagship Products Drive Utility and Growth

Ondo Finance stands out because it has flagship products that connect traditional finance with blockchain innovation. USDY stablecoin gives holders passive income backed by short-term U.S. Treasuries, so they can stay dollar-pegged while earning money.

OUSG sells tokenized U.S. Treasuries with yields of about 5% and lets you mint and redeem them on a number of major blockchains. Recently, J.P. Morgan and Chainlink successfully tested Ondo Chain’s settlement infrastructure, which shows that it is a reliable way to combine DeFi and TradFi. These products show that Ondo is serious about making tokenized assets that are good for the environment and make money, which will increase investor trust and use.

Institutional Partnerships Enhance Market Credibility

Partnerships with J.P. Morgan and Chainlink show that Ondo can combine institutional-grade settlements with tokenized asset offerings. Such cooperation gives credibility, making sure that tokenized assets and fiat deposits are settled safely and at the same time across blockchain ecosystems.

By agreeing to buy Oasis Pro, a licensed U.S. broker-dealer, Ondo strengthens its position with regulators even more. This purchase gives Ondo the right to sell tokenized securities to American investors, filling in compliance gaps and opening up new ways for people to use them. Institutional trust makes Ondo a trustworthy partner for investors who want to get tokenized exposure in a regulated way.

Recommended Article: Ondo Price Targets Recovery After Bullish Pennant Breakout

Catalysts Point to Big Growth Opportunities in the Future

In September, Ondo Global Markets opened up for business, allowing people all over the world to trade tokenized U.S. stocks and ETFs around the clock. This program makes it easier for everyone to get involved by allowing investments of as little as $100 across more than 100 assets.

Future growth goals include thousands of listings, making Ondo a leader in tokenized securities and making it more appealing to retail investors. USDY is growing into new chains like Sei, and Alchemy Pay integration lets people around the world buy things with Visa and Mastercard. A $250 million ONDO Catalyst fund from Pantera Capital speeds up adoption, showing that people have a lot of faith in on-chain markets in the long run.

Strong Community Support and Market Momentum

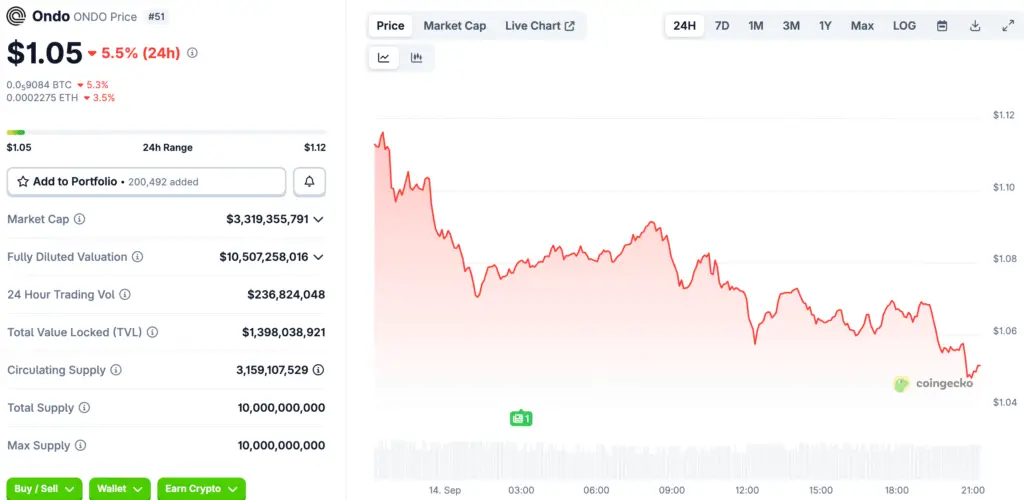

The total value locked in Ondo was more than $1.5 billion, showing that there is a lot of demand for tokenized Treasuries and stablecoins that pay interest. This success shows that both individual investors and institutional investors are becoming more interested in finding sustainable blockchain-based investment opportunities.

Analysts praise Ondo’s fundamentals and ecosystem expansion strategies, which are helping to drive adoption. Support from retail holders is in line with institutional momentum, which makes people more sure that Ondo could lead the next RWA breakout. This kind of momentum makes ONDO’s long-term story as a market leader stronger.

Competitive Position in the Growing RWA Sector

Ondo stands out from other RWA-focused projects because it has first-mover products, partnerships with institutions, and a strategy that is ready for regulation. It can combine compliance, yield, and cross-chain settlement, which makes it competitive in the rapidly growing world of tokenization.

Many of Ondo’s competitors don’t have the right regulatory framework or big partnerships, which gives Ondo a unique advantage in growing adoption in a sustainable way. By combining traditional finance with blockchain technology, Ondo becomes a leader in decentralized finance that focuses on real-world assets (RWA). Its trajectory shows that it could be the leader in institutional adoption cycles.

Ondo Finance Bridges Traditional Finance and DeFi

Ondo Finance is at the crossroads of traditional finance and decentralized ecosystems, using new ideas to get people to use it. Its treasury-backed stablecoins, tokenized securities, and settlement tools are useful in the real world, not just for speculation.

Partnerships with institutions and regulatory efforts boost credibility, bringing in more money and getting more people to use the service. With strong momentum, Ondo is becoming a top candidate to lead the way in mainstream tokenization. Its progress shows that it has a lot of potential to change the next wave of financial innovation.