Cardano Price Prediction for 2025 Gains Attention

Cardano is still a major blockchain project, trading for about $0.88, but analysts think it could grow to $2.50. Accumulation by whales, growth of the ecosystem, and technical setups all point to ADA making gains of between 200% and 300%.

Analysts say that overall sentiment still has a big impact on performance, which reminds investors that blockchain asset growth is heavily affected by outside market conditions. ADA’s long-term position is still strong in terms of adoption trends, but new projects that are trying to take its place in decentralized finance ecosystems are making it harder for it to stay on top. Cardano is a reliable asset because it is strong, but more and more investors are looking at newer platforms that promise higher returns.

Mutuum Finance Presale Attracts Growing Participation

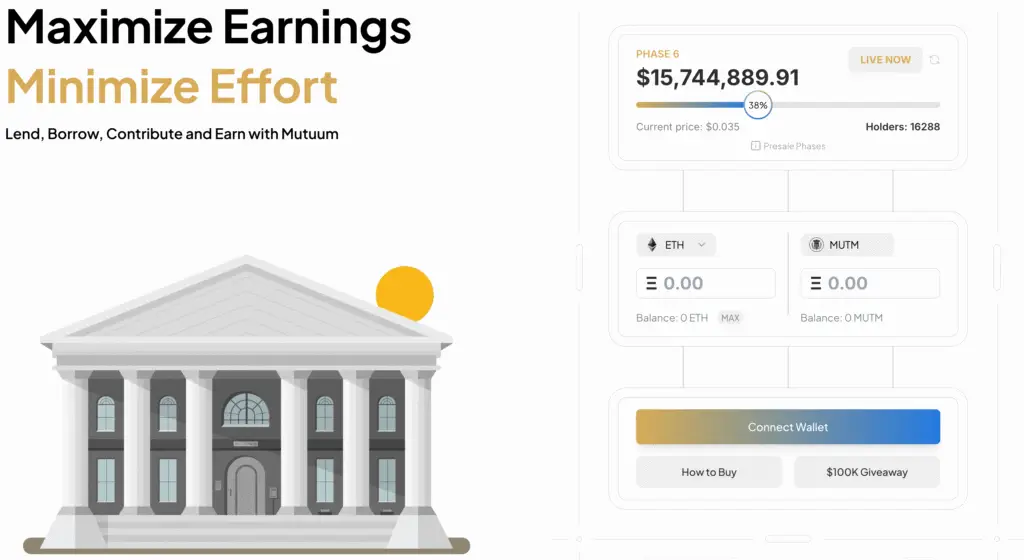

Mutuum Finance lets investors get in on the ground floor of development, and the tokens are cheap at only three and a half cents each. The presale was a huge success, raising fifteen million dollars and attracting over sixteen thousand holders. This shows how quickly decentralized investor communities are adopting the product.

The seventh presale phase expects token prices to rise to four cents, which makes people who want to get in early at a lower price more eager. This kind of momentum shows that there is a lot of interest in MUTM compared to other DeFi projects, making it stand out in a market that is getting more and more crowded. These successes give Mutuum Finance stability and credibility, making sure it gets off to a good start before its official launch and greatly increasing the confidence of early investors.

Bug Bounty Program Enhances Investor Confidence

Mutuum Finance has launched a $50,000 bug bounty program to enhance the ecosystem’s safety. This proactive approach demonstrates the company’s commitment to transparency, user protection, and reliability in a criticized industry. By working directly with the community, Mutuum Finance identifies vulnerabilities early, reducing risks before widespread use.

This boosts credibility and provides investors with confidence in security, platform functionality, and innovation. The bounty program demonstrates Mutuum Finance’s seriousness about growth and protection, giving it an edge over less prepared projects.

Recommended Article: Mutuum Finance Presale Surges as Solana Whales Join In

A Dual-Lending System Differentiates Mutuum Finance

Mutuum Finance offers a dual lending system that combines peer-to-contract and peer-to-peer frameworks, providing more options in decentralized lending environments. The peer-to-contract method allows smart contracts to automatically calculate interest payments, lowering costs and providing passive returns.

Peer-to-peer lending connects borrowers and lenders directly, eliminating middlemen, especially for volatile assets. This hybrid system makes MUTM more efficient and appealing to a wider range of borrowers and investors, meeting market needs for new ideas, efficiency, and accessibility in decentralized lending systems.

Infrastructure Helps Make Price Discovery Clear

Mutuum Finance employs Chainlink oracles and backup systems to ensure accurate collateral valuations, ensuring the right price for tokens against major assets like USD, ETH, MATIC, and AVAX. This reliable data simplifies liquidation and risk management, allowing the protocol to function in various cryptocurrency markets.

Correct pricing builds trust among users, particularly in collateralized lending, attracting long-term participants. MUTM’s robust infrastructure strengthens its credibility and readiness for growth in the increasingly competitive decentralized finance market.

Comparison Between Cardano and Mutuum Finance

People still respect Cardano for its established blockchain ecosystem, but Mutuum Finance is getting a lot of attention because of its innovation, momentum, and big growth projections. Investors are talking about which investment will give them better long-term returns: ADA’s steady growth or MUTM’s disruptive lending model.

Mutuum’s presale success and technological edge are strong reasons to get involved early, even though Cardano is still the most popular platform in established ecosystems. The difference shows bigger trends in the market, where speculative investors look for stocks that will do well while also balancing safety and innovation. This change suggests that future cycles may favor platforms that focus on utility and can provide practical solutions along with scalable, decentralized infrastructure.

Mutuum Finance a Game-Changer with 100x Growth Potential

People are still hopeful about Cardano’s price in 2025, but more and more people are paying attention to new platforms like Mutuum Finance that could change the game. ADA could grow by two to three hundred percent, but MUTM could grow by up to one hundred times that amount.

Mutuum Finance’s hybrid lending system, presale momentum, and improvements to its infrastructure make it a strong candidate for the top DeFi platform. With bug bounty programs making security stronger, investors are more confident as more people use the service, which strengthens the long-term potential for growth. Overall, ADA shows steady growth, but Mutuum Finance brings new ideas and energy to the table, making it a possible standout opportunity.