XRP Goes Above $3 After Custody Grows

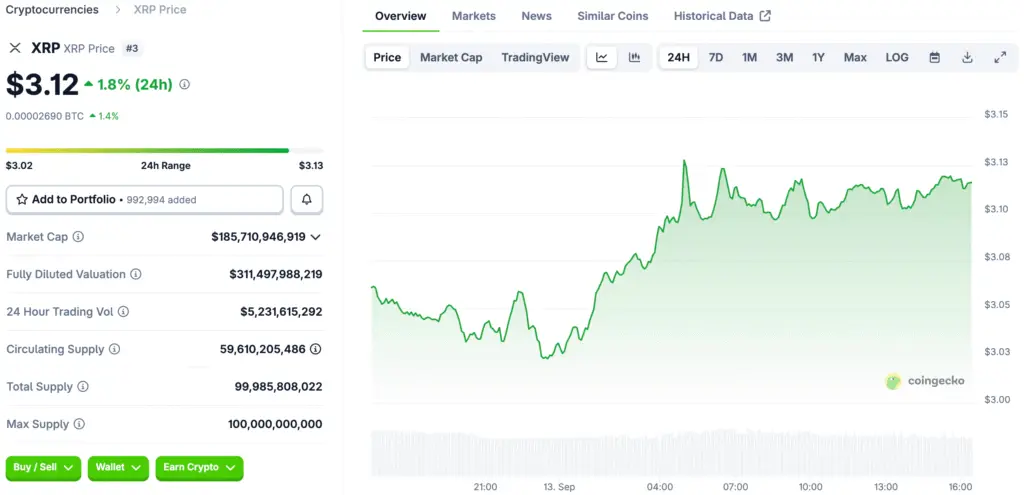

XRP has recovered three dollars and is trading near three point zero four, following Ripple’s partnership with BBVA to hold assets under the MiCA framework. Institutional adoption makes things more legitimate across the eurozone. Resistance at three point ten is a barrier that needs to be overcome.

If the price closes above resistance, it could open the way to three point twenty-five and three point fifty. Custody partnerships make rules clearer, making investors more confident. Ripple is now the leading compliant provider in Europe, a significant step forward for institutional trust. Market sentiment is hopeful about combining traditional banking with digital assets.

ETF Approval Leads to Inflows from Institutions

The REX-Osprey Spot XRP ETF, launched on September 12, has received SEC approval after a 75-day review. The ETF offers new liquidity, drawing in institutional and retail flows. Analysts predict short-term ranges between $3.30 and $4.00, with bullish targets reaching up to five dollars.

The filing for the Franklin Templeton ETF has been pushed back to November, causing excitement for later this year. The ETF’s approval makes XRP a settlement-grade asset, similar to Bitcoin ETF-driven inflows. Ripple is now considered one of the best digital assets because it has an official ETF. Market consensus shows that institutional confidence is rising quickly.

Whale Accumulation Contrasts With Exchange Reserves

On-chain flows are not the same. Exchange inflows went up by 4.52 million, which made reserves go up. Reserves hit a one-year high on Binance, with more than 3.66 billion XRP. Possible selling pressure found.

Whales, on the other hand, recently added three hundred forty million XRP to their accounts. Wallets with between ten million and one hundred million XRP saw their holdings go up by 2.1%. Divergence shows the fight between taking short-term profits and staying true to your long-term beliefs. Whale accumulation is seen as a strong sign of bullishness. Market dynamics show that participants have very different strategies.

Recommended Article: SEC Extends Franklin XRP ETF Review As Optimism Builds In Markets

Derivatives Market Confirms Bullish Bias

The open interest in futures rose from seven point three seven billion last week to eight point five one billion this week. The funding rate went up to 0.0107 percent. Traders are willing to pay more for long positions. Derivatives trading shows that there is a strong bullish conviction.

The resistance cluster around three point ten to three point fourteen is still very important. If the price stays above three point thirty-five, it would confirm that the market is still bullish. Technical targets go up to three point sixty-five and four point fifty. Analysts say that having a lot of leverage in one place increases risk. But momentum is still strongly positive in the current market conditions.

Macro Environment Supports XRP Outlook

The economy is bolstering the bullish trend, with a rise in unemployment benefits filings and a weaker dollar easing risky assets. XRP’s success is due to the increasing crypto market and the Altcoin Season Index reaching 728.

Ripple’s pursuit of a US national banking license could further strengthen the bullish case, with institutional adoption growing. Macro and regulatory tailwinds also contribute to the bullish case. The larger environment makes XRP a better global settlement layer, and investors are increasingly highlighting the potential for change.

Important Technical Levels to Watch

Support has increased from 2.92 to 2.94, with potential for a return to 2.75 if pulled back. Demand is high, and if the price breaks above three point ten to thirteen, the next target is three point thirty-five. The midterm path is between three point sixty-five and four dollars.

The MACD buy signal is active, and the RSI is close to fifty-five, suggesting room for overboughtness. The technical landscape is favorable, with confirmation above resistance key for speeding things up. Short-term consolidation may occur, but the structure favors a bullish continuation.

Long-Term Forecast Says $5 or More

Analysts say that the average range will be between 2.80 and 3.20 during September’s volatility. But catalysts raise expectations. ETF inflows and the approval of a banking license could push XRP up to $5 by the end of the year. Speculative models go up, saying that prices could reach eight to ten dollars in a long-term bull market.

There are still risks on the downside. If it doesn’t hold at two point seventy-four, it could drop to two point fifty. The 200-day EMA is close to the zone. Even though there are risks, a structural change in accessibility and adoption makes the outlook look good. There is a growing agreement that the short-term goals are between three and four dollars, and the year-end forecast is well over five dollars.

A Perfect Storm of Catalysts to Fuel XRP’s Next Rally

The investment outlook for XRP is still positive because of ETF approval, MiCA custody expansion, whale accumulation, and good macro conditions. The token trades much lower than the July peak of three point sixty-six. There is a lot of room for growth. Short-term goals are between $3.35 and $4.00. The year-end scenario shows that five dollars or more is possible.

There will be volatility, but structural change is good for long-term investors. Analysts say to buy more. The decision fits with the growth of institutional accessibility. XRP is different from other altcoins in some ways. The conclusion is still clear: XRP is a buy, and the targets show that the catalysts are coming together.