SEC Meeting Makes Sui Investors Happier

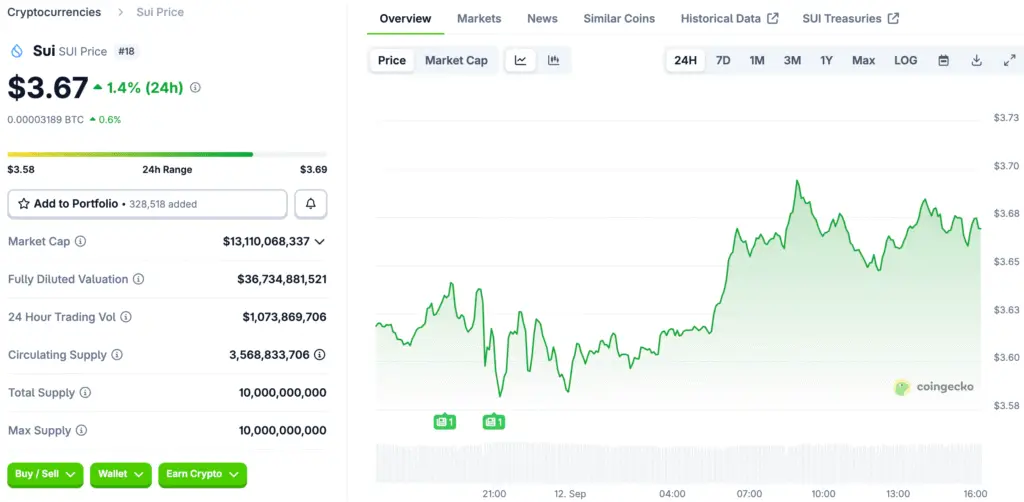

Mysten Labs discussed Sui’s role with the SEC’s Crypto Task Force, focusing on rules and ETF approvals. The market responded positively, with SUI’s price increasing by seven percent. This proactive stance emphasizes the importance of regulators in shaping the global cryptocurrency market.

The SEC talks highlight the importance of classifying assets, affecting adoption speed. Investors see dialogue as a sign of cooperation, boosting confidence in all markets. Sui’s role in regulated investment ecosystems worldwide is crucial for the growth of regulated investment ecosystems.

Price Momentum Is Driven by ETF Approvals

ETF approvals have historically led to price increases in cryptocurrencies like Bitcoin and Ethereum. Sui’s potential approval could make her ETF more legitimate and attract institutional investors. Analysts predict that if approved, prices could reach $7.50. However, there is still uncertainty as the SEC’s regulation approach changes, and approval paths depend on how well they align with new standards.

Investors must weigh the pros and cons of ETF approvals, as there is still a lot of uncertainty. Sui’s case demonstrates the difficulty in finding the right balance between opportunity and regulatory oversight when integrating cryptocurrencies into mainstream finance.

The Dangers of Speculative Market Bubbles

People are worried that speculative bubbles will form because Sui prices are going up. Open interest and volume spikes show that people are getting more excited about speculation than about real growth. Analysts say that there are similarities to past bubbles, when prices rose too quickly and then fell sharply, which hurt investors’ confidence a lot.

Markets that mix speculation and real adoption growth still have risks of volatility. Investors need to be careful and remember that there are both risks and chances. Regulatory oversight makes things even more complicated by adding more uncertainty. It is still important to balance excitement with caution when dealing with unpredictable cryptocurrency markets that have a history of speculative excesses.

Recommended Article: SEC Engages With Sui Blockchain Ahead Of Critical ETF Decision

Small Startups Face Regulatory Challenges

Small fintech startups face regulatory challenges due to changes in securities laws and the SEC’s Project Crypto. These changes make it harder for them to comply with stricter standards and increase costs. Startups, particularly in Asia, must balance limited resources with increasing demands for transparency, supervision, and compliance.

To stay competitive, they need to adapt strategically, work with licensed financial institutions, invest in compliance systems, and respond quickly. The shift in regulations highlights the importance of aligning growth with compliance sustainability in dynamic global digital asset ecosystems.

Best Practices For Treasury Management

To lower risks and make sure they follow the rules, businesses need to use strong crypto treasury management practices. One suggestion is to use treasury APIs, which let you track assets in real time and make transactions without any problems. These kinds of technologies make things run more smoothly, which helps with transparency and security.

Treasury systems must include AML and KYC compliance to help support legitimacy. Setting up business payout systems, looking into integrating stablecoins, and adding more ways to pay all make the system more resilient. Companies that use comprehensive treasury management strategies improve their long-term viability and position themselves well in crypto markets that are changing more and more because of regulation.

Community Trust Supports the Sui Outlook

Sui community involvement boosts investor confidence, demonstrating that blockchain can be useful beyond speculation. A strong ecosystem supports optimistic predictions, aligning with the utility-first story pushed during SEC talks. Community-driven growth is crucial for staying relevant, with value propositions based on participation in decentralized projects, developer ecosystems, and payment systems.

Strong engagement makes investors more confident in their investments, suggesting Sui’s credibility despite doubts. This balance between rules and community growth increases the likelihood of people continuing to use cryptocurrencies in the long run as technology evolves.

Sui’s Path to Institutional Adoption Awaits Regulatory Clarity

Sui’s future depends on ETF decisions, regulatory actions, and community participation. If approved, Sui could be widely used, similar to Bitcoin and Ethereum in institutional portfolios. However, failure or delays could slow progress, highlighting the importance of clear rules. Adoption depends on compliance frameworks and community involvement.

Investors closely monitor regulatory decisions, anticipating important months ahead. Sui’s growth demonstrates how innovation, regulation, and speculation can work together. The long-term path is promising, but due to uncertainty, cautious optimism is needed as we navigate this complex landscape.