Metaplanet Gets Billions to Invest in Bitcoin

Metaplanet announced a huge $1.45 billion share sale, which shows that it is very serious about increasing its Bitcoin holdings around the world. The sale shows that Japan’s biggest corporate treasury has changed hands, and it also shows that more and more companies around the world are using digital assets.

The sale, which was officially priced at ¥553 per share, raised a lot of money by selling 385 million shares, even though the stock price has been having problems lately. Almost all of the money made goes toward buying Bitcoin, which puts Metaplanet among the top companies in the world that own BTC.

Strategic Allocation for Buying Bitcoin

¥183.7 billion of the ¥212.9 billion raised will be used to buy more Bitcoin reserves in the coming months. Another ¥20.4 billion is set aside for activities that will make money, which supports Metaplanet’s strategy of being diverse but still focused on Bitcoin.

The company said that high debt levels, long-term negative rates, and the yen’s drop in value made this risky plan necessary. These economic factors made Metaplanet move toward digital assets, with Bitcoin seen as a way to protect their money from losing value in the long term.

Shareholder Approval Made the Way Forward

Shareholders voted on September 1 to allow the sale of up to 550 million shares. This approval let the company finish the deal after months of share price swings and investor arguments.

Even though its share price has dropped 54% since mid-June, investors still believe in aligning with Bitcoin-driven growth. The change is a big step forward in corporate finance and gives Japanese companies a new way to look into digital assets.

Recommended Article: Bitcoin Rally Eyes Two Hundred Thousand As Fed Fuels Optimism

Increasing Bitcoin Holdings and Global Rank

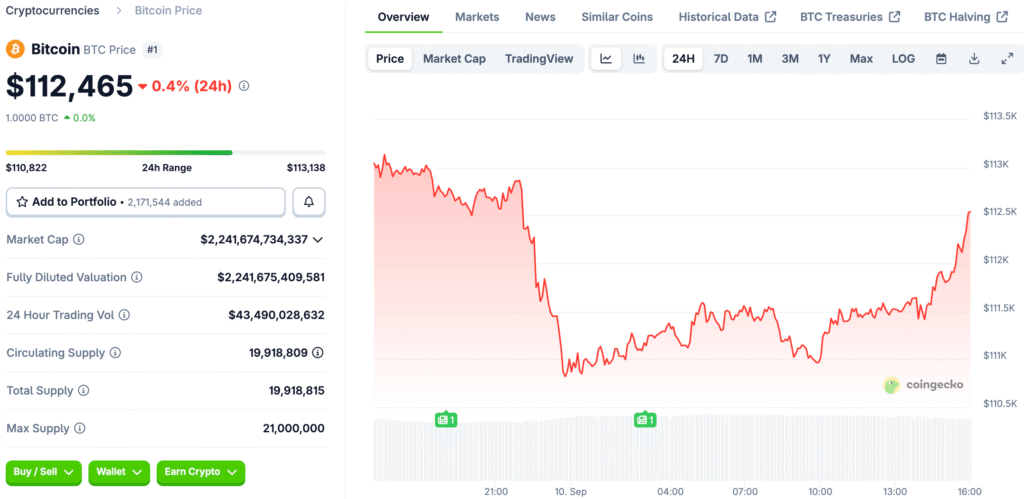

Metaplanet now has 20,136 BTC in its treasury, which is worth about $2.25 billion. This makes it the sixth-largest corporate holder in the world. This comes after the company bought 136 Bitcoin earlier this week, which strengthens its long-term vision.

The company is now behind big names like Marathon and MicroStrategy, but it is still ahead of Tesla, Coinbase, and Trump Media. This progress shows that Japan is becoming more involved in the use of Bitcoin by businesses, which was mostly done by U.S. companies.

Analysts Call Bitcoin a Mainstream Strategy

Experts in research say that using Bitcoin in business is moving from an experiment to a common strategy for managing the company’s finances, especially with the new accounting standards. It is also thought that the growth of ETFs and the normalization of Bitcoin exposure will speed up the integration of businesses around the world.

Analysts say that by the end of the year, public companies could own more than a million BTC, which would show that it is widely accepted. Bitcoin could be widely seen as digital gold by 2027, making it a key asset for treasury reserves.

Integration With Broader Financial Ecosystem

All of this happens at the same time as BlackRock’s IBIT ETF, which grew to more than $80 billion in assets in just one year. IBIT now makes more money than BlackRock’s main S&P 500 ETF, which shows that there is a huge demand for it.

The growth of ETFs and corporate treasuries has led to Bitcoin being used more widely in global finance. Bitcoin is becoming more popular with pension funds, hedge funds, and big companies, which is changing how people invest around the world.

Metaplanet Makes Japan’s Bitcoin Stronger

Metaplanet’s bold moves are more than just a business plan; they show that Japan is joining the global Bitcoin treasury race. This is part of a trend in Asia toward diversification, which is helping crypto grow outside of the U.S. market.

Metaplanet increases its role in financial innovation by adding more BTC to its holdings and joining the FTSE Japan Index. Its long-term goal makes it a key player in determining how digital assets will be used in global markets.