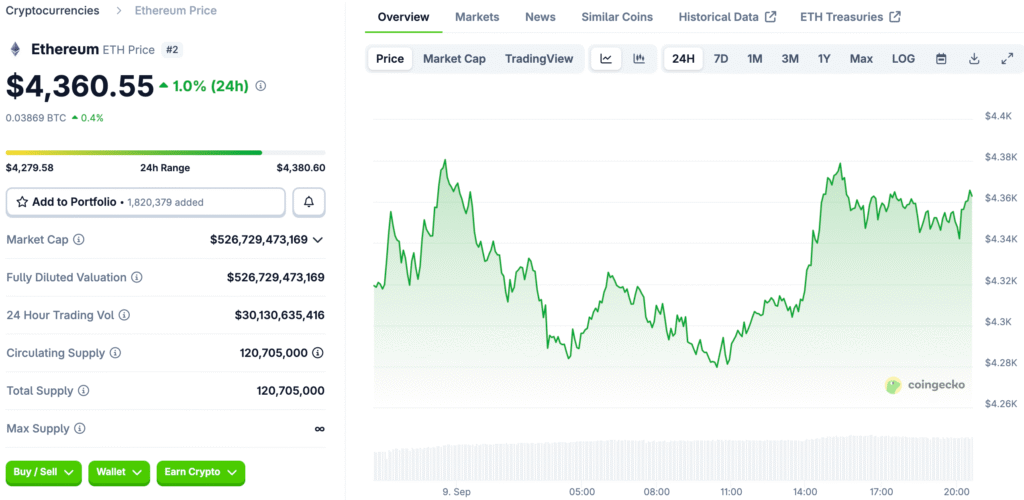

Ethereum Price Holds Steady Below Key Resistance

Ethereum is trading around $4,358 after failing to break out several times and making lower highs and lows, which could mean that the price will keep going down. It is still hard to get past the resistance at $4,500. The structure of the market suggests that a descending triangle pattern is forming, which could lead to a drop to $3,550.

Bullish traders are unhappy with this phase of consolidation. Weak demand stops a real breakout. Analysts point out signs of exhaustion that are hurting Ethereum’s short-term price outlook. Technical problems make it clear that you should be careful. Investors get ready for deeper pullbacks unless strong catalysts appear that can significantly boost buying momentum.

ETF Outflows Undermine Investor Confidence

Ethereum ETFs experienced outflows of $787.6 million last week, indicating a decline in institutional demand. On Friday, $446.8 million was taken out, indicating a loss of faith among investors. This decrease in exposure adds to the downward pressure on Ethereum’s short-term price movements.

The weakness of ETFs affects institutional adoption and the ability of Ethereum to maintain momentum without new demand. ETF flows remain a crucial indicator of investor sentiment in digital asset markets.

Futures Market Signals Less Speculation

The open interest in Ethereum futures dropped by 18%, going from a record $70 billion to $58 billion as demand for leverage fell. This drop shows that speculative traders are backing off. Lower futures activity shows that people are less sure about short-term bullish scenarios across Ethereum.

Less leverage activity makes a deeper correction more likely. Less speculative momentum makes it harder to bounce back during bearish breakdowns. The pressure on the downside is slowly building. Analysts see this as a sign of danger. Less speculative participation shows that both institutional and retail market participants are losing faith.

Recommended Article: Ethereum Price Surge Builds Case for $6K Breakout

Network Activity Shows a Drop in Revenue

Ethereum network fees fell by 44% in August, bringing in $14.1 million instead of $25.6 million in July. Despite a 240% decrease since April, these fees make the business less stable. Network upgrades, such as Dencun, made things cheaper but also made fee-driven deflationary mechanics less effective.

Lower fees hurt Ethereum’s deflationary story, affecting bullish catalysts. Investors are confused by this contradiction, as there are no strong fundamentals to support the current rally without strong network utility.

Stablecoin Dominance Supports Long-Term Bullish Case

Ethereum dominates the stablecoin market with a supply of $165 billion and a 57% market share, surpassing Tron and Solana. Its dominance in tokenized assets, including gold, treasuries, and tokenized bonds, contributes to its strong base and legitimacy.

Tokenization products also accelerate institutional adoption, demonstrating Ethereum’s importance in DeFi and the ecosystem. Despite weak speculative and network metrics, Ethereum’s dominance in these areas strengthens its position as a key player in the DeFi ecosystem.

Institutional Adoption Expands Financial Integration

Fidelity raised $203.6 million with the launch of the Ethereum-based Digital Interest Token. This move highlights Ethereum’s importance in finance and its neutrality compared to other blockchain competitors.

Institutional activity is laying the groundwork for long-term bullishness, as Ethereum gains a larger share of global liquidity flows as traditional assets become tokens. Although there are short-term weaknesses, long-term bullish trends in structural adoption support a long-term growth outlook.

Near-Term Outlook Suggests Bearish Risks

Ethereum is about to break the $4,200 support level. If confirmed, a breakdown of the descending triangle could push the price down to the $3,550 target. Investors keep a close eye on things. Bearish confirmation could set off a chain reaction of selling that would increase volatility and put the market’s strength to the test in a big way.

Analysts point out possible rebound zones near $3,800, even though there are risks. Testing these levels again could be the start of a bullish reversal. The short-term outlook is still cautious. Ethereum investors think about the risks against stories about institutional adoption that support long-term growth in structural demand.

Ethereum Awaits Catalysts to Define Its Path in Q4

Ethereum is weak in the short term but strong in the long term. ETF outflows and less network activity show how weak things are, even though structural dominance is strong. Resistance at $4,500 is still very important. Charts show that downside risks are the most important until they are broken. Investors are being careful and waiting for confirmation of renewed demand.

Stablecoin leadership and institutional use show how strong it is. These foundations help to balance out short-term bearish pressures. Ethereum is still very important for the growth of DeFi and tokenization. Outlook is a mix of short-term caution and long-term hope. In the last quarter, which is likely to be very volatile, markets are waiting for catalysts that will set Ethereum’s path.