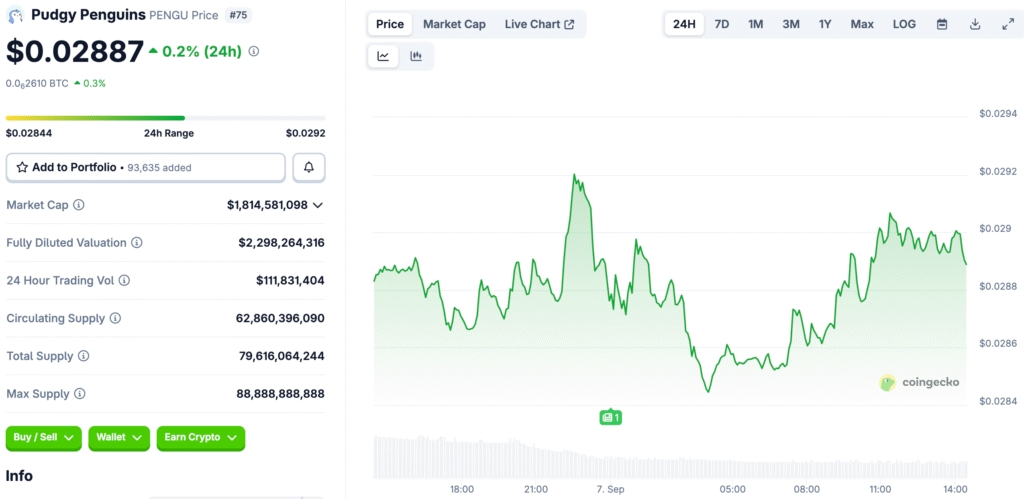

PENGU Holds Steady After a Good Reset

Recently, the price action settled down around $0.028. August made a base for a falling wedge. Consolidation is an important part of pattern maturation.

The structure looks like a cup and handle. The neckline is around $0.045 to $0.046. That critical band was defined by multiple rejections before.

Breakout Mechanics and Measured Objectives

A decisive neckline reclaim shows that strength is there. The measured move’s first target is about $0.060. If momentum keeps going, higher extensions will open up.

First, you need to clear the mid-range resistances. For momentum to work, there need to be higher highs and closes. Buyers need pressure to keep going.

Narrative Tailwinds Make People More Sure of Their Community

People started comparing DOGE to other things online. Ambitious projections drive engagement loops. Narrative energy often comes before spikes in liquidity.

Community growth helps rallies that happen on their own. Social proof encourages people to buy more than once. Cohesion makes it easier to get through corrective phases.

Recommended Article: Pudgy Party Game A Blueprint for Web3 Adoption

Market Cap Scenarios Frame Upside Curiosity

Analysts made up hypothetical scenarios for DOGE parity. A matching market cap means that prices will go up a lot. These kinds of things are still just dreams for now.

These comparisons have a big impact on what people expect. Traders need to tell stories and talk about chances separately. Risk control is always the most important thing.

Cycle Symmetry Suggests a Timely Change

The last correction lasted for thirty-nine days. The most recent reset lasted forty days. Pattern watchers are interested in duration symmetry.

Repeated timing points to behavioral rhythms. Markets often have the same patterns over time. Price must still confirm it.

Accumulation Zones and Plans for Managing Risk

Buyers kept a close eye on the $0.025 area. Support held up after being tested a few times. That kept constructive structures in higher time frames.

Placement of stops is important for survival. Invalidations are below the most recent swing lows. Scaling entries makes timing risk a lot lower.

Path to Ten Cents Requires Layered Wins

First, get the neckline back with volume. Then, turn mid-range resistances into support. Finally, ride the momentum to your goals.

Ten cents is a big goal. Execution and liquidity will determine viability. Discipline changes stories into results.