ADA Stays Above a Key Support Level

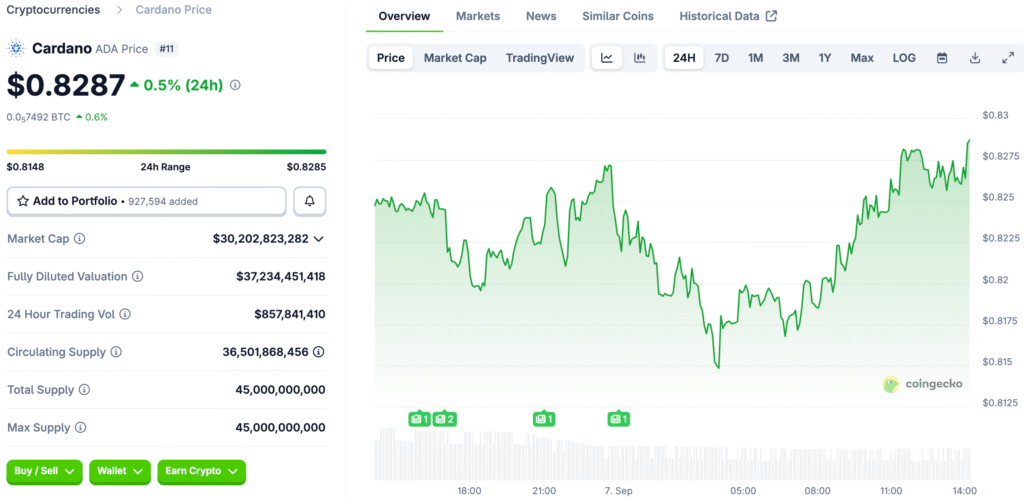

Cardano is currently trading at about $0.82. Buyers keep defending the $0.80 shelf. The level anchors larger efforts to consolidate.

Resistance is now between $0.83 and $0.84. Within that band, EMAs are very close together. Compression usually comes before directional expansion.

Symmetrical Triangle Frames Short-Term Structure

The four-hour chart shows that the price is moving in a triangle. Tight ranges show that people can’t make up their minds. Patience is still a good thing to have.

A clear close above $0.84 is good for bulls. If you don’t succeed, you might lose momentum. How you react to the third test is very important.

On-Chain Flows Signal Cautious Participation

Net outflows have been low lately. There were still rotations toward other assets. That temporarily stopped upside impulses.

The outflow scale still looks like it’s under control. Bids haven’t been overwhelmed by selling pressure. Keeping it at $0.80 keeps things positive.

Recommended Article: XRP, Cardano, and Remittix Show Diverging Market Paths

Cardano’s Ecosystem Wins Boost Developer Interest and Sentiment

SNEK did well on trend dashboards. Liquidity got better for some pairs. Activity brings people to Cardano places.

Ecosystem wins help keep people’s feelings stable. They show how much interest developers have in them. Later on, halo effects can help ADA.

Noise in Reputation and the Path to Trust

There was more debate about old accusations. Independent reviews had already cleared up concerns. Money was sent to governance structures.

It always takes time to rebuild trust. Transparency helps organizations think about how to reengage. Clear audits help keep credibility strong.

A Technical Guide for Breakout Hunters

A close above $0.84 quickly leads to $0.88. The $0.92 zone is the next level of upside. A measured path aims for parity later.

Failure brings $0.80 back into focus. A break could show $0.76 support. Stops below $0.79 handle bad excursions.

ADA’s Price Compression Hinges on $0.80 Support

ADA is in a very important compression phase. External stories change marginal flows. Local interest stays high when there are internal winners.

Holding $0.80 makes upside tests more likely to happen. The next big problem is $0.88. If there are no inflows, $1 may stay out of reach for a while.