Investors Pivot Toward Bitcoin Hyper

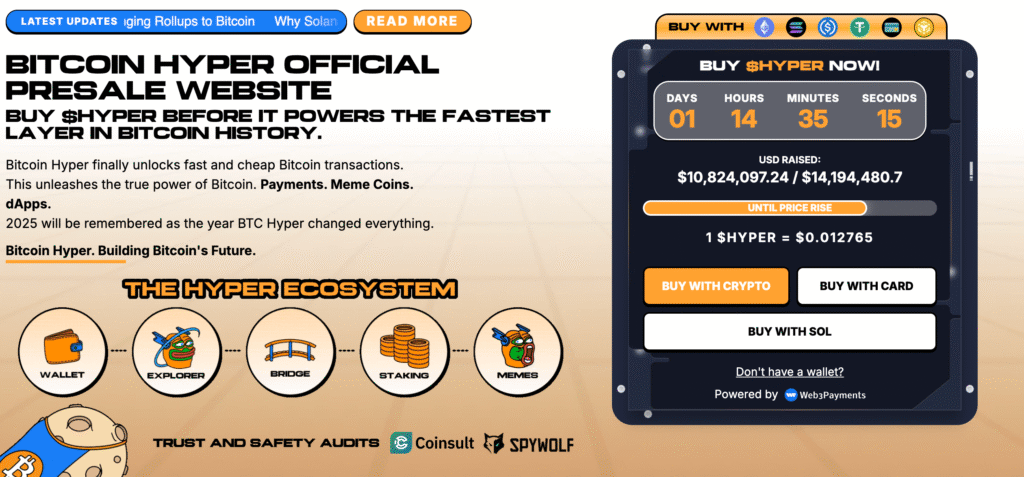

The cryptocurrency market is experiencing a period of sharp contrasts. While XRP continues to struggle under bearish pressure, a new contender, Bitcoin Hyper, is drawing growing investor attention with its bold presale success and innovative blockchain design. In just weeks, Bitcoin Hyper has already raised $10.4 million, with daily inflows exceeding $300,000.

The project is building a Bitcoin Layer 2 blockchain, designed to extend Bitcoin’s role beyond a simple store of value into an active ecosystem for DeFi, payments, and meme coins. This innovation positions Bitcoin Hyper at the intersection of utility and investor speculation, two forces that have historically driven explosive growth in crypto.

Bitcoin Hyper’s Technical Edge

Unlike most emerging tokens, Bitcoin Hyper leverages Bitcoin’s security while addressing its well-known limitations: scalability and transaction speed. The project uses ZK-rollups to report transactions back to Bitcoin’s Layer 1, ensuring integrity and immutability. At the heart of its design is a trustless canonical bridge, enabling users to move their Bitcoin into the Hyper ecosystem.

Once inside, holders can interact with DeFi applications, gaming platforms, and potentially an entirely new generation of meme coins built on Bitcoin’s foundation. Analysts, including Umar Khan of 99Bitcoins, suggest that Bitcoin Hyper could deliver 100x returns once it reaches major exchanges, citing its unique positioning and strong early momentum.

XRP Struggles Under Pressure

While Bitcoin Hyper enjoys optimism, XRP is facing turbulence. Its price has fallen below $3, down 4.7% in just 24 hours. Trading volume surged by 94%, but instead of signalling accumulation, the activity suggests mounting sell pressure. Analyst Ali_Charts warns that XRP could fall as low as $2.6 or even $2 in a worst-case scenario.

Still, some traders note significant buying interest at the $2.81 support level, which may provide a temporary lifeline for the token. Despite its strong 415% gain this year, history shows that XRP’s profitability at these levels often precedes corrections, seen most clearly in 2018 and 2021.

Ethereum’s Steady Climb

In contrast, Ethereum continues its upward trajectory, with 60% growth in 2025 and nearly 50% of stablecoin volume flowing through its network. Enterprises such as Visa, Shopify, and PayPal are exploring Ethereum-backed stablecoins, cementing its role in the broader digital economy.

Ethereum’s strength highlights a critical divide: while some projects struggle with volatility, others with strong utility ecosystems continue to dominate.

Why Bitcoin Hyper Stands Out

The most compelling aspect of Bitcoin Hyper is its timing. Investors are increasingly seeking asymmetric bets on projects that offer outsized returns compared to established players. With its $10.4M presale, daily inflows, and Layer 2 utility, Bitcoin Hyper fits this narrative perfectly.

Its growth trajectory mirrors that of early-stage altcoins that once delivered 1,000%+ rallies in short timeframes. By combining Bitcoin’s trust and liquidity with modern DeFi tools, Bitcoin Hyper is uniquely positioned to redefine how Bitcoin functions in the digital economy.

Bitcoin Hyper: The Breakout Contender of 2025

As XRP faces mounting resistance and Ethereum consolidates its dominance, Bitcoin Hyper is emerging as the breakout contender of 2025. Its innovative architecture, strong presale momentum, and bullish analyst projections place it at the forefront of the next wave of altcoin growth.

For investors looking to diversify into high-potential opportunities, Bitcoin Hyper represents more than just another presale; it could be a transformational Layer 2 ecosystem with 100x potential.

Read More: Bitcoin Hyper Presale Gains Momentum as Experts Predict Bigger Upside Than Solana