PEPE Price Prediction at a Make-or-Break Moment

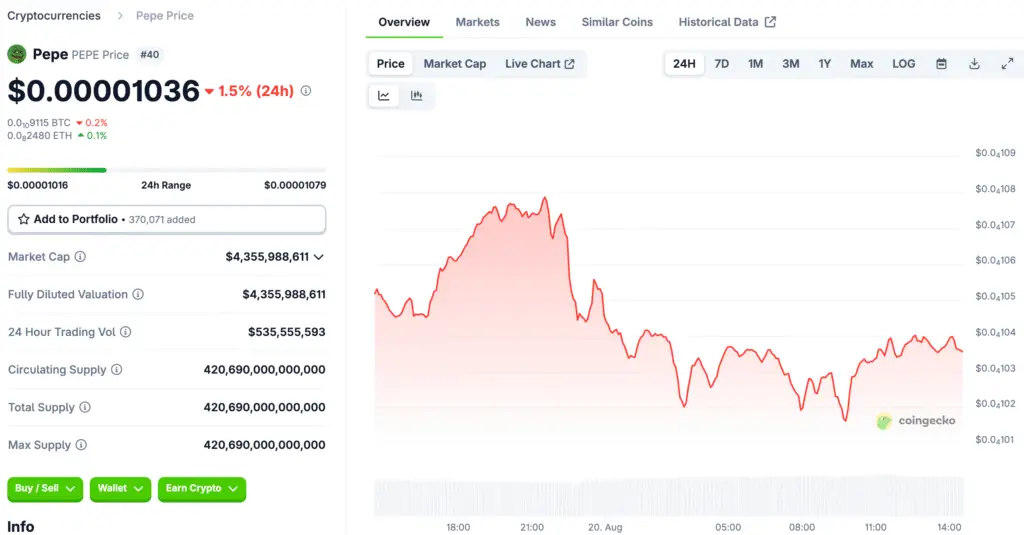

PEPE, one of the hottest meme coins in the crypto market, is once again sitting at a critical technical level that could define its next big move. Since March, a strong support line has repeatedly acted as the launchpad for sharp rallies. Now, with price action compressing between that dependable support and a stubborn resistance zone, traders are asking the big question: will PEPE break out or break down?

The setup has many investors comparing PEPE’s chart to classic bullish continuation patterns. Each dip has been met with strong demand, forming higher lows that signal sustained buying interest. At the same time, resistance overhead has kept a lid on major rallies, building pressure like a coiled spring. This tightening range suggests an explosive move could be just around the corner.

Why PEPE’s Support Level Matters

The importance of PEPE’s current support cannot be overstated. Since March, every time the price touched this ascending line, buyers stepped in aggressively. That kind of price behaviour shows genuine market conviction, not just random fluctuations. For technical traders, this level has become a psychological battleground, and so far, the bulls have consistently defended it.

What’s unique here is the textbook bullish market structure that has formed. The ascending trendline keeps producing higher lows, which is often a precursor to significant breakouts in volatile assets like meme coins. If this structure holds, the next move higher could extend beyond just a short-term bounce.

Volume Tells the Real Story for PEPE

Price levels matter, but volume reveals intent. In PEPE’s case, the story is still developing. Recent rallies toward resistance have been met with selling, but that selling pressure hasn’t looked overwhelming. Instead, it appears to be soft resistance, vulnerable to a serious surge in buyer demand.

What traders are watching closely now is whether PEPE can break resistance with convincing volume. Without it, the move might be just another false start. But if buyers flood in with force, the setup becomes extremely bullish, potentially unlocking new price highs.

The Bullish Breakout Scenario

The first major path forward is the bullish one. If PEPE continues respecting its March support and gains the volume needed to break resistance, it could surge toward previous highs. Once resistance is cleared, market sentiment often shifts rapidly, with sidelined traders jumping in to avoid missing the rally.

In this scenario, PEPE could not only revisit its earlier peak but also potentially carve out new territory. Meme coins thrive on momentum, and a confirmed breakout could set the stage for viral buzz, retail speculation, and fast gains that amplify the move.

The Bearish Breakdown Scenario

Of course, the bullish outlook is not guaranteed. If PEPE’s reliable support finally cracks, the chart would lose its bullish structure, and that could trigger a much deeper correction. Weak hands might be shaken out, creating panic-driven selling that accelerates the decline.

Such a breakdown would not necessarily kill PEPE’s long-term potential, but it would delay a breakout rally. Traders would then be forced to wait for a new base of support to form before expecting another push higher. For risk-averse investors, this scenario highlights why strict stop-loss levels are crucial when trading volatile meme coins.

What Traders Should Watch Next

Right now, all eyes are on two key factors: the March support level and trading volume near resistance. If PEPE maintains its base and breaks through resistance on heavy volume, traders may interpret it as the long-awaited green light.

On the other hand, if volume remains weak or support collapses, the bullish setup could unravel. In other words, the outcome depends not only on chart levels but also on conviction. Without buyers ready to commit, even the strongest-looking chart patterns can fail.

Pepe Coin Is Compressed Like a Spring

PEPE’s current price action reflects a pivotal moment for the meme coin. With support holding firm and a breakout structure forming, the coin is at a crossroads. Traders weighing both scenarios understand the potential reward is significant, but so is the risk if support gives way.

The bottom line: PEPE is compressed like a spring, and the tighter the range gets, the bigger the move that follows. Whether the bulls or bears win this battle depends largely on volume, the ultimate deciding factor in crypto markets. For now, the technical setup favours the bulls, but only if they step in with force when it matters most.

Read More: PEPE Price Surges 3.41% as Meme Coin Eyes $0.000017 Target