Whale Activity Signals Growing Confidence

Hyperliquid (HYPE) has attracted significant whale attention in recent days, with one large wallet investing over $40 million into the token. This included a single purchase of 466,000 HYPE worth approximately $21.5 million, made between $46 and $47 per token. Such whale behaviour often signals strong confidence in the asset’s near-term potential. It also adds pressure on retail and institutional investors who fear missing out on potential upside momentum. When whales accumulate, they typically lock tokens for long-term holdings, reducing available supply and intensifying scarcity.

Hyperliquid TVL Climbs to $2.81 Billion

The protocol’s Total Value Locked (TVL) continues to climb steadily, reaching $2.81 billion this week. According to DeFiLlama, Hyperliquid has also set records in perpetual contract trading volumes, surpassing $29 billion in just 24 hours. Protocol fees exceeded $7.7 million on August 15 alone. Since 97% of fees are directed to token buybacks, these metrics are highly bullish for HYPE holders. This mechanism creates constant upward pressure on the token price, aligning the platform’s success directly with investor returns.

Institutional Backing Strengthens Bullish Case

Institutional investors are increasingly positioning themselves around Hyperliquid. Paradigm currently leads with holdings exceeding 20 million tokens, while Galaxy Digital maintains over 10 million. Other institutions, including Laurent and Hyperion, have taken multi-million token stakes. Anchorage Digital has also added support for institutional custody of HYPE, making it easier for hedge funds and asset managers to enter the market. With more tokens moving into long-term storage, available liquidity continues to shrink, supporting the bullish outlook.

Valuation Metrics Indicate Undervaluation

Beyond institutional interest, on-chain fundamentals suggest that Hyperliquid may be undervalued. Analysts note that HYPE’s supply-weighted P/E ratio sits at 3.39, comparing float-adjusted market cap to protocol earnings. With revenue growth averaging $3.45 million based on the 30-day EMA, the token trades below its historical valuation levels. This metric implies investors may still be early to capture the full growth potential of Hyperliquid as revenues scale higher.

Technical Patterns Point Towards Breakout

On the technical side, HYPE is trading near a critical resistance zone at $48. Chart analysis reveals the formation of an ascending triangle, a bullish continuation pattern that signals increasing buying strength. Higher lows paired with repeated resistance tests suggest that momentum is building for a breakout. If HYPE breaks above $48 with volume confirmation, analysts project rapid movement towards the $65–$70 range, with the potential to extend into $84–$90. This aligns with predictions from analyst Crypto Target, who believes the breakout could double prices within weeks.

Read More: Bitcoin 2025: A Look at Bullish Projections and Market Dynamics

Potential Risks Remain in Play

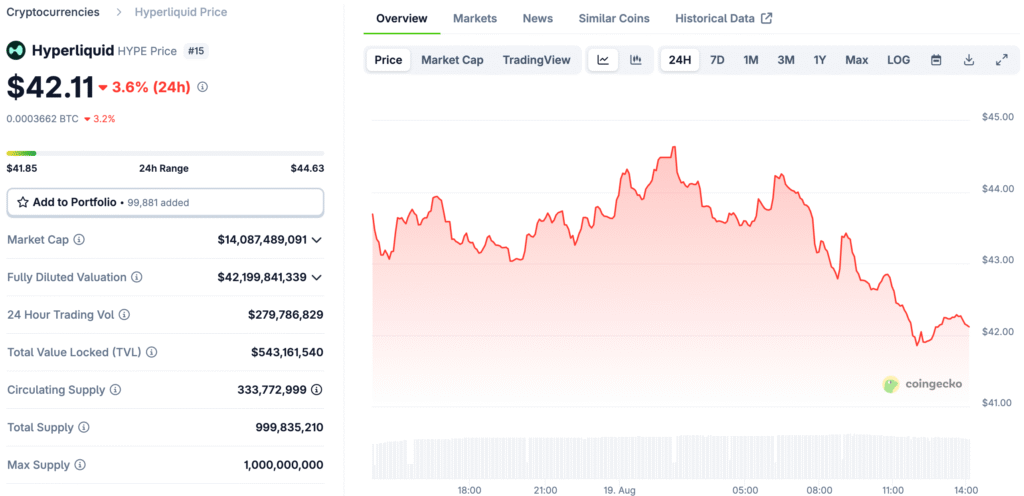

Not all market observers are fully convinced of the bullish case. Some analysts warn of a possible rising wedge pattern, which could indicate weakening momentum. A breakdown below $45 support might shift sentiment, pushing HYPE back towards the $40 zone. Similarly, broader market volatility in Bitcoin and Ethereum could weigh on HYPE’s performance despite its strong fundamentals. Investors should therefore balance optimism with risk management strategies.

Hyperliquid’s Competitive Edge in DeFi

One of the reasons Hyperliquid has captured market share is its custom-built Layer 1 blockchain. Capable of processing 100,000 orders per second with sub-second finality, it provides decentralised execution speeds comparable to centralised exchanges.

This technological advantage has enabled Hyperliquid to claim 6.1% of all perpetual contract trading volumes, up from nearly zero a year ago. In July alone, the platform processed $320 billion in trades, showcasing its rapid adoption curve.

Hyperliquid’s Next Move Is on the Horizon

With whale accumulation, strong institutional backing, and consistent growth in trading activity, Hyperliquid appears poised for its next major move. The short-term battle lies at the $48 resistance level, which could open the path towards significantly higher price targets.

On-chain signals and valuation metrics both point to an undervalued asset, while technical charts suggest bullish continuation. However, traders must remain cautious of market corrections and structural risks. Whether HYPE breaks out or retraces, the coming weeks will be critical in defining its trajectory.