Solana’s Price Surges Past a Key Milestone

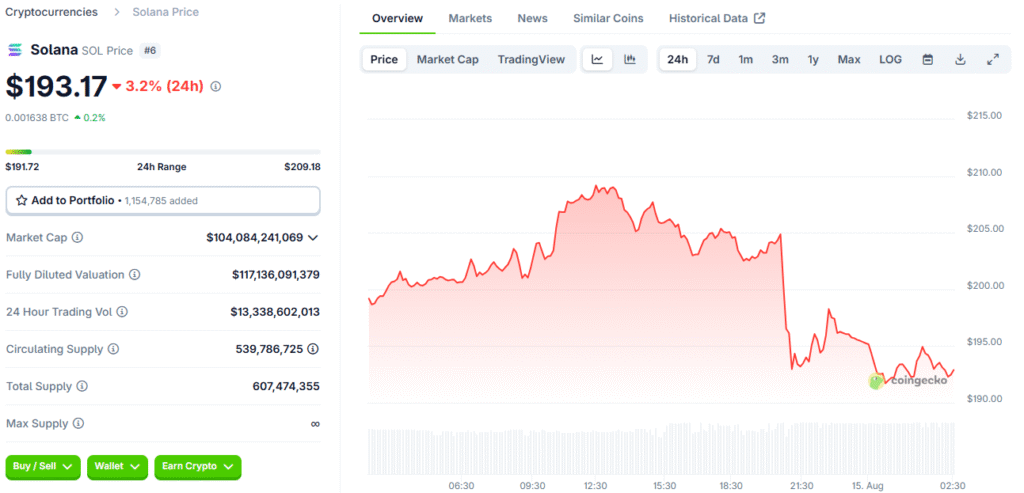

In a dramatic and decisive turn for the cryptocurrency market, Solana (SOL) has surged past the critical $200 mark, reaching a new price of nearly $204. This rally marks its highest price since July 22 and represents a significant gain of over 25% in the past seven trading days alone. The momentum behind this move is undeniable, as trading volume spiked to nearly $15 billion in a single day, a clear sign that both institutional desks and retail traders are piling back into the network.

This powerful influx of capital is driven by a renewed confidence in Solana’s ability to not only compete with but also potentially challenge other major digital assets. Despite this impressive rally, Solana is still trading more than 30% below its record high of over $290 set earlier this year. This fact leaves plenty of room for momentum-driven traders and long-term investors to target fresh highs if the current market sentiment holds. For many, breaking the $200 psychological barrier is a powerful signal that Solana is back in a bull market and is well-positioned for its next phase of growth.

The Corporate Treasury Trend

A key driver behind Solana’s rally is the growing and powerful trend of corporate treasuries holding digital assets. This is no longer a fringe idea; it is a mainstream strategy being adopted by publicly traded companies. According to the crypto research platform The Block, Solana treasury firms now collectively hold a record 3.4 million SOL. This is a significant amount of the total supply being taken off the market and held for the long term. Public companies such as Upexi, DeFi Development Corp, and Canada-based Sol Strategies are at the forefront of this accumulation trend.

They are positioning themselves not just to benefit from price appreciation but also to participate in the lucrative DeFi yield opportunities that the Solana ecosystem offers. This trend mirrors the corporate accumulation wave seen in the Ethereum space, where firms are scooping up ETH for long-term holds. This broadening acceptance of digital assets as legitimate entries on a company’s balance sheet is a powerful endorsement of the crypto space and a strong catalyst for sustained growth that goes far beyond a simple retail-driven rally.

Altcoin Season Heats Up

The synchronised rally across major altcoins is a strong indicator that “altcoin season” has officially kicked off. This narrative is further supported by Bitcoin hitting a fresh all-time high of $124,500 earlier today, pushing its market cap to about $2.5 trillion. This “buy everything” risk-on rally, fueled by a renewed sense of optimism, is now spilling into the broader crypto market. With Ethereum just shy of its 2021 record, its impressive performance is also providing a significant tailwind for the broader altcoin complex.

The synchronised rally across these majors reignites the altcoin season narrative, where high-beta tokens like Solana and Ethereum have historically outperformed during Bitcoin-led bull waves. This dynamic suggests that investors are moving profits from Bitcoin into other assets, seeking higher-risk, higher-reward opportunities and fueling a new wave of growth. The capital flow from the market leader into altcoins is a classic sign that a full-fledged altcoin season is underway, and Solana is a prime beneficiary of this trend.

The Role of Technology and Network Health

Beyond the macroeconomic factors and corporate trends, Solana’s rally is also driven by the fundamental health and technological strength of its network. Solana’s core technical advantages its incredibly high throughput, low transaction fees, and fast block times make it an attractive platform for developers and users alike. This has led to a vibrant and growing ecosystem of decentralised applications, from finance and gaming to NFTs.

The network’s robust developer community is constantly building new projects, which in turn drives more utility and demand for the SOL token. Unlike other networks that have struggled with scalability and high fees, Solana offers a seamless and efficient user experience, a crucial factor for a market that is increasingly focused on real-world utility. This focus on building a high-performance, developer-friendly network is a key reason why Solana is seen as a legitimate rival to Ethereum and a top destination for new projects.

Solana’s Rally: A Narrative of Maturation and Dominance

The current rally is not just about the price of SOL; it’s about a broader narrative of Solana’s maturation and its position in the crypto world. The ecosystem is growing at an incredible pace, with new projects and integrations being announced regularly. This progress in areas like decentralised finance (DeFi), NFTs, and gaming shows that Solana is more than just a high-speed blockchain; it is a foundational layer for a new digital economy.

The influx of institutional capital and corporate treasuries is a powerful validation of this narrative. It signals that traditional finance is no longer viewing Solana as a speculative bet but as a serious investment with a long-term future. This shift in perception is what gives this rally its staying power and separates it from the fleeting hype cycles of the past. The broader narrative of Solana’s growth and its potential to become a dominant force in Web3 is a key reason why so many are now piling back into the network.

Solana’s Rally to $200: Institutional Capital and Altcoin Optimism

The confluence of positive macroeconomic trends, corporate adoption, and a strong technological foundation creates a compelling case for Solana’s future. The rally to over $200 is a powerful first step, but the conditions are now in place for the network to potentially reach and surpass its previous all-time high. The inflow of institutional capital provides a structural demand that will be a key driver of the next phase of growth.

The renewed optimism in the altcoin market, fueled by Bitcoin’s performance, provides a strong tailwind. And the health of the Solana ecosystem, with its high-performance network and vibrant community, provides a solid foundation for long-term value. While a new all-time high is not guaranteed, the conditions are now more favourable than they have been in a long time. The market is now watching closely to see if Solana can capitalise on this moment and solidify its position as a leader in the next crypto cycle.

Read More: Upexi Appoints Arthur Hayes to Boost Solana Treasury Strategy