Bitcoin and Ethereum: Market Awaits Macroeconomic Alignment for New Highs

The cryptocurrency market is experiencing a period of volatility following a new report on wholesale inflation. While Bitcoin managed to hit a new high of over $124,000 overnight, the largest cryptocurrency has since fallen back from its peak. This pullback has had a ripple effect across the market, causing several large altcoins to drop significantly.

The market’s reaction highlights its sensitivity to macroeconomic data, as investors are now trying to gauge the potential impact of a hotter-than-expected inflation report on the Federal Reserve’s monetary policy. This shift in sentiment, which has reduced confidence in a September interest-rate cut, has caused a pullback in risky assets, including cryptocurrencies.

Hot Inflation Data and Its Impact on Crypto

The market’s mixed performance is a direct result of new Producer Price Index (PPI) data, which showed that wholesale inflation picked up more than expected in July. A higher-than-expected PPI report is often viewed as a bullish signal for the U.S. dollar, as it suggests potential rising inflationary pressures.

This, in turn, can lead to a more restrictive monetary policy from the Federal Reserve, which is bad news for high-risk assets like cryptocurrency. The data appeared to reduce confidence that the Fed will lower borrowing costs after its September 16-17 policy meeting. Lower rates tend to make risky assets more attractive, so a shift in expectations for a rate cut can cause a pullback in the crypto market.

Ethereum, Solana, and XRP Slump in Market-Wide Selloff

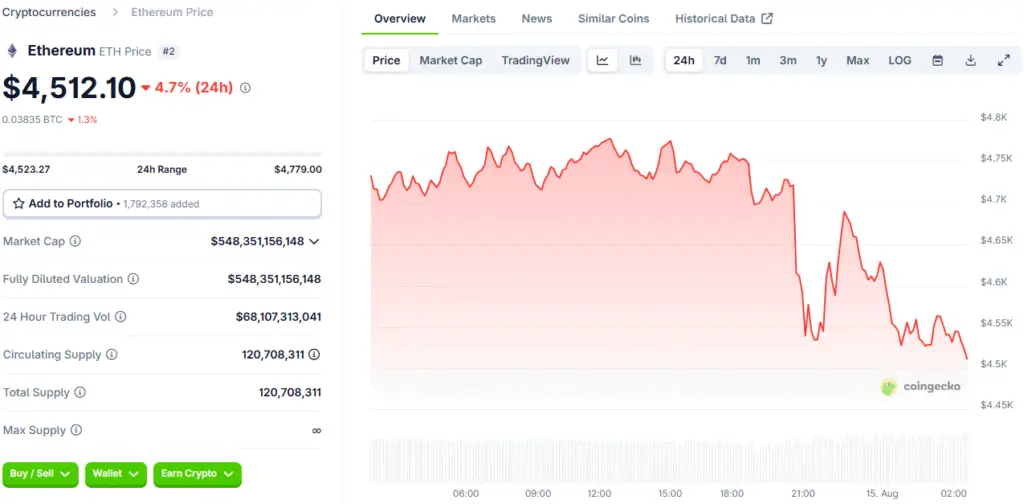

While Bitcoin managed a modest gain over the past 24 hours, several large altcoins saw significant drops. Ethereum (ETH), for example, was down 2.3% to a price of $4,577. This decline is a notable change of pace for Ethereum, which has recently seen strong performance and institutional interest.

Other major cryptocurrencies also experienced a slump, with Solana dropping 2.9% and XRP slumping 5.1%. Even the meme coin sector was not immune, with Dogecoin down 7.7%. This broad-based decline suggests that the selloff is not tied to a single project but is a market-wide reaction to the new macroeconomic data.

The Divergent Fortunes of Crypto Stocks

The market’s volatility is also affecting publicly traded crypto-related companies, with a mix of good and bad news. Shares of the cryptocurrency exchange Bullish were in focus after a strong performance in its initial public offering (IPO), soaring 84% on its debut and rising another 8.5% in premarket trading. However, the stock of another crypto-related company, 180 Life Sciences, which had purchased large amounts of Ether and intended to rebrand as ETHZilla, was down a sharp 28% in premarket trading.

This divergent performance highlights the high-risk nature of the crypto market, where even companies with a clear crypto strategy can experience significant losses. It also shows that investors are becoming more discerning, rewarding some crypto-related ventures while punishing others.

The Role of Interest Rates and the Dollar

The relationship between interest rates and the U.S. dollar is a crucial factor for the cryptocurrency market. Lower rates tend to make risky assets like stocks and digital assets more attractive, as they offer a higher potential return than lower-yielding bonds. A reduction in interest rates also tends to weaken the dollar, which boosts crypto valuations as they are often priced in U.S. dollars.

The hot PPI data, however, has created a sense of uncertainty about the future path of interest rates. While the market is still holding onto the hope of a September rate cut, the new data has raised the possibility that the Federal Reserve may need to maintain its restrictive monetary policy. This shift in sentiment is what is causing the volatility, as investors are now trying to price in the new risk.

The Fed’s Dilemma: Rate Cut or Rate Hold The Impact on Crypto

All eyes are now on the Federal Reserve’s upcoming September 16-17 policy meeting. The PPI data, with its hotter-than-expected reading, has added a new layer of complexity to the central bank’s decision-making process. While a rate cut is still heavily anticipated, the data has raised the probability that the Fed could maintain the rate or even signal its readiness to raise the federal funds rate in the future.

The outcome of this meeting will have a profound impact on the future direction of the cryptocurrency market. Investors will be closely monitoring any further inflation data and commentary from Fed officials to gauge the central bank’s next move. The volatility of the past day is a clear sign that the market is now a central part of the global financial conversation.

Read More: Ethereum Treasury Company Bitmine Immersion Rises as ETH Gains