Mutuum Finance: A New Frontier of DeFi Investment

The cryptocurrency market has a storied history of transforming innovative projects into significant market players, and Mutuum Finance (MUTM) is rapidly emerging as a compelling new contender in the decentralised finance (DeFi) landscape. With its presale gaining serious momentum, the token is currently priced at $0.035, positioning it as a potentially lucrative opportunity for investors seeking substantial growth.

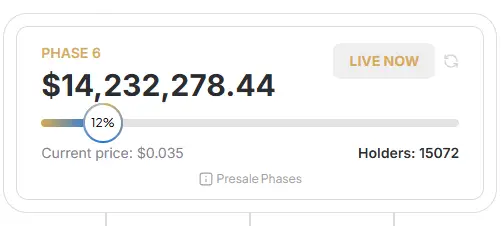

The project has already raised an impressive $14.25 million in its Phase 6 presale, with a community of over 15,000 holders. This robust early support signals a strong market demand and confidence in the project’s potential. Mutuum Finance stands out by offering more than just hype; its foundation is built on a utility-driven model and a clear roadmap, making it a compelling alternative to established players.

A Hybrid Lending Model for Diverse Investors

The core of Mutuum Finance’s innovation lies in its unique hybrid lending system, which combines two distinct models to cater to a broad spectrum of investor profiles. The platform offers a Peer-to-Contract (P2C) lending model that allows users to deposit assets such as ETH and AVAX into smart contracts, earning competitive yields as high as 12% Annual Percentage Yield (APY). This model is designed for risk-averse investors who prioritise security and predictable returns. Complementing this is a Peer-to-Peer (P2P) system, which provides more flexible, direct lending opportunities, such as a potential 33% APY on loans using meme coins like FLOKI.

This dual approach gives users the flexibility to use various assets as collateral or negotiate lending terms directly, effectively balancing safety and flexibility. By providing a platform that can serve both conservative and risk-tolerant investors, Mutuum Finance is building a more robust and inclusive DeFi ecosystem, setting it apart from more rigid platforms.

Strategic Technical Advantages for Scalability

Mutuum Finance is focusing on delivering superior scalability and user experience through its strategic technical roadmap. The platform’s Layer-2 integration is a key step to reduce transaction costs and increase speed, making it more competitive in the DeFi space. This move aims to enhance scalability and user experience, positioning Mutuum Finance as a long-term player capable of handling massive user influxes without compromising performance.

The roadmap also includes the development of a native stablecoin, overcollateralized and pegged to $1, with governance-controlled interest rates and arbitrage mechanisms ensuring price stability. Mutuum Finance is not just following market trends but actively building infrastructure for sustainable growth and real-world adoption.

Read More: Mutuum Finance DeFi Opportunity Nearing 80% Presale Sellout

Security and Community Driving Trust

Mutuum Finance prioritises security and community trust for its decentralised project. The platform has received a rigors audit from CertiK, earning a 95 out of 100 security score. This ensures investors have confidence in the smart contract’s integrity. To further demonstrate safety, Mutuum Finance has launched a $50,000 Bug Bounty programme and a $100,000 giveaway campaign.

These initiatives encourage community participation in identifying potential vulnerabilities and fostering engagement. The project’s rapid presale growth and holder base of over 15,000 members demonstrate its community’s strength and trust. This foundation will enable Mutuum Finance to attract cautious investors who prioritise safety and transparency.

Presale Success and Explosive ROI Potential

Mutuum Finance (MUTM) has seen significant growth potential, with $14.25 million raised so far. The token’s current price of $0.035 is a significant increase from its initial $0.01 price. Early investors in Phase 1 have seen a 3.5x return. The token price is set to increase to $0.040 in Phase 7, narrowing the entry window.

Analysts predict that the MUTM token could achieve over 10x gains by 2025 after the beta launch and Layer-2 integration. If it reaches its expected listing price of $0.06 on major exchanges, it could deliver a potential 60x return for early participants. The project’s focus on long-term sustainability and a clear adoption roadmap make it a compelling investment.

Mutuum Finance vs. Chainlink: A New DeFi Contender

Mutuum Finance is a high-utility token focused on decentralised lending, offering a unique value proposition compared to established giants like Chainlink. Unlike Chainlink, Mutuum Finance’s growth is measured by its large market capitalisation. Its innovative hybrid P2C/P2P lending model and technical upgrades, such as Layer-2 integration, aim to solve real-world problems and enhance user experience.

With a clear adoption roadmap, Mutuum Finance is a strong contender in the DeFi ecosystem. Its projected 60x return, compared to legacy tokens like LINK, offers a more aggressive growth trajectory, making it an attractive option for investors seeking explosive gains in the market.

Mutuum Finance Leads the Way

Mutuum Finance (MUTM) is emerging as a top cryptocurrency to invest in, seamlessly blending innovation with tangible returns. Its presale success, robust security architecture, and dual-lending model encompassing both Peer-to-Contract (P2C) and Peer-to-Peer (P2P) systems outshine many of its competitors. With the beta launch and Layer-2 integration on the horizon, the project is poised for significant growth.

The ongoing developments and a growing interest from investors seeking projects with real utility suggest that Mutuum Finance could be a major player in the future of decentralised finance. Investors are urged to join Phase 6 before the price rises, securing a stake in a project poised for a significant valuation in 2025. Act now to explore Mutuum Finance (MUTM) and capitalise on its immense growth potential, securing your position in the future of decentralised finance.