BONK’s Battle at Key Resistance

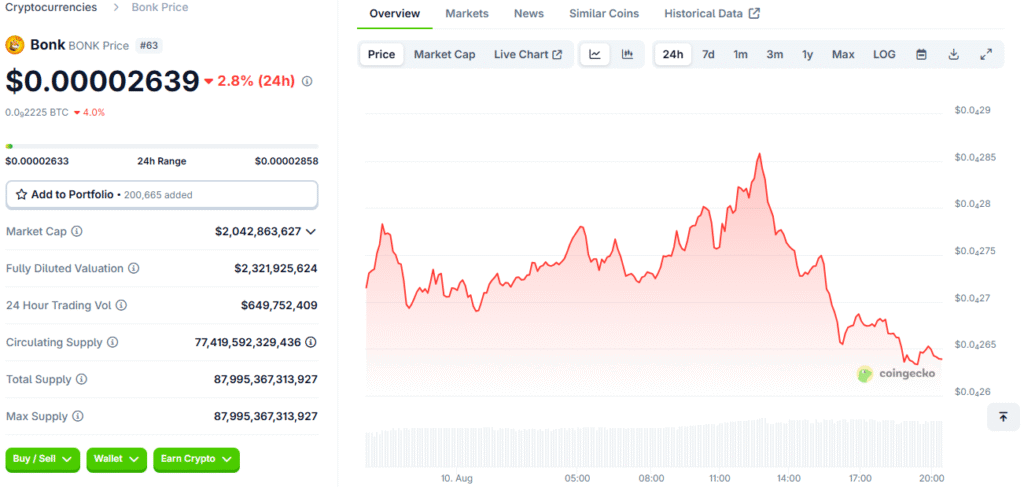

BONK, a prominent memecoin on the Solana blockchain, has recently experienced a 1.7% price increase over the past 24 hours, with its price fluctuating within a tight range of $0.00002485 and $0.00002645. This movement, while positive, indicates a significant battle between buyers and sellers at a critical price point. According to CoinDesk Research, the narrow trading spread during this period was just $0.00000160, a clear sign of market indecision. The price successfully rebounded from a low on August 7, reaching a high during the European morning session, but ultimately met significant resistance at the $0.00002640 level.

This consistent selling pressure has limited further upward movement, positioning this level as a key psychological and technical barrier for the token. A notable volume spike of 48.86 billion tokens was recorded at 12:07 UTC in a clear attempt to push the price higher, but this effort was met with strong resistance, forcing the price back into consolidation. Analysts have highlighted that the high concentration of buy orders between $0.00002580 and $0.00002610 indicates a strong presence of liquidity and investor interest in this specific range, making it a crucial battleground for bulls and bears to determine the token’s next move.

Conflicting Price Forecasts and Speculative Nature

The broader memecoin market, including BONK, remains highly volatile, a characteristic that requires investors to adopt a cautious and well-informed approach. This caution is justified by the significantly varied short-term price forecasts for BONK. For instance, DroomDroom, a trading analytics platform, predicts a five-day price high of $0.000030, reflecting a potential 16.19% increase. In stark contrast, another forecast from Bitget projects a 12.63% decline by July 2025, with a projected price of $0.00002670. These conflicting projections underscore the highly speculative nature of the token.

Unlike more established cryptocurrencies, BONK’s price movements are largely driven by these speculative forces and social media trends rather than by fundamental developments. This reliance on speculation, as emphasised by publications like Coinspeaker, which notes that BONK lacks a clear long-term roadmap, makes the token a high-risk asset. The lack of a clear, utility-based roadmap means that the token’s value is primarily tied to market sentiment, which can shift rapidly and unpredictably, making it a challenging asset for long-term investors.

The Role of Community and Market Shifts

Unlike many Ethereum-based memecoins that sometimes rely on paid influencers for promotional boosts, BONK’s growth has been more organically driven by community participation. This grassroots approach is a key part of its appeal and provides it with a unique position in the memecoin space. A passionate and active community is often a strong indicator of a project’s potential, as it can generate sustained social media buzz and trading momentum. However, this organic growth also makes the token highly sensitive to external market factors, such as broader crypto trends and sudden regulatory changes. The token’s future remains uncertain, as its performance is heavily influenced by market sentiment and speculation.

A major shift in the crypto market, a new regulatory announcement, or even a change in social media trends could have a significant impact on BONK’s price. Investors are advised to stay informed about these external factors and to conduct their own due diligence, as the token’s lack of long-term fundamentals means that its price journey remains highly unpredictable in the short term. The ongoing maturation of the broader crypto market is also forcing a realignment of capital, with investors becoming more discerning and less prone to following pure hype.

BONK: The Battle for $0.00002640 Resistance

In summary, BONK’s price journey remains unpredictable in the short term, with strong resistance at $0.00002640 and active buying between $0.00002580 and $0.00002610, indicating a critical price range to watch. While some forecasts suggest short-term upside potential, the lack of long-term fundamentals means BONK remains a high-risk asset. Traders and investors should closely monitor market sentiment and social media for potential price catalysts, as these often play a key role in driving memecoin rallies.

The battle at the $0.00002640 resistance level will be a key determinant of whether BONK can make a bullish breakout or if it will consolidate further. The token’s future performance will depend on its ability to sustain community engagement and navigate the volatile crypto market. The coming weeks will be crucial for BONK, as the outcome of this consolidation phase will set the tone for its trajectory for the remainder of the year. Investors should be prepared for sharp movements in either direction, as the token is currently at a critical crossroads.

Read More: BONK’s Potential Rally: Key Support Holds as Momentum Builds