Corruption And Weak Rule Of Law Deter Foreign Investment

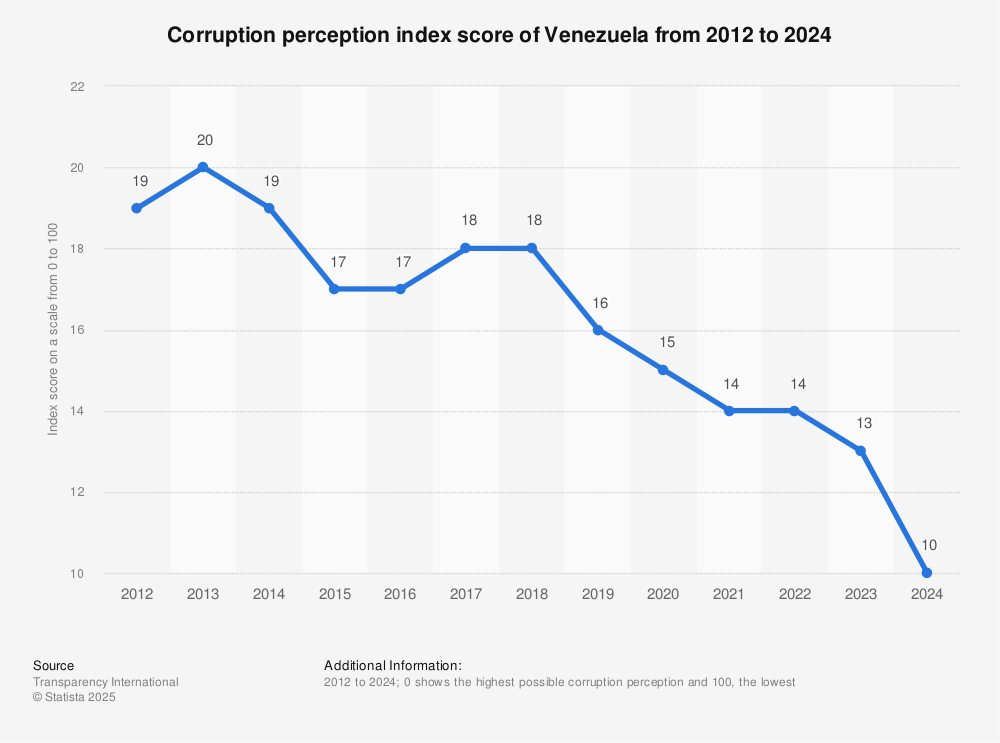

According to global measures like the Corruption Perceptions Index, Venezuela is still one of the most corrupt countries in the world. In 2024, the country came in 178th out of 180, with a score of only 10 on a scale where higher is cleaner. This widespread corruption makes it harder for potential investors to see what’s going on, hold people accountable, and trust them.

Weak enforcement of anti-corruption laws and a bad court system make it hard to do business. Bribery that happens all the time and institutions that are influenced by politics make rules less clear. Companies are at high risk of having strange requests, outcomes that aren’t clear, and expensive legal battles.

Source: Statista

Political Shifts Do Not Guarantee Economic Reform

Some people from other countries have said that recent political changes could be good for Venezuela’s economy. Experts, on the other hand, say that just changing leaders is not enough to make real changes in institutions. Long-term political instability has made it hard for the economy to recover quickly.

Without major changes to the law and business, big companies are hesitant to invest money. Notably, the CEO of a big oil company said that Venezuela was “uninvestable” without big changes to investment protections. These kinds of comments show that investors are not sure about the business climate.

Economic Concentration Limits Diversification Opportunities

Oil has long been the mainstay of Venezuela’s economy, bringing in about 80% of the country’s export income. However, production has dropped a lot, and the country now only provides about 1% of the world’s oil supply. This small economic base makes it hard to find work outside of the energy sector.

Heavy crude production is expensive and hard to refine, especially when infrastructure is getting worse and prices are low around the world. These things make it less likely that new businesses will start up and existing businesses will grow.

Recommended Article: CONAPESCA Pushes Sustainability in Aquaculture and Fisheries

Infrastructure And Labor Constraints Hinder Market Entry

Investors also have to deal with big problems with transportation, power, and basic services. After years of not being invested in or cared for, many facilities are still undercapitalized and not very useful. This makes the costs of logistics high and the supply chains weak.

Labor shortages make things even harder because unemployment is still high and many skilled workers have left the country. Foreign companies that want to grow may have a harder time doing so because there are fewer skilled workers available.

Poverty, Unemployment, And Social Instability Raise Costs

Venezuela is still dealing with extreme poverty and unemployment, which makes it hard for people to buy things and for businesses to sell things. About 88% of the people live in poverty, and almost 32% are out of work. Unstable economies make businesses more risky and slow down market growth.

These conditions lead to inconsistent consumption patterns and higher risks for businesses. When deciding whether to enter a market, companies must take into account changing demand and high security costs.

Uncertainty Surrounds The Sectors That Might Recover

Some analysts think that in a hypothetical post-conflict situation, sectors like energy, construction, agriculture, and services might be the first to bounce back. But any such recovery is likely to happen slowly rather than quickly. The big drop in total exports, from about $112 billion in 2010 to about $13.6 billion in 2024, shows how bad the economy is getting.

Even with possible changes, businesses would probably still put long-term plans ahead of quick profits. When looking at investment opportunities, investors need to think about the structural problems and the potential for growth in the sector.

Strategic Focus Must Extend Beyond Profit To Resilience

Experts say that to be successful in high-risk markets like Venezuela, you need to stop focusing on making as much money as possible and start focusing on being strong and effective. Along with traditional economic measures, businesses should also look at geopolitical, infrastructure, and talent risks. This method helps businesses plan for long-term problems and make sure their strategies are in line with them.

Venezuela’s current situation shows how important it is for companies that want to do business in unstable emerging markets to have strong risk management and flexible planning. Any investor looking into Venezuela’s potential needs to be aware of and ready for these long-term structural barriers.