Social Metrics Flash Bright Green For XRP

LunarCrush recorded a sharp rise in XRP chatter, with mentions reaching 71.71K in the latest interval. Social dominance climbed to 5.90%, more than double its average participation in crypto conversations.

The platform’s Galaxy Score rose nine points to 68, reflecting stronger engagement from active accounts. AltRank improved to 455, indicating relative outperformance when combining price and social activity signals.

Tokenized Treasuries Arrive On The XRP Ledger

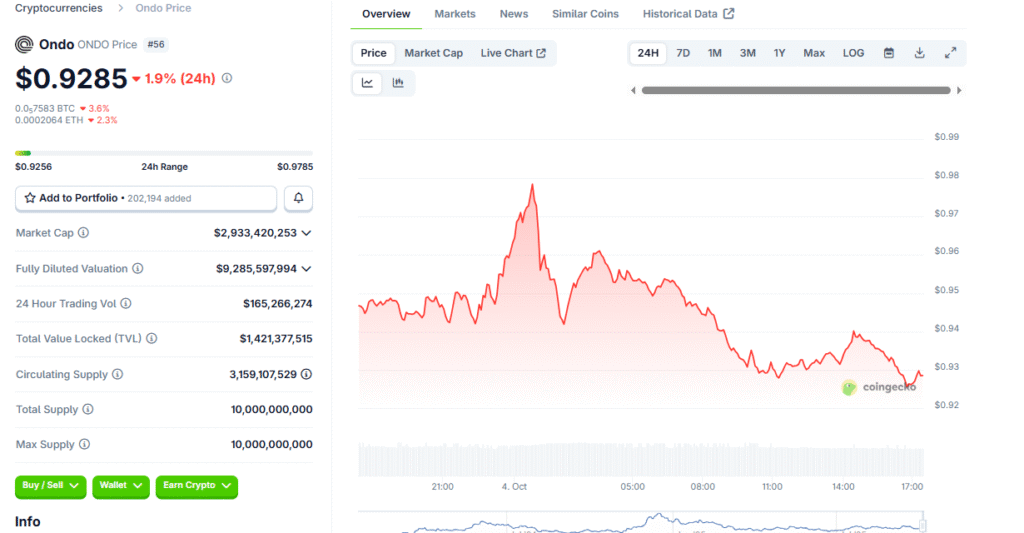

Ripple’s collaboration with Ondo Finance brings OUSG, a tokenized short‑term U.S. Treasury product, onto XRPL. Minting and redemption settle in Ripple’s RLUSD stablecoin, streamlining lifecycle operations.

Qualified institutions gain around‑the‑clock access to Treasury exposure without traditional clearing frictions. The move places conservative yield instruments on payment‑centric blockchain rails.

Recommended Article: SUI Futures Set to Launch on Coinbase Derivatives This October

Why The Partnership Matters Strategically

Marrying Treasuries with XRPL broadens the ledger’s institutional relevance. Tokenized fixed‑income products can deepen liquidity and attract compliance‑oriented participants into crypto infrastructure.

Ondo emphasizes alignment with underlying U.S. government securities, while Ripple supplies the transaction environment. Together they aim to expand access and reduce settlement drag.

Will Attention Convert Into Durable Demand?

Spikes in social activity often precede inflows, but follow‑through isn’t guaranteed. Sustained adoption depends on issuer transparency, operational reliability, and institutional onboarding velocity.

Tracking custody integrations, market‑maker participation, and secondary market depth will help validate durability. Social signals are early; usage metrics confirm impact.

Leadership Changes And Community Confidence

Ripple announced that longtime CTO David Schwartz transitions to CTO Emeritus while remaining on the board. Continuity at the governance level may help reassure stakeholders during strategic expansion.

Stable leadership, combined with institutional partnerships, can anchor sentiment. Execution quality becomes the decisive factor in converting interest into ecosystem growth.

Key Metrics To Watch Next

Monitor OUSG mint/redemption volumes, RLUSD settlement throughput, and cross‑venue liquidity. Observe whether Galaxy Score and social dominance remain elevated as operational milestones accrue.

Alignment between social and on‑chain metrics strengthens conviction that attention reflects genuine adoption. Divergence suggests a transitory narrative cycle.

Bottom Line: Promising Signals, Execution Will Decide

XRP’s social momentum reflects a credible, institution‑friendly use case arriving on XRPL. The coming weeks will reveal whether attention catalyzes lasting demand.

If tokenized Treasuries gain traction, XRPL’s role in real‑world asset rails could meaningfully expand. For now, investors should pair social data with hard usage indicators to judge persistence.

Recommended Article: SUI Futures Set to Launch on Coinbase Derivatives This October