XRP Faces Sharp Downturn After Failed Recovery Attempt

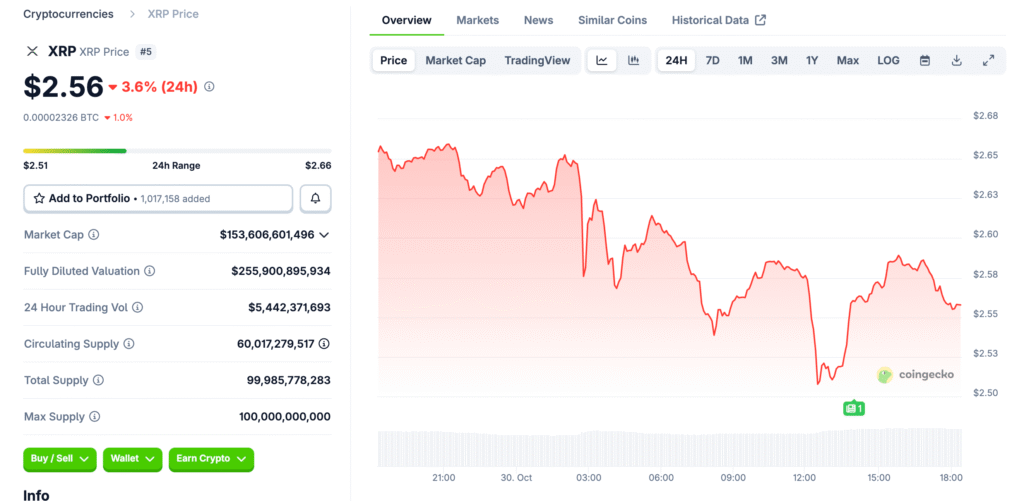

XRP has returned to bearish territory following a failed attempt to hold above its short-term support near $2.60. Over the past 24 hours, the cryptocurrency has dropped more than 2.5%, erasing most of its early-week gains and signaling growing investor caution. The price now hovers around $2.18, with momentum indicators pointing to continued weakness. Analysts note that the inability to maintain higher levels reflects broader selling pressure across the digital asset market, where traders are shifting focus to stronger-performing assets.

Technical Breakdown Suggests Further Downside Risks

From a technical perspective, XRP’s rejection near the 50-day moving average confirms that bears remain in control. The 50-day line, typically seen as a short-term trend indicator, has acted as a ceiling for price rebounds throughout October. Failing to close above this resistance suggests that the asset may be preparing for another leg down. If current momentum persists, a drop toward the $1.95 to $1.80 range appears increasingly possible before any meaningful consolidation begins.

Ripple CTO Clarifies Role in New XRP Treasury Firm

Ripple’s Chief Technology Officer, David Schwartz, has publicly addressed ongoing speculation surrounding his involvement in the newly formed XRP treasury company, Evernorth. The firm recently announced plans to raise over $1 billion through a Nasdaq listing, sparking rumors that Ripple executives were directly managing the initiative. Schwartz clarified that his role is purely advisory and limited in duration, emphasizing that he remains focused on Ripple’s core projects. This clarification came after several media outlets mistakenly reported that he had joined Evernorth’s executive board, fueling confusion among investors.

Recommended Article: Ripple’s $1B XRP Buyback Signals a Structural Shift in Crypto Liquidity

Evernorth’s Ambitious $1 Billion Treasury Plan Explained

Evernorth, the company at the center of recent speculation, is designed to function as an XRP-focused treasury vehicle. Created through a merger with Armada Acquisition Corp II, the firm aims to accumulate large XRP reserves and operate similarly to MicroStrategy’s Bitcoin strategy. By absorbing tokens from the open market, Evernorth seeks to reduce supply volatility and build long-term value for institutional investors. The concept has drawn both interest and criticism, with supporters viewing it as bullish for XRP and skeptics warning of potential centralization risks.

Market Sentiment Weakens Despite Growing Institutional Attention

Despite the announcement of Evernorth’s plans, XRP’s market reaction has remained muted, reflecting mixed investor sentiment. Many traders remain cautious due to regulatory uncertainty in the United States, where digital asset policy remains fragmented. The broader crypto market’s mild correction has also weighed on XRP, causing it to underperform relative to peers like Bitcoin and Ethereum. Until clear signals emerge from both the SEC and institutional buyers, analysts expect price volatility to persist through early November.

Bitcoin Outperforms as Gold Loses Momentum

While XRP struggles to regain traction, Bitcoin has recorded its strongest rally since April, outperforming traditional assets like gold and silver. Gold, which had been one of the year’s top performers, experienced its largest single-day decline in years as investor appetite shifted back toward risk assets. Bitcoin’s renewed momentum underscores a broader rotation into digital stores of value amid global economic uncertainty. This shift may indirectly benefit XRP in the longer term if renewed market optimism spreads across the crypto sector.

Conclusion: XRP Awaits Clarity Amid Volatility and Confusion

XRP’s latest pullback highlights the market’s fragile confidence as traders await clarity on both Ripple’s regulatory stance and the Evernorth treasury narrative. Ripple’s prompt clarification helped ease some investor concerns, but price action suggests sentiment remains cautious. Maintaining support above $2.00 will be critical for avoiding a deeper retracement, especially if Bitcoin continues to dominate market attention. In the near term, XRP’s path forward depends on whether Evernorth’s long-term accumulation strategy can translate into measurable market stability.