XRP Consolidation Signals Imminent Breakdown Pressure

XRP’s price is steady near key support levels, indicating a potential sharp fall. Bearish momentum is increasing, potentially pushing prices towards less liquid areas. Traders are monitoring price changes to determine if bulls will protect key areas.

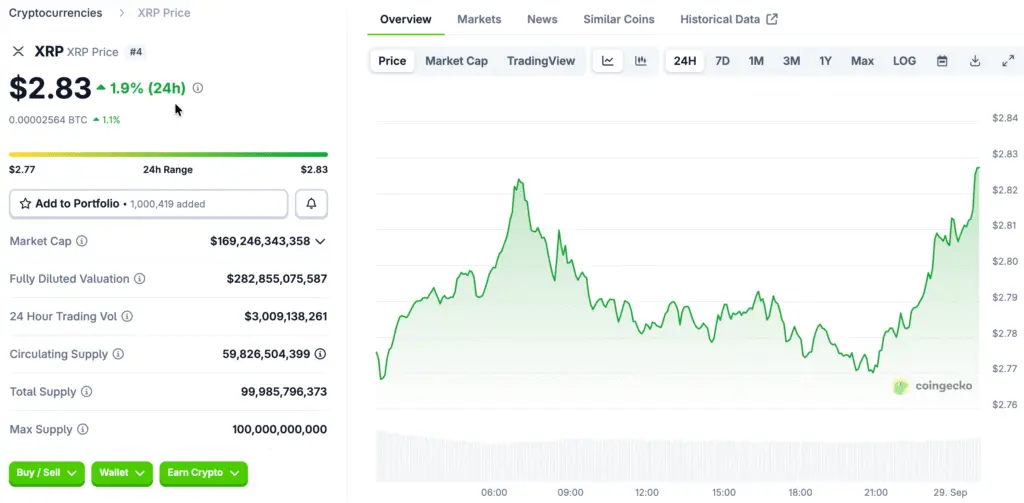

Research indicates XRP is hovering around $2.75, creating a descending triangle pattern in bearish continuations. If downward pressure is enough, the $2.50 level could be tested, aligning with previous fair value gaps and Fibonacci retracement zones. This structure suggests a final dip before strong buying clusters recover.

Key Support Cluster Emerges Between $2.45 and $2.55

On-chain data indicates strong cost basis support levels between $2.45 and $2.55, where many buyers gather to act as defensive barriers. These clusters have been seen before price rises due to liquidity sweeps.

Glassnode’s Unrealized Price Distribution data supports this, suggesting that more owners in this price range could potentially lead to price resurgence. Analysts believe more buyers will stabilize market sentiment, making it easier for a relief rally. Traders can make crucial decisions based on technical and on-chain factors.

Liquidity Compression Points Toward Volatility Release

Sistine Research reports that XRP is currently in its third major liquidity compression phase since November 2024. The narrower price action has tightened order books, creating larger gaps between key liquidity levels and preparing for significant moves.

The compression structure is forming around higher lows, indicating bullish pressure beneath the current weak market. Traders are preparing for a volatility release event that could lead to a breakout or drop, depending on market conditions. Strategic positioning is crucial before this phase.

Recommended Article: XRP Positioned As Wall Street’s Dark Horse Amid ETF Buzz

ETF Changes Could Help the Market Change Direction

Franklin Templeton’s decision on the XRP ETF has been rescheduled to November 14, and the REX/Osprey XRPR ETF has started trading with a daily volume of $38 million. These changes could potentially impact the XRP price in the coming weeks.

Analysts suggest that the positive news about ETF approvals may already be partially priced in, making “sell the news” reactions more likely. However, if successful, ETFs could open up institutional demand, potentially leading to a larger bullish reversal.

Fractal Patterns Suggest One More Sweep Before Reversal

The way XRP’s price is right now is like fractals seen in past market cycles, where a liquidity sweep came before bullish recoveries. Earlier this year, prices broke below key support for a short time before strong rebounds led to long-lasting rallies. These past events help traders guess how prices will move in the near future.

The fractal similarity also shows that there is weakness on the weekends, followed by fair value gap sweeps at the start of new weeks. If this pattern keeps happening, XRP might test the $2.50 zone again before starting to recover. Analysts say that while fractals can help us understand things, we can’t be sure that things will happen exactly the same way every time.

Spot Market Flow Dynamics Show Sellers Are in Control

The spot market data indicates that sellers remain in control, despite strong buyer activity in 2025. A shift in volume towards buyers is necessary for bullish momentum to persist, but this has not yet occurred.

Market participants are waiting for clearer signals before investing heavily in long positions. Pelin Ay’s analysis indicates ongoing competition over prices on major exchanges, and volume confirmation is crucial for confirming potential reversals and ensuring real demand-based moves.

XRP Bullish Reentry Zone Found Between $2.45 and $2.55 Support Range

Based on past data and data from the blockchain, the $2.45–$2.55 zone is still the most likely place for bulls to aggressively re-enter. Strong buyer clusters give structural support, which lowers the risk of prices going down and gives strategic investors good chances to buy more. After these kinds of liquidity sweeps, market sentiment often changes quickly.

If XRP can hold this important range, it could set the stage for a long-term bullish reversal. Traders should look for clear breakouts above $2.90 to confirm momentum shifts and cancel bearish setups. As XRP gets closer to this important point, good risk management and strategic positioning will be very important.