XRP Faces Continued Downtrend in September

XRP’s five-day losing streak continued as it dropped to $2.6935, its lowest point since July. Even though the macro signals were positive, traders were worried about weak momentum. The Fed’s rate cuts didn’t stop prices from moving, and sticky inflation made things more complicated.

The crypto markets fell because the US dollar got stronger. Treasury yields kept going up, which helped the dollar’s recovery. XRP’s losses come after an 8.14% drop in August, which makes people worry that it could lose money every month if bearish sentiment keeps up.

October Brings Critical ETF Decisions

October could be a big month for XRP markets. Seven issuers have submitted ETF applications that are waiting for SEC approval. Deadlines between October 18 and October 25 could change how much institutions are exposed.

The SEC might let several issuers file at the same time so that one doesn’t get an unfair advantage. Analysts think that approvals happening at the same time would speed up inflows. These kinds of changes could lead to a new demand for XRP from both retail and institutional investors.

Lawmakers Push for 401(k) Crypto Access

Republican lawmakers sent a letter asking the SEC to work with them on new rules for retirement investments. The letter mentioned President Trump’s executive order that made it easier to get to alternative assets. Supporters say this change could free up trillions of dollars in retirement savings for people who want to invest in cryptocurrencies.

The lawmakers stressed that a lot of Americans don’t have access to a wide range of investment options. Allowing crypto in retirement accounts could change the way people want things in a big way. Market watchers pointed out XRP as a possible winner because of its usefulness story.

Recommended Article: XRP Price Lingers Below $3 Despite Spot ETF Launch Momentum

XRP Faces Key $2.80–$3.00 Levels as Traders Await ETF Approval

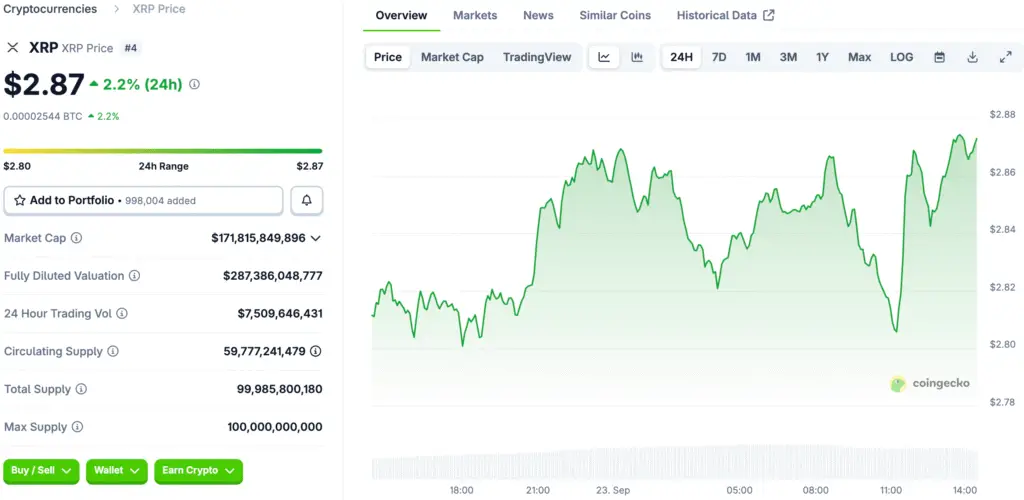

On September 22, XRP fell 4.06% and closed near $2.854. This drop made resistance stronger at $3.00 and support weaker at $2.80 and $2.50. Analysts are keeping a close eye on these areas to see which way they are going.

If it breaks below $2.80, it could go down even more to $2.50. On the other hand, a bounce back above $3.00 could go after resistance at $3.20 and higher. People in the market say that ETF approvals are the most important thing that makes things happen.

Bullish Scenarios Build Optimism

Optimistic forecasts say that ETF approvals and money coming in from institutions could push prices up. Analysts say that blue-chip companies might start using treasury assets. A successful application for a Ripple bank license could give things even more momentum.

If BlackRock or another big company files XRP products, the flow of money could speed up. If Ripple’s technology becomes more popular for global payments, it could increase the potential for gains. These things could push XRP up to $3.33 or more, which is more than $3.20.

Bearish Scenarios Remain a Threat

One risk is that the SEC might turn down or delay ETF applications. Weak inflows from institutional vehicles could make support weaker. Regulatory problems could make people feel even worse.

If blue-chip companies stopped using XRP as a reserve asset, it would put more pressure on it. Not being able to get a bank license could also hurt people’s trust. If this happens, XRP could drop below $2.80 and test support at $2.50.

XRP Traders Balance Volatility With Hopes for Institutional Breakthrough

Regulatory and institutional factors will determine XRP’s future. There are big things going on with ETF approvals, 401(k) reforms, and Ripple’s plans to get into banking. These choices will affect how things move forward in October and beyond.

Analysts all agree that ETF approvals would be a big deal for XRP markets. Until then, the market is still very volatile, with traders weighing their bullish hopes against their bearish doubts. XRP’s path for the rest of 2025 could be set by the next month.