Ripple Legal Chief Blasts Senate Crypto Bill for Ambiguity

Ripple’s chief legal officer, Stuart Alderoty, has submitted a formal and blistering response to the U.S. Senate Committee on Banking, Housing, and Urban Affairs, criticising its draft legislation for failing to deliver regulatory certainty for the digital asset industry. In a detailed letter submitted on August 5, Alderoty argued that the proposed framework, which attempts to divide jurisdiction between the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), would entrench confusion rather than resolve it.

His core message was clear: “The draft creates more ambiguity than clarity for the industry in its attempt to delineate SEC jurisdiction over digital assets.” This strong critique from a leading voice in crypto law highlights a significant concern that the proposed bill, far from being a solution, could inadvertently create a new set of problems for an industry desperate for clear rules of the road.

The Danger of “Ancillary Assets” and Perpetual Oversight

Alderoty’s response raised particular alarm over the draft’s definition of “ancillary assets,” warning of its potential to create a state of perpetual regulatory limbo for a wide range of established cryptocurrencies. The proposed definition suggests that any token once sold through an investment contract could remain indefinitely under SEC jurisdiction. Alderoty emphasised that this presumption ignores the current utility and trading conditions of mature assets, specifically naming XRP, Ethereum (ETH), and Solana (SOL).

He warned that this approach “could subject long-established, widely traded tokens operating on open and permissionless networks… to perpetual SEC oversight, even when current or future transactions bear none of the hallmarks of a securities offering.” This is a critical point, as it suggests the bill’s framework could fail to account for the evolution of a digital asset from an initial offering to its widespread use as a functional currency or utility token.

The “Howey Test” as a “Tool of Limitless Discretion”

The letter from Ripple’s legal chief also strongly opposed the bill’s continued reliance on the Howey test without clear congressional constraints. Alderoty warned that the historical misuse of the Howey test under previous administrations had turned it into “a tool of limitless discretion” for the SEC. This subjective interpretation of the law, he argued, has been a major source of regulatory chaos and unpredictability in the digital asset space.

He recommended that Congress provide specific statutory criteria to avoid further subjective interpretations and ensure agency accountability. This call for specific legislative definitions is a core tenet of the crypto industry’s push for regulatory clarity, as it would provide a predictable framework that both innovators and investors could rely on, rather than being subject to the changing whims of a single agency or administration.

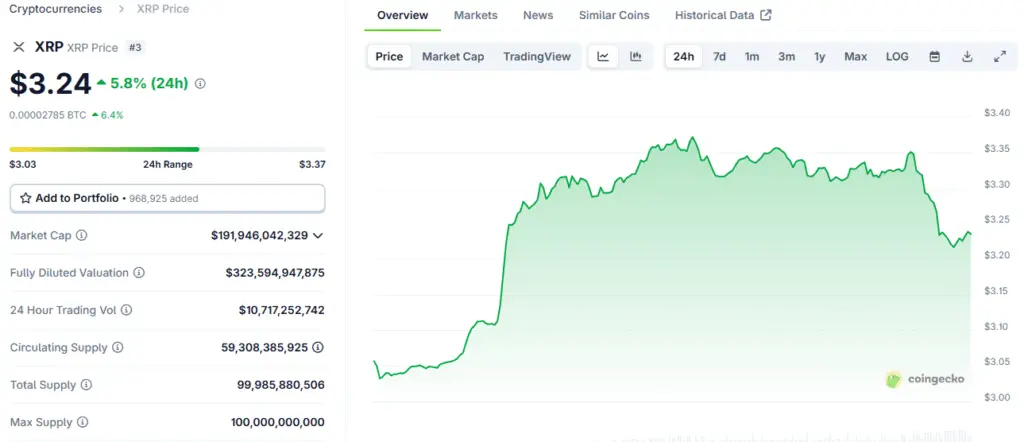

Read More: XRP Price Dynamics: Crucial SEC Guidance Looms

Proposed Reforms for a Balanced Oversight Framework

In addition to his criticisms, Alderoty advocated for several structural reforms to ensure the final legislation creates a balanced oversight framework. He proposed a grandfathering exemption for long-traded tokens, which would protect assets like XRP that have been in the market for years from retroactive classification as securities. He also called for statutory limitations on the SEC’s authority to redefine related-party transactions, a move aimed at preventing agency overreach.

Furthermore, he recommended clear protections for protocol-level activities like staking and consensus operations, which are fundamental to the functioning of many modern blockchains. Alderoty’s letter stressed the need for a balanced approach to regulation, one that fosters innovation while protecting consumers, a delicate balance that has been a central point of debate in the U.S. political landscape.

The Push for Federal Preemption of State Laws

A key element of Alderoty’s advocacy is his call for federal preemption of inconsistent state laws. He argued that “Federal legislation should preempt certain state laws to establish national consistency, reduce regulatory fragmentation, and support innovation.” This is a crucial point for a global industry that operates across state lines. A fragmented regulatory landscape, with each state having its own set of rules, creates significant operational hurdles for businesses and can stifle innovation.

Alderoty noted that preemption is especially critical in areas like market structure, stablecoin issuance, custody standards, and token classification, where “uniform federal oversight is essential.” However, he also clarified that federal legislation should still preserve state authority in traditional areas such as consumer protection and fraud enforcement, advocating for a clear division of authority that supports a cohesive national market.

XRP Lawsuit Spurs Push for Regulatory Clarity in the U.S.

The significance of Alderoty’s letter extends beyond the specific details of the bill; it reflects a broader and ongoing political battle over the future of crypto regulation in the U.S. With the XRP lawsuit having become a landmark case, the outcome of legislative efforts in Congress is being watched closely by the entire industry. The push for a clear regulatory framework is aimed at ensuring that the U.S. remains a global leader in financial innovation, rather than falling behind other jurisdictions.

Alderoty’s letter is a powerful voice from the industry, directly engaging with policymakers to shape the future of a market that has been defined by ambiguity and a lack of clear rules. His warnings about “perpetual SEC oversight” and the need for a balanced framework are not just about XRP; they are about the future of every digital asset and the potential for a new era of growth driven by regulatory clarity.