XRP Holds Momentum Amid $8 Price Speculation

XRP is trading close to $3.05, which shows steady growth as more businesses use it for cross-border payments around the world. Resistance levels between $3.20 and $3.30 make it hard for prices to go up any more, while support levels between $2.80 and $3.00 stay strong.

Analysts say that the $8 target is possible if the breakout happens at the same time as the broader market momentum and institutional demand grows a lot. For a lot of people, XRP is a safer bet for growth in 2025 than the riskier DeFi tokens that are starting to show up on the market.

Mutuum Finance Presale Gains Massive Investor Attention

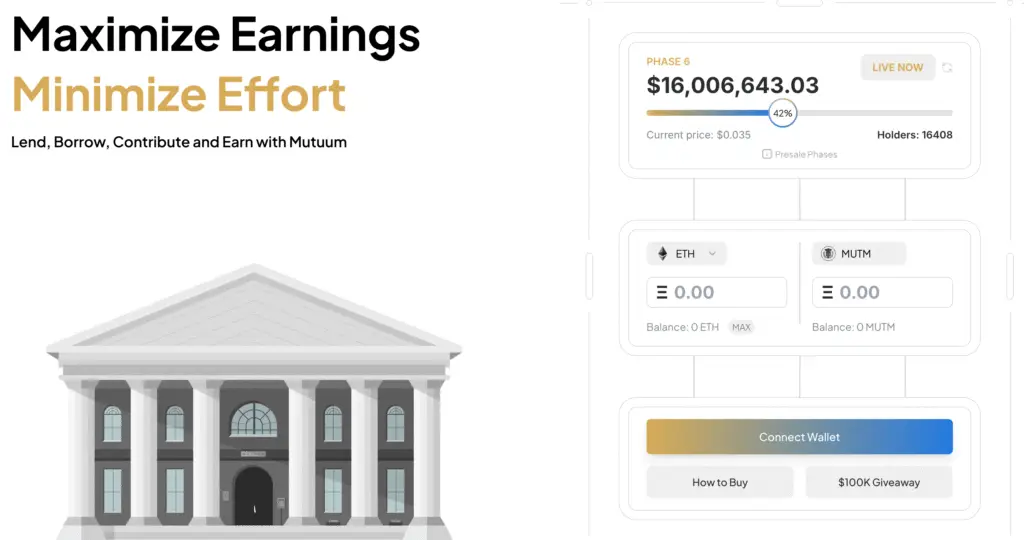

The price of Mutuum Finance tokens is $0.035 in presale phase six, and more than 16,280 investors are already interested. The raised capital is over $15.75 million, which shows that there is a lot of demand in the market for new decentralized finance opportunities in the growing crypto space.

The presale phase shows what could happen. Demand is growing, which raises hopes for high returns after the listing. Analysts say that positive feelings are growing. Stage six is almost done, and the next stages will probably raise the price even more, which will greatly increase the potential rewards for investors.

Security Measures Build Mutuum Investor Confidence

Mutuum and CertiK set up a $50,000 bug bounty that rewards researchers who find possible vulnerabilities quickly across four levels of severity. Participants feel better about the project because it is committed to being open and honest, which is in line with industry standards for trust, security, and proactive risk management.

These steps make investors feel a lot more confident. Projects that have good audits usually get more people to use them, which is good for the project’s long-term prospects. Mutuum stands out from speculative tokens that don’t have structural security frameworks or independent verification procedures because it has more credibility.

Recommended Article: Mutuum Finance $1 Target Gains Momentum Over Dogecoin

Collateralization Framework Strengthens Protocol Stability

Mutuum handles risk by using different types of collateral based on how volatile an asset is. This makes sure that exposure is proportional and reserve protection is spread out. Overcollateralization stops people from going bankrupt, and liquidation incentives quickly close undercollateralized positions, which lowers systemic risks.

Tokens that are highly correlated get the most use within a controlled framework, which reduces systemic imbalances. Riskier assets get less money. This structured approach protects the integrity of lending and borrowing, making sure that the protocol stays stable even when things are unstable.

Community Growth Driven By Active Incentive Campaigns

Mutuum is giving away $100,000 to help the company grow from the ground up. Ten winners will each get $10,000 in tokens. These campaigns encourage people to join, which grows the community and keeps investors loyal and grassroots projects involved.

Strong communities are often what make tokens successful. Mutuum uses incentives to boost network effects, which puts it in a good position for growth. Engagement is still important. In competitive DeFi environments, increased participation consistently leads to more liquidity, adoption, and social awareness.

Comparing XRP Reliability Against Mutuum’s Explosive Promise

XRP is appealing to conservative investors because it has partnerships with institutions and is recognized by regulators, which could lead to gradual long-term price increases. Mutuum promises big profits, which draws in risk-tolerant people who want to make a lot of money quickly through new DeFi opportunities.

The choice depends on how much risk you are willing to take. XRP is stable, but Mutuum has the potential to go up in value. Different groups of investors respond to each story in different ways. For portfolios that want to be exposed to a wide range of cryptocurrencies, using a variety of strategies may help balance stability and explosive growth opportunities.

Mutuum Finance Emerges as the High-Reward Contender

As projections show that Mutuum Finance will grow by 8,000%, the hype around it grows, making XRP’s expected $8 milestone seem small by comparison. Mutuum is a promising project in the DeFi sector because of its strong presale demand, risk management frameworks, and community involvement.

XRP is still very strong. But momentum is increasingly in favor of high-reward options like Mutuum, especially among retail traders around the world. Both assets represent different paths, with one representing stability and the other representing speculation as the crypto markets change quickly as we head toward 2025.