Whale Accumulation Lifts Market Sentiment

Whales accumulated roughly 250 million XRP within forty‑eight hours this week. On‑chain trackers flagged steady inflows to large wallets during the latest rally. Such clustered buying often precedes sharp moves as circulating supply tightens quickly. Institutional interest from Asia added fuel, widening speculation about upcoming catalysts.

Analysts note whales usually position before breakouts, shaping liquidity and order depth. Their activity can accelerate rallies once technical levels trigger momentum participation. Retail flows then chase price, compounding moves into overextended swings. This sequence increased focus on XRP’s nearby resistance and risk levels.

Symmetrical Triangle Breakout Signals Strength

XRP broke above a multi‑week symmetrical triangle, a pattern favoring bullish continuation. The breakout followed several higher lows, pointing to persistent dip buying pressure. Volume improved on the move, reducing the risk of a failed thrust. Traders now assess validation through sustained closes above the breakout zone.

Technical traders watch for measured‑move targets derived from triangle height projections. Those projections overlap with the $4.40 region highlighted by Fibonacci analysis. A firm close above intermediate resistances would confirm continuation potential. Invalidation would involve a decisive return back inside the pattern’s range.

Key Resistance Levels To Monitor

Near term, $3.13 remains a pivotal Fibonacci 0.5 retracement level to reclaim. Closing above that band would strengthen the case for advancing toward $4.40. Secondary hurdles cluster near $3.45 and $3.72 based on prior supply zones. Each step cleared reduces overhead friction and invites additional bids.

Momentum systems often add exposure once successive resistances flip to support. As that happens, liquidity providers widen ranges and absorb breakout flow. This feedback loop can lift prices faster during strong sentiment phases. Still, caution is warranted until weekly closes confirm structural progress.

Recommended Article: XRP Social Buzz Jumps On Ondo OUSG Launch: Trend Shift Or Short‑Lived Spike?

Supports In Case Of Pullbacks

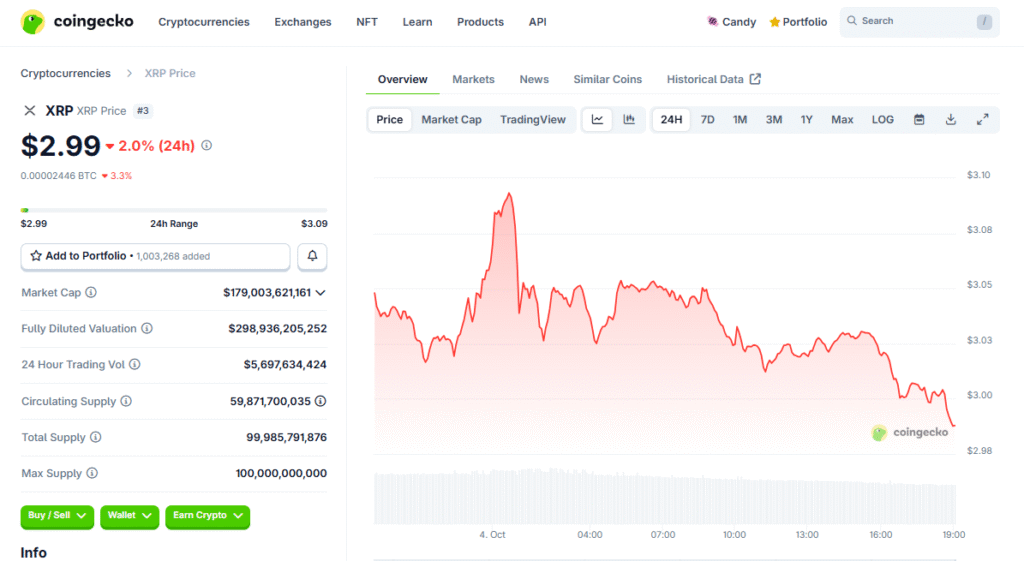

If momentum stalls, traders watch $2.97 to $2.95 as initial local support. Below that, zones near $2.65 and $2.40 align with former demand clusters. These areas could host bounces if broader risk appetite weakens temporarily. Deeper breaks would question the breakout’s durability across timeframes.

Risk management remains essential because triangle retests can get violent. Stops beneath invalidation levels help contain losses during shakeouts. Sizing conservatively reduces stress when volatility spikes unexpectedly. Disciplined plans outperform reactive decisions in fast conditions.

Derivatives And Liquidity Context

Open interest rose roughly twelve percent alongside price strength this week. That expansion reflects fresh participation without extreme funding distortion. Healthy leverage helps trends persist while avoiding unstable crowded positioning. Traders prefer such balance when building swing exposure into resistance.

Spot‑led rallies tend to be sturdier than purely leveraged surges. Recent flows suggest spot demand underpins moves, improving reliability. Liquidity depth has improved, enabling cleaner rotations between levels. That backdrop supports continuation if catalysts arrive on schedule.

Regulatory Watch And ETF Speculation

Ongoing regulatory developments still influence sentiment around XRP’s trajectory. Clarity on litigation outcomes could draw additional institutions off the sidelines. Speculation over potential ETF paths added optionality to late‑year scenarios. Any progress there would likely compress spreads and boost volumes.

Regionally, treasury allocations from firms in Japan stirred renewed discussion. Announcements around corporate holdings tend to normalize treasury use cases. Normalization often precedes broader adoption by traditional finance players. That pathway could anchor XRP’s role within tokenized liquidity networks.

Path Toward $4.40 And Scenario Planning

With $3.13 reclaimed, the roadmap opens toward the highlighted $4.40 target. Continuation requires strong closes and constructive funding across venues. Failure to hold reclaimed levels raises odds of range re‑entry risk. Traders adapt plans as weekly structures confirm or negate the thrust.

As of early October, XRP trades near $2.98 with steady momentum. A clear push past stacked resistances could unlock upside extensions. Conversely, weakness in Bitcoin could dampen follow‑through for alts. Active management and patience remain key in headline‑driven markets.