Thorn Predicts Reserve Formation Soon

Alex Thorn, head of research at Galaxy Digital, thinks that there is a good chance that the United States will set up a Strategic Bitcoin Reserve in 2025. He said that markets don’t fully understand the potential announcement that is about to happen. The executive order that was signed in March already set up the framework. The main point of the debate is when the official confirmation will happen and how the strategy for accumulating will work around the world.

Thorn said that the reserve would make Bitcoin a more important strategic asset. His comments got people talking on social media. Analysts thought the statement meant that the government was confident that policy changes were still going well. Supporters say that recognition fits with the larger trends of institutions adopting new technologies, which are having a big impact on the current market cycle in all global financial ecosystems.

Legislative Changes Support Outlook

US lawmakers have introduced a bill directing the Treasury to investigate the possibility of a Strategic Bitcoin Reserve, considering technical factors affecting the accumulation process. Legislative momentum suggests the strategy is progressing steadily, with political support indicating that reserve plans are more than just talk.

The creation of a reserve was seen as a logical next step after the March executive order setting up the US Digital Asset Stockpile framework. Market support for the reserve’s creation suggests an official announcement is likely this year, rather than being delayed.

Administration Maintains Strategic Interest

The Trump administration has expressed interest in a strategic Bitcoin reserve, despite its brief mention in a crypto policy report. The crypto liaison reaffirmed their commitment in July, despite unclear policy clarity. Market watchers emphasize the importance of executive signals for investor sentiment.

The administration’s balancing act makes the future less clear, with skeptics suggesting a delay until accumulation targets are met and others urging swift action to prevent competitors from gaining an edge. Despite uncertainty, a strong case reserve formation is still possible this fiscal year.

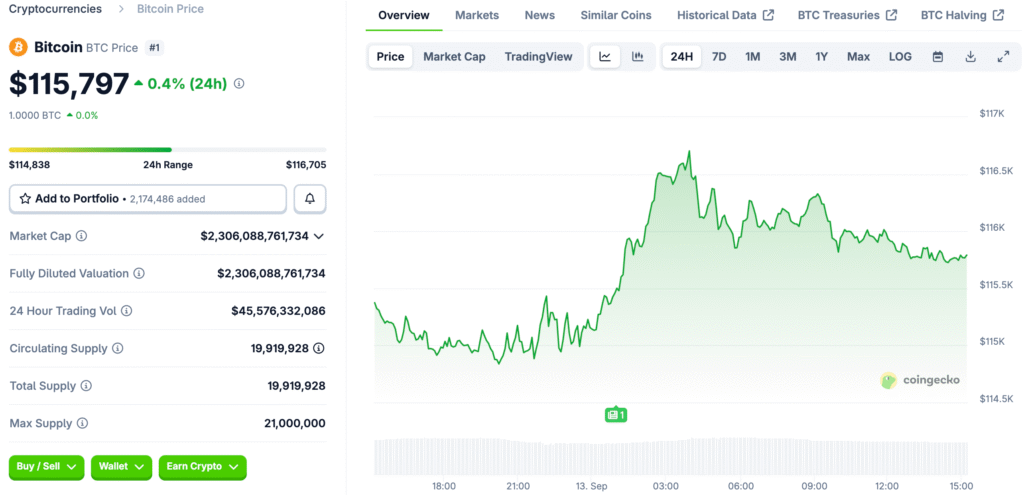

Recommended Article: Chinese Firms Fuel Bitcoin Momentum As Price Nears $114k

Skeptics Highlight Delayed Timelines

Cryptocurrency industry experts disagree on the future of reserve formation, with some suggesting it could occur in 26 months, while others believe the administration is strategically waiting until accumulation goals are reached.

Skeptics argue that short-term changes should not be overly influenced by complicated rules and political calculations, while optimists believe legislative momentum and executive orders outweigh delays. The debate highlights the difficulty in accurately predicting government timelines in a constantly changing digital asset environment, as industry veterans may not always agree.

Risks of the US Falling Behind Internationally

Well-known supporters of Bitcoin say that delaying reserves could give other countries an edge. Samson Mow said that the US needs to get more Bitcoin this year or risk falling behind its competitors. He pointed out that Pakistan could be a competitor in the front-running strategy. If action is delayed, it could have a big effect on strategic positioning in the global financial hierarchy.

As other countries move, worries grow. Kyrgyzstan passed a law to create a state cryptocurrency reserve. Indonesia talked about the economic benefits of accumulating Bitcoin. These kinds of projects show that the world is moving toward sovereign reserves. Analysts say that delaying risks is a geopolitical disadvantage. The United States needs to quickly establish a strong presence this year in order to stay competitive.

International Developments Accelerate Pressure

Cryptocurrency usage in Central Asia is increasing rapidly, with Kyrgyzstan’s laws indicating a surge in cryptocurrency usage. Indonesian advocacy groups are pushing for strategic Bitcoin frameworks to boost the economy. Regional competition is increasing, and governments are combining their Bitcoin reserves.

This trend indicates a shift in geopolitics, with digital assets becoming more integral to national strategies. Delays can damage a country’s reputation and strategy. International progress is increasing the stakes, forcing US policymakers to accelerate decision-making to stay ahead of global competitors.

US Policy to Shape Bitcoin’s Global Financial Future

The future of Bitcoin depends on the US’s confirmation, as market professionals monitor laws, the president’s statements, and global events. The announcement could alter the global Bitcoin story and make it a legitimate sovereign reserve. This could lead to increased prices and institutional adoption.

Investors believe this year will be crucial for US policy direction, with Thorn’s confidence aligning with legislative activity. The momentum suggests a high probability reserve announcement before the end of the year, as a strategic Bitcoin Reserve is crucial for cryptocurrencies’ integration into global financial systems.