UK Economy Records Stronger Than Expected Growth in November

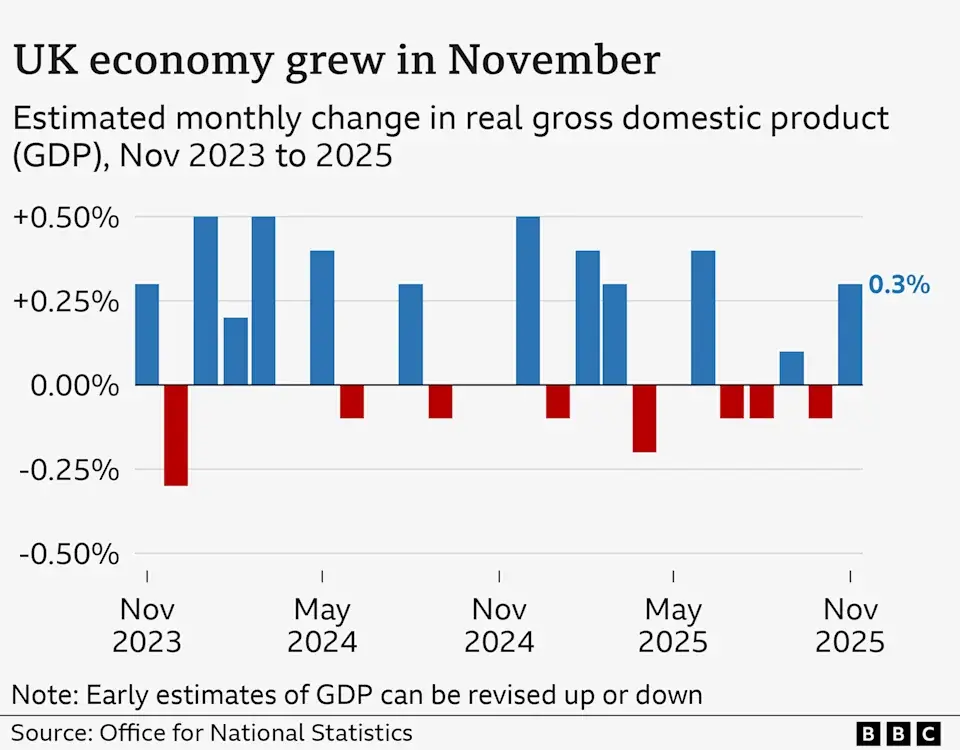

In November, the UK economy grew by 0.3%, even though there was political and financial uncertainty about the government’s budget plans. The national statistics office’s official data showed that growth was back on track after a drop the month before. Economists said that the performance was better than expected and gave policymakers some short-term relief from the growing financial pressure they were under.

Analysts had only expected growth of 0.1% because of low investment confidence and uncertainty about government policy. The better result made businesses feel better about tax policy changes and the slowing of consumer spending. While government officials were happy to see signs of stabilizing economic performance, financial markets were cautious.

Source: Yahoo

Jaguar Land Rover Recovery Supports Manufacturing Output Growth

Earlier this year, Jaguar Land Rover’s manufacturing systems were hit by a cyber attack that caused a lot of problems for vehicle production. Shutdowns at factories across the country messed up supply chains and cut down on industrial output at a number of automotive production facilities. During the fall, recovery efforts began, slowly bringing back manufacturing and worker productivity to normal levels.

Compared to the month before, motor vehicle production went up by more than 25% in November. Statisticians said that this rebound had a big effect on the overall growth numbers for production during the period. During the month, automotive suppliers also said that their order volumes were going up and their delivery schedules were getting back to normal.

Services and Production Sectors Offset Construction Industry Decline

According to official statistics, the services sector grew by 0.3% in November. There was a big increase in demand for professional services, technical consulting, and accounting work each month. Analysts said this was because companies were doing advisory work related to budgets and getting ready for regulations.

Industrial production went up by 1.1%, but construction activity dropped sharply by 1.3%. Economists said that this drop was due to infrastructure projects being put off and costs of borrowing money going up. People are still worried that the housing and commercial development pipelines will stay weak as we move into the new year.

Recommended Article: Japan Pledges $550B Investment to Secure US Trade Deal

Economists See Temporary Stability Rather Than Long Term Momentum

KPMG economists said that the data showed that the economy had briefly stabilized after a period of instability. Speculation about tax policy that caused uncertainty in business had previously put off investment decisions in many sectors. Less political tension after the budget announcement helped businesses feel a little more confident.

Analysts said that the growth momentum is still fragile because people aren’t spending as much and borrowing costs are going up. Even though inflation pressures are easing across the country, consumer confidence indicators are still low. Interest rate decisions and clear fiscal policy will have a big impact on future performance.

Budget Policy Shapes Business Confidence and Market Expectations

The government’s budget for November included tax hikes meant to make the long-term fiscal situation more stable. Before the announcement, a lot of speculation made it hard for businesses and banks to plan their investments. Businesses put off plans to grow because they were worried about sudden changes in the rules.

Economists said that the announcement made things less uncertain, which helped stabilize decisions about hiring and spending money. During the speculation period, there was more demand for accounting firms and tax consultants. This strange spike helped the service sector grow in November, as shown by the numbers.

Political Criticism Challenges Official Interpretation of Growth Data

Leaders of the opposition said that the growth numbers hid deeper problems with the economy’s structure. Critics say that taxes that keep going up are still hurting long-term productivity and private sector investment incentives. They said that inflationary pressures could come back even though output has improved in the short term.

Shadow finance officials said that the government was mismanaging public money by changing its policies too often. Political arguments over how to tax farms and business rates made things even more tense in Parliament. Investors are still cautious while they wait for a clearer long-term economic strategy.

Interest Rates and Inflation Outlook Influence Future Growth Prospects

Market expectations of interest rate cuts caused borrowing costs to drop to their lowest level in more than a year. Lower costs of borrowing money could boost mortgage lending and business investment in the first few months of the year. Officials at the central bank are still being careful because inflation risks are still there.

Economists say that the next reports on inflation and unemployment will give us a better idea of where the economy is headed. Some people said that more cuts to interest rates might be put off because of worries about wage growth. For the recovery to last, inflation control and support for consumer demand must be balanced.