Tom Lee Makes Massive Ethereum Purchase Worth $281 Million

Renowned investor and Fundstrat co-founder Tom Lee has once again made headlines after reports surfaced that his company, BitMine Immersion, purchased over $281 million worth of Ethereum in the past 24 hours. The move has stirred speculation among traders and analysts who are now debating whether Lee’s bullish conviction signals an imminent rally in ETH prices.

BitMine Expands Ethereum Holdings to Over 3 Million Tokens

According to industry reports, BitMine Immersion added approximately 72,898 ETH during its most recent accumulation phase, bringing its total Ethereum holdings to 3.03 million tokens—roughly 2.5% of the total circulating supply. This follows a series of strategic purchases beginning in early October, during which the company accumulated over 200,000 additional ETH.

Lack of Transparency Raises Questions

Despite the buzz, analysts have noted a lack of transaction hashes or verifiable wallet addresses linked to the purchase. Neither BitMine nor Lee has publicly confirmed the acquisition, leaving the reports unverified for now. However, crypto traders remain fascinated by the timing of this move, as it coincides with Ethereum’s ongoing recovery from last week’s market-wide correction.

Recommended Article: Tom Lee’s $281M Ethereum Buy Sparks Speculation On ETH’s Future

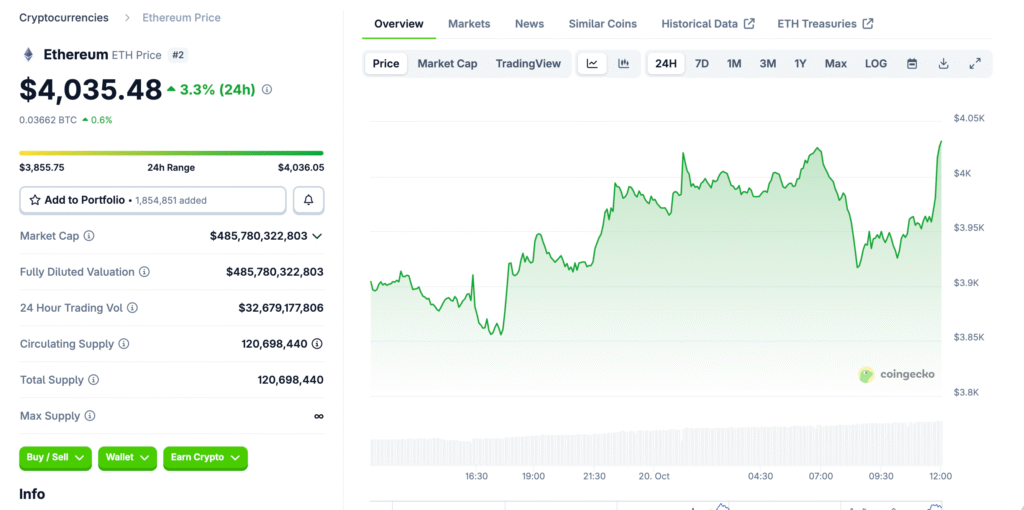

Ethereum Holds Firm Around $3,800 Despite Market Volatility

According to data from CoinGecko, Ethereum is trading between $3,830 and $3,870, showing modest daily gains of about 0.8%. The token remains below its early October highs but has shown resilience following the sharp liquidation wave on October 10–11, which saw over $19 billion erased from the crypto market. The ability of ETH to maintain stability despite this pressure has renewed optimism among long-term investors.

Key Liquidity Zones Could Define Ethereum’s Next Breakout

Crypto analyst Ted highlighted that Ethereum’s next significant move depends on how it reacts to a large liquidity cluster between $4,400 and $4,800. Heavy sell orders are concentrated in this range, suggesting many traders plan to take profits near those levels. Conversely, strong buy orders have been forming between $3,200 and $3,400, indicating investor confidence at lower support zones. This dual-zone setup could dictate ETH’s short-term direction in the coming days.

Double Top or Double Bottom? Analysts Weigh In

Technical charts show Ethereum forming a potential double-top pattern around the $4,600 mark, followed by a minor pullback. However, analysts believe a deeper retest near $3,300 could set the stage for a double-bottom formation—a bullish reversal signal that typically precedes major upward movements. If this scenario plays out, ETH could rally toward the $5,000 mark by the end of Q4 2025.

Elliott Wave Analysis Suggests Corrective Phase Before Recovery

Crypto strategist Crypto Tony shared his Elliott Wave analysis on X, suggesting that Ethereum is currently within a W–X–Y corrective structure. This pattern often occurs during consolidation phases before a continuation of the broader uptrend. He projects that a short-term dip toward $3,300 could mark the final corrective wave before ETH resumes its long-term bullish trajectory toward $5,000.

Ethereum’s Macro Fundamentals Remain Strong

Beyond technical analysis, Ethereum’s fundamentals continue to strengthen. The network’s transition to proof-of-stake has significantly reduced energy consumption, while Layer-2 scaling solutions such as Arbitrum and Optimism are expanding adoption. Institutional interest also remains high, with Ethereum-based ETFs seeing steady inflows amid growing investor confidence in blockchain infrastructure.

External Factors Could Influence Ethereum’s Short-Term Path

Global market conditions remain a crucial variable in Ethereum’s trajectory. Analysts note that the potential approval of a U.S.–China trade agreement could lift market sentiment and boost risk assets, including crypto. However, if geopolitical tensions or macroeconomic uncertainty intensify, ETH could retest lower support levels before resuming its uptrend.

Conclusion: Tom Lee’s Bet Reinforces Confidence in Ethereum’s Future

Whether confirmed or not, the reports of Tom Lee’s $281 million Ethereum purchase have reignited market enthusiasm. His long-standing bullish stance on digital assets and history of accurate market calls lend weight to the speculation. As Ethereum hovers between critical liquidity zones, traders are watching closely to see whether Lee’s conviction will once again prove prescient—potentially setting the stage for the next major ETH breakout toward $5,000 and beyond.