SUI Price Action Confirms a New Direction

SUI recently broke out of a falling wedge pattern, which is a well-known bullish reversal trading pattern. This breakout shows that the market is getting stronger again and is a key turning point, especially after weeks of trading in narrow ranges.

Traders now see the wedge breakout as proof that the market is changing direction. Strong confirmations make people more sure that there will be more upward moves. The structure is stronger because the support line has been tested again. Buyers have been strong, taking on selling pressure while keeping bullish momentum going.

Resistance Levels Show the Short-Term Direction

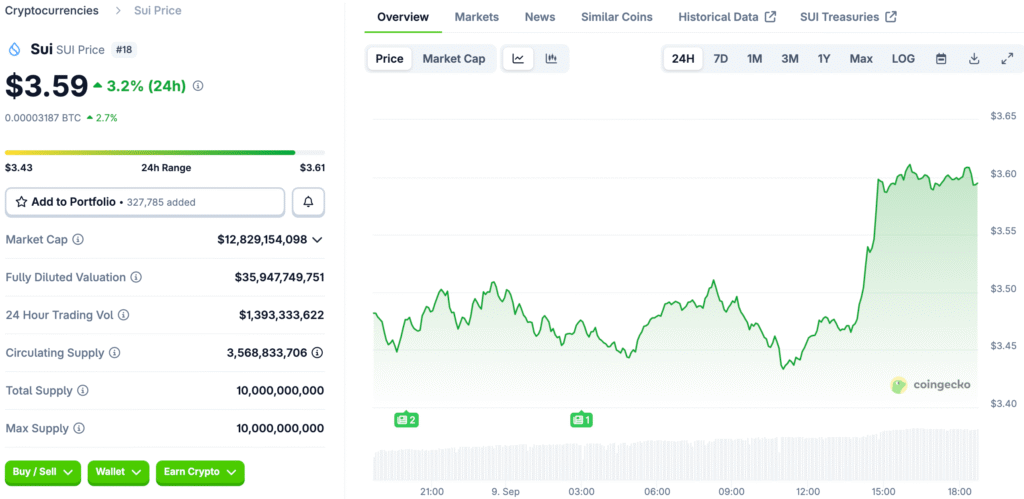

The next problem for SUI is the $3.35 resistance level, which has been a ceiling in several trading sessions recently. If bulls break through this barrier, the focus will quickly shift to the bigger breakout goal near the $3.50 area.

Analysts say that breaking the $3.50 mark could create new demand. A successful surge could give the medium-term uptrend a stronger base to build on. But if resistance isn’t broken quickly, there is a risk of long-term consolidation. Before trying to break out again, the markets may move sideways for a while.

SUI’s Technical Indicators Align to Confirm Bullish Breakout

SUI is trading above its five-day and ten-day moving averages, which means that active market participants are putting upward pressure on the stock. RSI has bounced back from oversold levels, which means that more people are buying. These signals fit with a story of better technical conditions.

Also, MACD has made a bullish crossover, which shows that momentum is getting stronger. Indicators all work together to make the bullish case stronger. These alignments confirm the technical breakout, making it more likely that prices will stay strong in the short term and that the overall bullish structure will continue.

Recommended Article: Sui Price Prediction Bulls Target $4.88 With Strong Support

Key Support Levels Provide Market Confidence

The $3.20 zone is now an important first line of support, giving you a buffer against short-term pullbacks or events where you take profits. This level must hold if selling pressure rises in order to keep the market’s confidence. Failure could make people want to make bigger corrections.

$3.00 psychological support is the last stronghold below that. People who watch the market stress how important it is for traders to have a stable point of reference. It will be important to keep these supports in place. Strong bases support bullish stories and keep traders confident during times of high volatility.

Market Sentiment Turns Increasingly Optimistic

Investors see SUI’s breakout as a sign that it can handle volatile market conditions. Retail and institutional investors are interested in momentum. Analysts point out good confirmations, which makes people more hopeful. When several indicators line up with bullish technical formations, market confidence grows.

This change in mood makes a loop that keeps going. When people are more optimistic, they are more likely to buy, which pushes prices up and makes investors even more optimistic. These kinds of cycles are often the start of bigger rallies. Long-term confidence will be very important for keeping the current upward trends going.

What Traders Should Expect Moving Forward

The $3.35 to $3.50 resistance band is what traders are looking at now. A decisive breakout here could cause prices to rise quickly in the short term. If momentum keeps building strongly in line with technical confirmation patterns, targets above $3.50 may become realistic.

But if resistance stays strong, consolidation is still possible. Price action may move sideways within a range before making another attempt. Both situations show how important it is to be patient. Before calling a stronger rally, it is important to confirm that prices have closed above resistance.

SUI’s Falling Wedge Breakout: A Key Moment for Traders

SUI’s breakout from its falling wedge structure is a very important event. Technical indicators now point to a bullish continuation in the next few sessions. The outlook is shaped by momentum indicators, resistance challenges, and strong support. Current conditions make it likely that the market will continue to rise.

Traders need to keep a close eye on both support and resistance zones. These levels need to hold during times of price volatility for the market to stay balanced. If bulls break through the $3.50 level, SUI could go up even more. For now, buyers are still ahead, but consolidation is still a possibility.