SUI Price Faces Pressure Amid Market Downtrend

SUI has dropped a lot in value over the past week, by 14%, which puts a lot of downward pressure on its short-term technical structure. Traders are keeping a close eye on this corrective phase to see if it will offer a good chance to buy the dip.

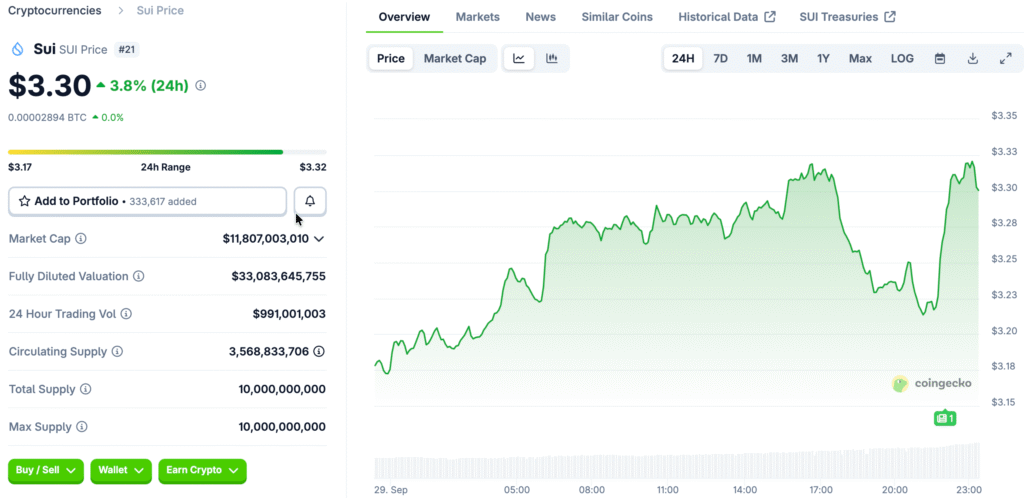

The token is currently worth $3.12, which shows that people are being careful. Analysts think that if the market stays weak for a long time, it could allow accumulation in good price zones before a possible recovery rally starts.

Key Support Levels Define Market Outlook

Market analyst Ali Charts said that $3.00 is a very important psychological and structural support level that buyers need to protect at all costs. If the price drops below this level, it could set off a chain reaction of sell orders that would make the downtrend much worse.

If SUI stays above support, analysts think it will turn around and go for $3.80 or more in the next few sessions. This situation would fit with larger bullish forecasts, which means that traders are becoming more hopeful that the market will soon be in a good place.

Resistance Barriers Affect Short-Term Recovery

Resistance is still mostly around $3.40, which is the first big obstacle to any long-term upward movement. Bulls need to convincingly take back this area in order to change people’s minds and set the stage for prices to keep going up.

If the price breaks above $3.40, it will likely move toward $3.80, which is in line with what analysts are saying will happen. Traders who use momentum are keeping a close eye on things and are ready to enter positions if confirmation signals get stronger during breakout attempts.

Recommended Article: Sui Eyes $4.50 Breakout as $3.30 Support Holds Firm

Bearish Weakness Shows in Momentum Indicators

The Relative Strength Index is at 38 right now, which means that there isn’t much buying pressure and the market is leaning toward being oversold. These kinds of readings often come before possible reversal phases, as long as supportive technical catalysts show up in later sessions.

But if RSI stays weak for a long time without a strong follow-through, it could mean that the market will stay in a range for a long time or go down even more. Traders are still being careful and waiting for clearer confirmation before putting a lot of money into new long positions.

Market Liquidity and Turnover Decline Sharply

Over the last twenty-four hours, SUI’s daily trading volume has dropped by 49.16%, bringing it down to $521.39 million. This contraction shows that speculative activity is going down and short-term market participants are taking less aggressive positions.

When liquidity is low, volatility can get worse, especially near important support levels. If demand from buyers doesn’t pick up, price swings could get worse, making it hard for both retail and institutional traders to trade.

Traders Expect a Possible Rebound Scenario

People in the market are getting ready for two possible outcomes based on how SUI acts around the $3.00 support level. A successful defense could lead to a rise back to $3.80, thanks to bullish momentum coming back.

On the other hand, if support doesn’t hold, the pressure to go down could speed up toward $2.90 and lower. Analysts say that this split is very important for figuring out if the current dip will turn into a good place to buy more.

SUI Could Attract Fresh Capital If Bitcoin Stabilizes and Sentiment Improves

SUI’s recent drop in value is part of a larger trend among major altcoins, which makes it harder to sell. Traders know that the overall mood in the crypto market is still very important for how assets like SUI will do in the short term.

If the economy stabilizes and Bitcoin settles down, SUI could see a new influx of capital. In this kind of environment, technical outlooks would get better, making bullish reversals more likely to happen around the important $3.00 support level.