Solana’s Treasury Approach Gains Attention

Solana’s treasury strategies are gaining traction among crypto banking startups seeking liquidity improvements. These practices optimize digital assets through staking, DeFi tools, and strict compliance standards. Startups benefit from Solana’s speed, low fees, and growing institutional trust supporting modern finance. Strategic treasury planning becomes a competitive edge in the evolving blockchain economy.

Crypto startups explore Solana to reduce friction and improve capital efficiency across operations. By leveraging fast finality, they gain flexibility legacy systems cannot replicate easily today. Institutions also find Solana appealing for programmable, transparent finance aligned with regulations. This shift reflects broader adoption of decentralized infrastructure worldwide.

Staking SOL Tokens Creates Extra Revenue

Startups use Solana’s staking to generate consistent additional revenue during market fluctuations. Locking SOL provides staking rewards, similar to interest earnings within traditional systems. These rewards offer cash‑flow buffers, helping firms maintain operations amid volatile cycles. Staking becomes a practical treasury tool rather than a speculative play.

Reliable yields encourage long‑term SOL holding, supporting network stability and validator security. This alignment ties treasury goals to blockchain incentives, creating mutual benefits. Founders view staking as safer than high‑risk DeFi farming or frequent trading. Through staking, startups blend predictable income with participation in Solana’s ecosystem.

Payroll Efficiency Improves With Solana

Solana enables real‑time salary payments, improving payroll efficiency for scaling fintech teams. Network speed allows near‑instant transfers, removing delays seen in traditional banking systems. Startups use this capability to attract global talent with flexible, reliable payment rails. Faster payroll builds operational confidence and retention for competitive teams.

Decentralized organizations often face payroll bottlenecks that Solana’s performance helps alleviate. Payments settle quickly across borders, supporting team growth in multiple jurisdictions. This feature appeals to DAOs and firms paying contributors worldwide. Speed and predictability foster trust between employers and staff.

Stablecoin Diversification Strengthens Treasuries

Startups diversify by combining SOL with stablecoins like USDC to reduce volatility risks. This approach stabilizes reserves, ensuring continuity when market conditions become unstable. Balanced treasuries help firms navigate uncertainty without stalling product roadmaps. Diversification becomes a cornerstone of sustainable financial management.

Stablecoins store value reliably while keeping blockchain compatibility and transaction speed. Blended holdings provide resilience compared with relying only on volatile assets. This allows confident budgeting even during difficult bearish cycles. Stablecoin diversification also simplifies accounting and reporting obligations significantly.

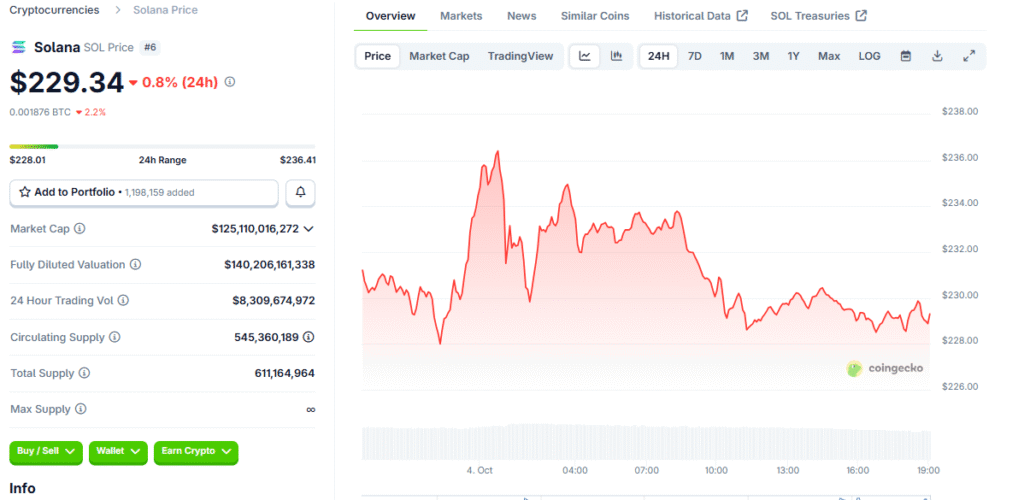

Recommended Article: USDT Dominance Slides As Solana Hits $225 And Capital Rotates To Alts

Technical Challenges Remain For Small Teams

Implementing Solana treasuries requires expertise many small startups may lack initially. Secure wallets, role controls, and audits introduce complexity needing specialized knowledge. Without careful setup, treasury risks increase, potentially destabilizing operations. Addressing these challenges early improves scaling and financial safety long term.

Multisig wallets and contract audits are essential yet can strain limited resources. These safeguards improve accountability but require skilled teams to deploy correctly. Partnering with experienced providers helps bridge technical gaps efficiently. Overcoming such hurdles is crucial to unlocking Solana’s full advantages.

Regulatory Compliance Shapes Adoption

Regulatory requirements strongly influence how teams implement Solana treasury practices. Firms must comply with AML and KYC standards while managing decentralized assets. Clarity attracts institutions by ensuring transparency and standardized controls. Compliance also builds credibility with investors and banking partners.

Failure to meet standards can expose startups to legal risk and penalties. Proactive engagement with regulators fosters trust and smoother scaling. Many teams now embed compliance tooling directly into treasury processes. Aligning innovation with rules supports durable ecosystem growth.

Best Practices Enhance Long‑Term Success

Effective Solana treasuries follow risk frameworks, asset diversification, and strong governance. Regular audits and policy updates keep operations resilient to shocks. Institutional partnerships bring capital, custody, and compliance expertise. Strategic planning turns treasury from admin work into a growth lever.

Long‑term success balances innovation with risk control and regulatory adherence. Teams leveraging Solana’s strengths can scale efficiently while protecting capital. These practices transform treasury into an advantage, not a liability. Ultimately, Solana empowers startups to navigate complex crypto markets confidently.