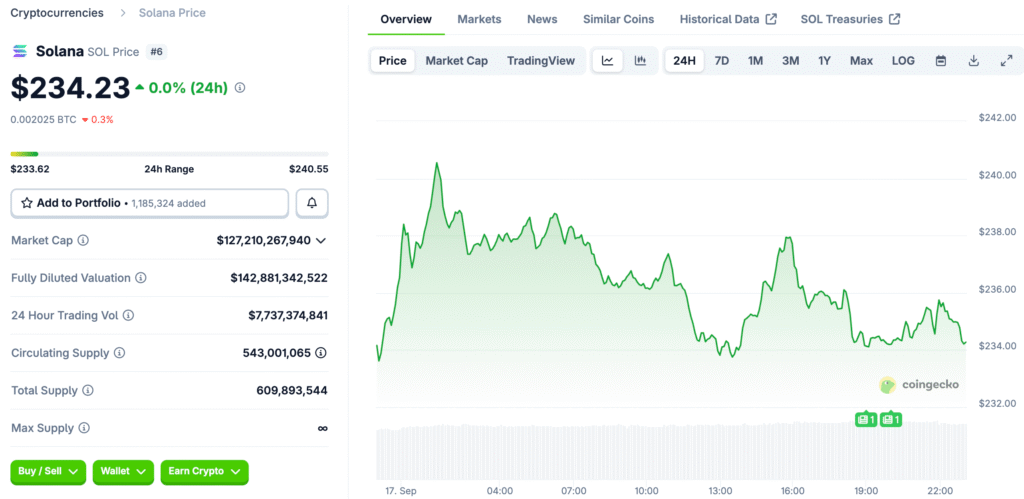

Solana Price Drops Amid Treasury Surge

Even though there were big changes in the treasury, Solana’s price fell 5% to $232. The drop is a sign of more general instability in the bitcoin industry. Investors were careful before a big decision by the Federal Reserve.

People were interested when they heard that Helius was putting $500 million into a Solana treasury vehicle. This bullish indicator, on the other hand, did not stop Solana’s price from going down. Market uncertainty made investors more cautious, which slowed down ecosystem progress.

Broader Market Shows Weakness

The total value of all cryptocurrencies fell by 1.3% in 24 hours, reaching $4.08 trillion. Bitcoin made up 56% of the market, while Ethereum made up 13.3%. Even when there were good reports about the ecosystem or investments, major assets went down.

Bitcoin declined 0.5% to $114,800, and Ethereum fell 2% to $4,497. XRP went down a little, by 0.2%, to $3.03. The extensive losses show that people are being cautious with their digital assets.

Treasury Deployments Highlight Solana Strength

Even though the price is low, treasury news shows that people have faith in Solana in the long run. After financing $1.65 billion, Forward Industries said it will spend $1.58 billion. These moves show that Solana’s growing ecosystem has support from institutions.

Treasury injections often make network activity more stable and strong. In Solana’s case, they help the ecosystem develop and may even make it easier to get cash. But because of the short-term state of the market, SOL’s value didn’t go up right away.

Recommended Article: Solana Treasuries Surpass $4B Mark as Adoption Expands

Liquidations Add Selling Pressure

In the last 24 hours, $440 million worth of crypto was sold. This total included $362 million in long positions. Ethereum had the biggest proportion, with $117 million cleared.

Solana liquidations hit $77 million, which shows that trading is riskier and prices are more volatile. Bitcoin also made $46 million in liquidations. These liquidations made the selling momentum across the market even stronger.

ETFs Reflect Investor Confidence

Even though there was a lot of volatility, ETF inflows showed that investors were still interested. On September 12, spot Bitcoin ETFs brought in $642 million. During the same time, Ethereum ETFs also saw $405.5 million in new money.

In total, digital asset offerings brought in $3.3 billion. Assets under management rose to $239 billion, which is close to the record levels established in August. This shows that institutions still want to invest, even when things are shaky in the short term.

Solana Sets a New Record for ETFs

Solana also saw inflows, with a new daily high of $145 million. These inflows show that more and more people are aware of Solana as a part of a diverse portfolio. Even though there is a lot of volatility in the short term, institutional investors are still putting money into the market.

ETF trading provides long-term stability by taking in supply and showing trust. For Solana, the expansion of ETFs shows that they can handle more than just short-term market drops. Investors are getting ready for a possible recovery after the present problems in the market.

Fed Decision Looms Over Markets

Everyone is waiting to see what the Federal Reserve will decide about policy on Wednesday. There is a 96% chance that the futures markets will cut by 25 basis points. There is still a small likelihood of a surprise 50bp cut.

Analysts say that rate policy will have a big impact on crypto risk assets. Any sign of a sluggish job market or dovish language could cause larger reactions. Bitcoin, Solana, and Ethereum are still at risk of abrupt changes in the economy as a whole.

Solana’s Resilience in a Cautious Market

Cryptocurrency markets are finding a balance between ecosystem strength and macroeconomic dangers. The boost to Solana’s treasury shows that it is a trustworthy organization, but there is still short-term strain. The Federal Reserve needs to be clear about what it is doing for the rest of the market.

If the Federal Reserve’s policies help risky assets, cryptocurrencies might bounce back from their present lows. But ongoing liquidations and cautious investors might make things worse. People who work in the market need to be ready for changes in the next few days.