Solana Builds Momentum After Forming Rounded Bottom

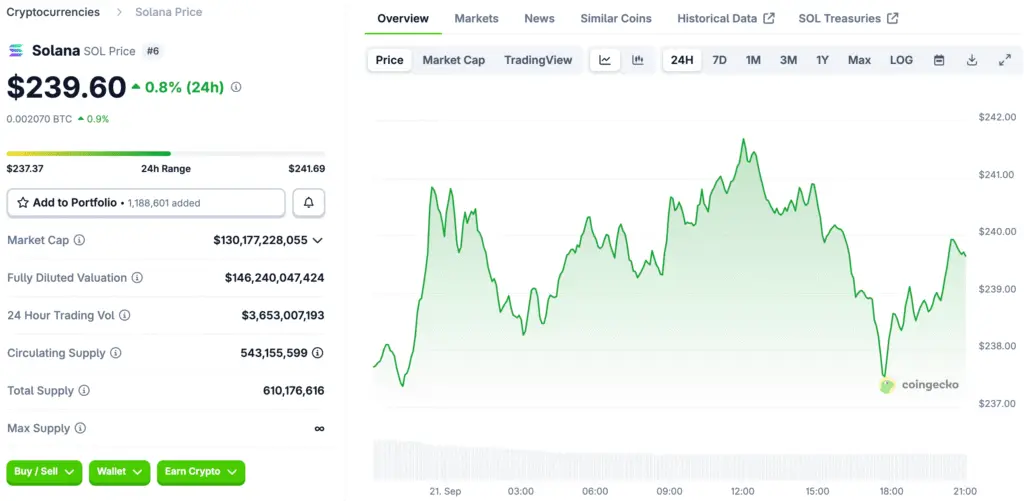

Solana’s price is rising, boosting confidence for traders and long-term investors. Analysts believe that the $260-$273 area has been turned into support, indicating a bullish trend. The rounded bottom formation from earlier this year suggests price increases, similar to past price fluctuations.

Spot market flows have stabilized, and the spot taker CVD has moved into neutral territory. This move away from long-term seller dominance is seen as a positive sign. If demand remains strong, bulls could use these conditions to push Solana to an all-time high in the coming months.

Treasury Accumulation Strengthens Long-Term Outlook

The steady accumulation of Solana tokens by institutions and the treasury boosts confidence in its long-term value proposition. Companies investing in SOL reserves strengthen demand and reduce the amount available to retail markets. This trend often occurs before price rises, as capital rotation favors altcoins over Ethereum.

Solana’s high daily transaction volume gives it a competitive edge. Analysts believe that these factors could help SOL outperform Ethereum until the end of 2025. If demand for treasury remains strong and cryptocurrencies’ overall liquidity improves, Solana’s value could rise rapidly.

Technical Signals Indicate Path Toward $300 First

The CMF and MFI momentum indicators indicate a bullish structure on Solana’s technical charts, indicating strong buying pressure and investor confidence. Breaking through the $262 resistance level was crucial for the price to rise towards the $300 level.

Solana’s price changes have been marked by periods of stability and big jumps, with a recovery from a high of $295 in late 2024 and a fall to $95. Traders are now monitoring the $260–$273 support zone’s ability to hold up in volatile markets.

Recommended Article: Solana Treasury Firms Bet on Long-Term Holdings and Staking

Fibonacci Extensions Outline Higher Long-Term Targets

Solana’s weekly chart shows Fibonacci extension levels indicating price targets of $363 and $473, aligning with past crypto bull cycles. Traders view these areas as natural extensions of the current rally, offering bullish goals for the medium to long term.

If Bitcoin continues to rise, Solana could reach $583, solidifying its position as one of the best altcoins of this cycle and potentially putting it in competition with Ethereum’s market position.

Market History Provides Context for Current Rally

Solana, a token, experienced a two-year rally with ups and downs, reaching its lowest point around $8. The drop from $295 to $95 was a normal retracement, and Solana demonstrated structural strength by retesting deep Fibonacci retracement levels and bouncing back up.

This cyclical behavior is similar to Bitcoin and Ethereum’s bull markets, making it likely that Solana will follow a similar path and reach new highs. This rally may signal the start of a larger expansion phase for long-term investors.

Short-Term Caution as Solana Approaches Supply Zones

Solana is struggling to break past the $280 supply zone on the daily chart, with selling pressure potentially returning. Analysts advise traders to take profits as the price approaches this area, as it lowers their risk of losing money.

Consolidation around this level would not change the bullish trend but would give disciplined traders chances to enter. If Solana can turn the $260-$273 area into confirmed support, the bullish outlook will strengthen, allowing traders to place bids for higher extensions.

Solana Targets $400 as Technicals and Liquidity Support More Upside

Most analysts agree that Solana has a good chance of reaching $400 if things stay the same. The likelihood of more upside is supported by the accumulation of treasuries, good technical patterns, and better liquidity dynamics. Fibonacci projections of $363 and $473 make it even clearer what mid-cycle goals are possible.

If the overall market stays good and Bitcoin keeps going up, Solana’s $400 milestone might not only be reached but also exceeded. Investors think that these kinds of milestones will make Solana a top blockchain asset in 2025 and beyond. Solana’s long-term path is still pointing toward significant growth because its fundamentals, technicals, and sentiment are all in line.