Solana Shows Bullish Signs as Network Activity Surges

Solana’s recent price movement reflects strengthening fundamentals driving renewed investor confidence in its ecosystem. Over the past week, SOL has traded within an ascending channel, climbing steadily toward critical resistance levels. Network demand, transaction volume, and growing dApp usage continue supporting bullish sentiment. Investors are now closely watching whether Solana can maintain momentum and push toward new highs.

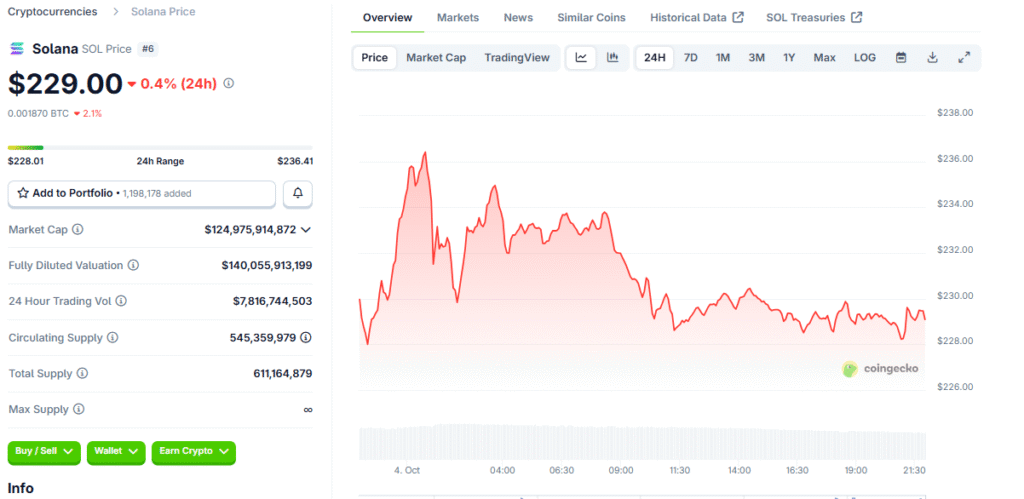

The token briefly dipped after reaching $237, but its underlying uptrend remains intact across multiple indicators. This performance follows a period of sustained growth in on-chain activity, underscoring Solana’s expanding role within DeFi markets. Analysts highlight that holding above the 50-day EMA is essential for sustaining this momentum. Any failure to do so could invite short-term volatility and profit-taking behavior from traders.

On-Chain Activity Reaches Record Levels in 2025

Solana’s blockchain has experienced a dramatic rise in daily activity as more users deploy smart contracts and engage in transactions. Defillama reports indicate active addresses stabilized above two million, averaging 2.2 million per day during recent weeks. Transaction volumes surged accordingly, hitting averages of around sixty million daily transactions. This combination of growth in users and transactions suggests a robust expansion of Solana’s ecosystem.

Stablecoin transfers also highlight Solana’s rising utility across financial applications. Over the last thirty days, stablecoin activity jumped 12.54% to surpass two hundred million transactions. Such metrics point to healthy liquidity and growing trust in Solana’s scalability. Developers and institutional participants alike are leveraging this network strength to build new products and services.

Recommended Article: Solana Treasury Strategies Empower Crypto Startups

DeFi Applications Drive Ecosystem Expansion

Decentralized applications built on Solana continue to thrive, reflecting increasing developer interest. Platforms such as Raydium, Pump.fun, and Jupiter now lead user engagement metrics, collectively driving significant transaction throughput. This expansion has translated into higher fee generation across the network, signaling improved economic activity. Solana-based dApps have become essential drivers of daily network usage.

Fee and revenue growth further reinforce this narrative of ecosystem maturation. Daily application fees average between ten and twenty million dollars, occasionally spiking higher during peak usage. Revenue streams consistently range between five and twelve million daily, demonstrating sustainability. Such strong fundamentals attract both liquidity providers and developers to Solana’s fast-growing platform.

Futures Market Demand Strengthens SOL’s Price Outlook

In parallel with on-chain growth, Solana’s futures markets are experiencing increased capital inflows. Perpetual volumes rebounded from lows of 0.8 billion dollars to approximately three billion dollars after price recovery. This rise indicates heightened speculative interest and active participation by both retail and institutional traders. Notably, the long-short ratio remains skewed toward longs, reflecting broader bullish conviction.

Data from Coinalyze shows the long-short ratio standing at 2.49, with seventy-one percent of positions favoring upward movement. This imbalance underscores market optimism regarding Solana’s near-term trajectory. Traders are positioning aggressively for continued upside as network fundamentals improve. Sustained demand in derivatives markets typically amplifies spot price momentum during bullish phases.

Technical Indicators Highlight Key Resistance Levels

From a technical perspective, Solana faces critical resistance near $254, aligning with previous retracement points. Maintaining support above both short-term and long-term EMAs is essential for validating breakout potential. The 50-day EMA currently rests at $220, while the 200-day EMA provides secondary support near $195. A decisive close above these levels would strengthen bullish continuation signals significantly.

Meanwhile, Parabolic SAR levels indicate ongoing upward pressure as SOL remains comfortably above $197. Traders view this confluence of support and indicator alignment as encouraging for further rallies. However, if Solana slips below EMA thresholds, bearish pressure could temporarily interrupt its uptrend. This scenario would likely attract dip buyers seeking favorable entry points.

Market Sentiment Remains Optimistic for Q4 2025

Market participants continue expressing confidence in Solana’s long-term prospects heading into Q4 2025. The network’s rapidly expanding user base combined with its low transaction fees positions it well against competitors. Institutional adoption trends and DeFi expansion further add to this optimistic narrative. Analysts suggest these tailwinds could propel SOL above $250 if current momentum persists.

Nevertheless, traders remain cautious of macroeconomic risks that could influence overall crypto market sentiment. Interest rate shifts or liquidity contractions may temper speculative enthusiasm. Despite potential headwinds, Solana’s fundamentals currently provide a strong buffer against downside moves. Many investors view temporary corrections as opportunities rather than threats.

Conclusion: Solana Positioned for Potential Breakout

Solana’s impressive network growth, strong technical structure, and rising market participation collectively paint a bullish picture. Key resistance levels around $254 represent immediate hurdles, but sustained momentum could clear the path higher. Developers, traders, and institutions are increasingly recognizing Solana’s role as a high-performance blockchain platform. If demand continues growing, SOL could emerge as one of Q4’s standout performers.

Holding support levels and maintaining strong on-chain metrics remain crucial for this outlook. The interplay between network fundamentals and technical indicators will determine Solana’s next major move. A confirmed breakout above resistance may spark renewed interest and capital inflows. Traders are watching closely as Solana approaches this critical juncture in its market journey.