Solana Rebounds Strongly From Key Support Zone

Solana (SOL) has regained strength after a turbulent week, rebounding from a critical support range between $174 and $175. The recovery has sparked optimism across the market, with traders eyeing potential gains beyond the $190 level. Analysts note a clear formation of higher lows, signaling improving sentiment among participants. This resurgence has renewed discussions about Solana’s technical resilience and growing investor confidence.

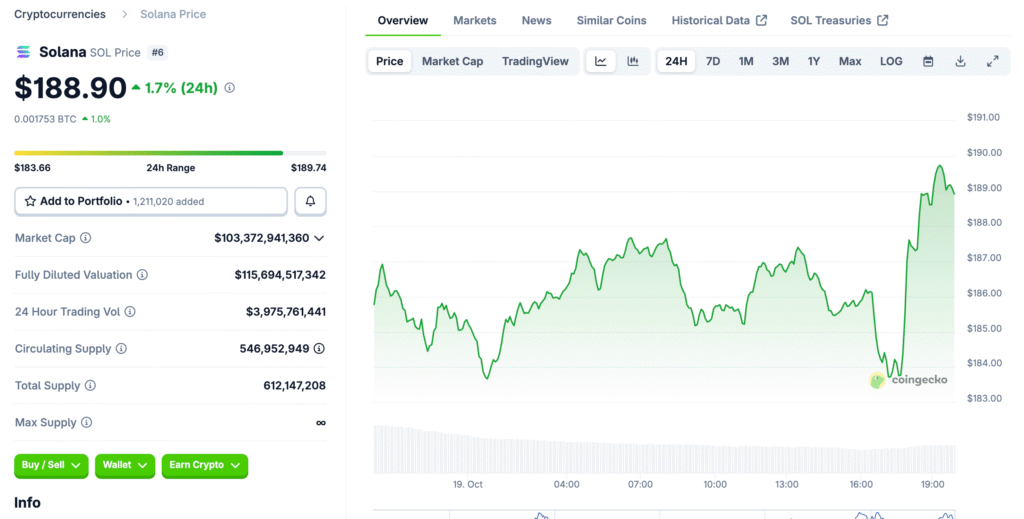

Momentum Builds Toward $190 Resistance Zone

Trading volume on Solana has increased substantially, indicating renewed market participation from both retail and institutional buyers. Technical analysts identify $189 to $192 as the next resistance area aligned with Fibonacci retracement levels. A daily close above $190 could confirm a short-term reversal and open the path to further gains. Bulls are targeting the $198 to $200 zone as Solana’s next objective if momentum continues.

Bullish Divergence Strengthens Recovery Outlook

Chart indicators show a double-bottom structure supported by bullish divergence on the relative strength index (RSI). This signal suggests that selling pressure is easing and buyers are regaining control. Analyst Fresh_Fontana observed that this type of divergence often precedes sharp upward movements. As RSI trends higher, traders expect a breakout if Solana maintains its position above the $185 level.

Major Ecosystem Announcement Boosts Sentiment

Speculation around Solana’s upcoming ecosystem announcement has added excitement to the market. Cointelegraph reports that the reveal is scheduled for October 20, prompting anticipation of new partnerships or protocol upgrades. Historically, Solana-related announcements have coincided with price rallies fueled by increased on-chain activity. Investors now await confirmation of the event’s details, which could act as a powerful short-term catalyst.

Ascending Channel Structure Supports Mid-Term Bullish Case

Solana continues to trade within a well-defined ascending channel, maintaining support near $170 and resistance close to $260. The asset’s ability to hold its lower trendline reinforces a bullish mid-term outlook. Analyst Satoshi Flipper projects that sustained buying could lift SOL toward $220 to $230 in the next wave. The upper boundary of the channel near $270 remains a potential long-term target if the structure persists.

Recommended Article: Solana Foundation Fuels Ecosystem Growth with Discounted Token Treasuries

Stablecoin Outflows Hint At Short-Term Caution

Despite bullish technical signals, recent data shows approximately $400 million in stablecoin outflows from the Solana network. Coin Bureau attributes this trend to temporary risk-off sentiment following broader market corrections. Such liquidity shifts often precede accumulation phases as investors reposition portfolios. If Solana maintains its structure above $175, analysts expect this cautionary phase to be short-lived.

Technical Confidence Returns Among Traders

Traders are increasingly confident that Solana has established a firm base for recovery following its $174 rebound. Volume metrics indicate steady accumulation, suggesting market participants are positioning for further upside. The convergence of bullish divergence, rising RSI, and structural support points to strong technical foundations. Analysts believe sustained momentum could push Solana toward the $200 zone before month-end.

Solana’s Broader Ecosystem Strengthens Its Market Appeal

Beyond price action, Solana’s ecosystem continues to expand through DeFi integrations, gaming collaborations, and cross-chain initiatives. This ecosystem growth reinforces investor confidence and drives consistent network activity. As new projects join the network, Solana’s transaction throughput and cost efficiency remain key competitive advantages. These factors collectively support the view that Solana could sustain its upward trajectory through Q4 2025.

Outlook: Solana Positions For Potential $270 Breakout

Solana’s recovery momentum, backed by improving technicals and upcoming ecosystem developments, presents a constructive outlook. A decisive breakout above $190 could mark the beginning of a broader rally toward $220, $230, and potentially $270. While short-term volatility may persist, the underlying trend remains bullish as buyers continue to dominate. If current support levels hold, Solana could lead the next leg of the crypto market recovery.