Institutional Capital Flows Into Solana Ecosystem

As institutions speed up their buying, Solana is trading close to $234. Pantera Capital said it would invest $1.1 billion, which makes Solana’s bullish case stronger. FalconX took out more than 413,000 SOL worth $98.4 million from exchanges. This shows that institutions want to keep tokens outside of places where they can be easily traded.

Analysts see the moves as a way to get ready for ETF changes. Strong inflows show that Solana is becoming more widely accepted as a legitimate institutional-grade digital asset around the world. These actions support bullish expectations, and the overall mood in the Solana ecosystem is becoming more favorable to scenarios where prices keep going up.

Spot ETF Speculation Strengthens Solana Bullish Outlook

There is more and more talk that the US SEC might approve spot Solana ETFs before the end of 2025, even though other applications have been delayed recently. Traders think that Bitcoin’s ETF success plan will work again, which could lead to a lot of people wanting Solana once it gets approved.

Technical analysts say that $239 is a very important level. If the price breaks above $250, it could start a rally toward $500, and if the ETF confirms it, the price could reach $1,000. A lot of buying and speculation together make a strong case for Solana’s long-term upside potential.

Technical Breakouts Could Push SOL to New Highs

The way the price is structured shows that it could break out. Analysts say that breaking through the $239 resistance level is what caused the parabolic move up. Momentum indicators are helpful. Heavy accumulation makes bullish conviction stronger. Breakouts could free up cash, speeding up rallies beyond their initial targets.

The news about ETFs is still the most important thing. Resistance may slow down momentum if it doesn’t get regulatory approval. However, the way institutions are positioning themselves suggests that they are sure that the approval will happen. Bullish targets show that there is a lot of room for growth, which makes them more appealing to investors looking for big growth stories in the crypto markets.

Recommended Article: Remittix Gains Spotlight As Solana Price Prediction Sparks Debate

Remittix Emerges As Rising Star Among Altcoins

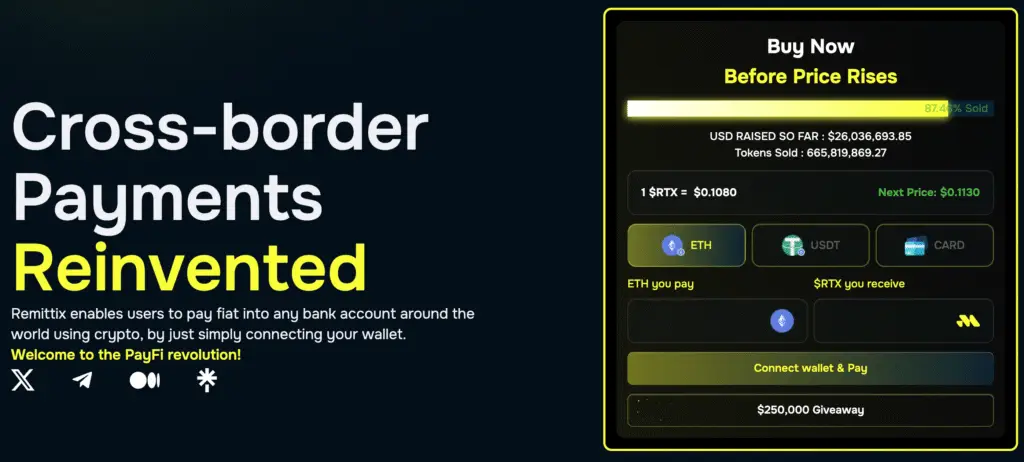

Remittix made $26 million by selling more than 665 million tokens for $0.1080, which shows that there is a lot of interest in the project. Confirmed listings on BitMart and LBank exchanges make it easier to buy and sell, which gives the market more exposure before trading becomes available to everyone.

The launch of the beta wallet gives early users safe places to store their money. The growth of the Remittix ecosystem strengthens the basic ideas behind the presale growth story. Momentum is still building, making RTX a strong candidate in the competitive global crypto market.

Increase in Security and Openness Credibility of Remittix

Remittix passed the CertiK audit, which gave it the top spot before launch and showed its commitment to transparency, compliance, and protecting investors. This kind of certification builds trust, which is important for investors who are worried about the risks of new projects that don’t have institutional oversight protections.

A referral program that gives a 15% USDT bonus encourages people to use the service. This encourages more people to take part in the presale, which will lead to more community involvement in the future. The combined measures show that the focus is on sustainability, credibility, and fairness in the growing ecosystem development pipeline.

Comparing Solana Institutional Surge and Remittix Opportunity

Solana is getting a lot of attention from ETFs and institutional investors, which could lead to big gains if the approval catalysts work out. In the meantime, Remittix gives you early access to a market that could change the way people send money around the world, which is worth trillions of dollars each year.

Investors think about the pros and cons. Solana has a proven track record and is trusted by institutions, while Remittix has a higher risk-reward dynamic overall. Diversification strategies may help balance exposure by combining the long-term strength of Solana with the speculative upside of the Remittix token.

Solana’s Rise Meets Remittix’s Disruption

Institutional interest and speculation about ETFs are setting the stage for Solana to rise toward the $1,000 mark if things go well. The $26 million presale, exchange listings, and audited transparency of Remittix make a strong case for big returns for speculative investors.

In 2025, both projects will get a lot of attention. Solana is an example of how institutions are adopting new technologies, while Remittix shows how new companies can disrupt the market. Together, they are important opportunities that will change how investors build their portfolios as the cryptocurrency market changes.