Retail Traders Seize Buying Opportunities Near $190

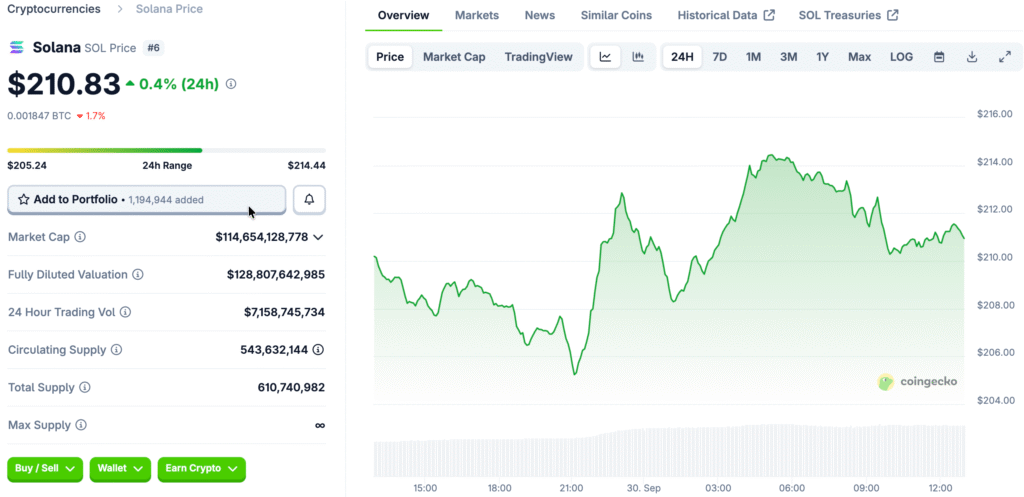

Last week, SOL’s price dropped sharply, hitting $190 before traders started buying up cheap positions quickly. This sudden rise in spot buying showed that people were becoming more sure that the correction was only a short-term setback and not a long-term decline.

Traders saw this drop as a chance to buy before a possible bullish regulatory event. ETF decisions often have a big impact on prices, so when sentiment changed from cautious to opportunistic, it sparked a new bullish trend in Solana markets.

SEC Solana ETF Decision Looms Large

Traders who are expecting big changes in the market are keeping a close eye on the SEC’s decision about the Solana ETF, which is due by October 10. If the verdict is good, it could lead to a lot of money coming in from institutions, just like past ETF-related price increases in Bitcoin and Ethereum.

The possibility of getting regulatory approval has made traders act before the decision is made. Many people are getting ready early to take advantage of any potential upside if ETF news matches what the market expects. This has added to the buying frenzy before the decision.

Volume Metrics Reveal Intense Accumulation

Cumulative volume delta data shows that retail traders were buying a lot on both Binance and Coinbase during the price drop. The spot and futures markets showed synchronized accumulation, which means that many different groups of traders were sure of the same thing.

During the sell-off, Hyblock’s True Retail Longs metric shot up from 54.3 to 78.2. This rise shows that most retail traders saw the pullback as a chance to build up their positions before the ETF catalyst.

Recommended Article: Solana Block Size Removal: Boosting Speed or Risking Control?

Order Book Dynamics Favor Buyers

The bid-ask ratio on Solana’s total spot order book rose to 0.47 at a 10% depth, which clearly favored buyers. This shows that there is a lot of demand pressure building up as traders rush to get into positions.

The anchored 4-hour cumulative volume delta data shows that there was $71.98 million in buying volume in the most recent time period. These numbers show how traders are aggressively buying up stocks in the hopes of a near-term breakout caused by changes in ETFs.

Open Interest Levels Hold Key Clues

For SOL to get back to $250, open interest on centralized exchanges and CME futures needs to get close to the levels seen during previous highs. On September 18, SOL’s CME futures open interest reached $2.12 billion, and the volume reached $1.57 billion.

Open interest is still below those highs right now, but traders are keeping a close eye out for signs of leverage buildup. If prices rise back to where they were before, it could mean that speculative momentum is in line with bullish spot activity, which could lead to a big rally.

Institutional and Retail Flows Converge

The combination of institutional interest and retail excitement is making a strong case for the ETF decision. Institutional traders often buy in before big news comes out, while retail buyers make bigger moves by chasing momentum.

If both groups keep buying during the decision window, Solana’s price could go up very quickly. In the past, this mix of smart money positioning and retail hype has come before big altcoin breakouts in bullish regulatory environments.

Solana Gains During U.S. Sessions Signal Growing Regional Bullishness

Since Friday, SOL’s cumulative returns during U.S. trading sessions have been positive, showing that traders in the region are feeling more hopeful. During U.S. market hours, ETF decisions usually cause big moves, so this is an important time.

Analysts are keeping an eye on whether the APAC and EU sessions start to look like the U.S. sessions. If global sessions line up, it could mean that a lot of people are feeling bullish, which would be the perfect time for SOL to try to break through $250 before the ETF announcement.