Shiba Inu Price Reacts Strongly to Federal Reserve Rate Cuts

When the Federal Reserve lowers interest rates, it often makes speculative assets more valuable. This puts money into risky markets where meme tokens like Shiba Inu do very well. Current dovish policies make it easier for SHIB to go up, and investors are moving money from bonds to high-yield cryptocurrencies in general.

On the other hand, raising interest rates makes liquidity tighter, which hurts speculative markets and slows the growth of meme coins. This shows how macroeconomic trends affect the outlook for tokens. Shiba Inu investors keep a close eye on changes in central bank policy because they know they have a big impact on short-term market volatility.

Upcoming Federal Reserve Decision Marks Critical Moment for Shiba Inu

The next FOMC decision, which is set for September 17, is very important for traders who think SHIB’s momentum will continue. The odds in the market are still split because of inflation and labor data, so the outcome is still unclear because the economy is still complicated.

A surprise cut could start new speculative rallies, while a hawkish policy stance could limit SHIB’s upside potential by a large amount. Traders are ready for price swings, and Shiba Inu is ready to respond quickly if macroeconomic sentiment changes.

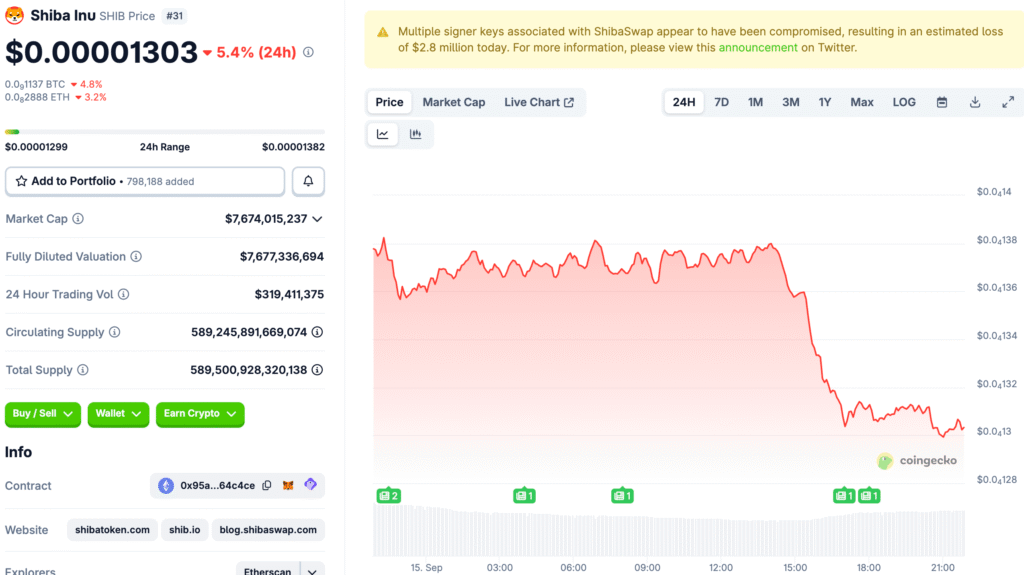

Shibarium Bridge Hack Raises Concerns About Ecosystem Security Today

Even though the economy is doing well, SHIB recently had to deal with ecosystem risks after a $2.4 million hack of the Shibarium bridge infrastructure. The attacker took control of validator governance for a short time before developers stepped in, freezing assets and restoring some operational security.

Even though the response was quick, the exploit hurt market confidence and showed weaknesses that made already skeptical investor groups even less likely to trust the market. These kinds of things make it harder for Shiba Inu to be credible and make it harder to reach ambitious price goals.

Recommended Article: Shiba Inu Faces Uncertain Future Amid Market Volatility

Technical Analysis Confirms Bullish Breakout From Consolidation Range

Prices rose from $0.00001200 to $0.00001429 before falling back down. Charts show SHIB breaking above Bollinger bands and moving averages. Heikin Ashi candles show mixed pressure, which means that people were both eager to buy and taking profits in the most recent trading sessions.

Support is close to $0.00001350, resistance is at $0.00001500, and the next upside target is clearly visible at $0.00001700. Widening Bollinger bands show that volatility is increasing, which means that more moves could happen if buying momentum picks up again soon.

Analysts Debate Realistic Possibility of Shiba Inu Reaching $1

SHIB needs to grow seventy thousand times to reach $1 at its current price of about $0.000014. This means that the market cap would be trillions of dollars. These numbers are higher than the world’s crypto markets and GDP, which means that the target is not mathematically possible with the current supply structures unless there are major changes to the tokenomics.

Developers are trying out different ways to burn coins, but the scale needed for $1 is still not realistic, which makes it less likely to happen even though investors are excited. Experts say that more realistic milestones should be set, with historical highs near $0.00008 as realistic cycle targets instead.

Market Forecasts Suggest Incremental Gains Across Upcoming Trading Cycles

The short-term outlook suggests that the price will test the $0.00001500–$0.00001700 resistance level. If it breaks through, it could move toward the $0.00002000 level. If Bitcoin leads the market in 2025, medium-term forecasts say that cycle highs will be around $0.00005 to $0.00008.

Long-term predictions mostly ignore one-dollar scenarios that don’t involve big burns, instead predicting slow, steady increases in value. Speculative cycles and retail hype are still the main things that support realistic growth paths into the future.

Shiba Inu Remains a Speculative Play Amid Macro Liquidity Conditions

Shiba Inu is a speculative investment that benefits from dovish macro policies, a culture based on memes, and retail investors during bullish cycles. Current momentum fits with the general risk-on mood, which is drawing in traders who want to invest in crypto markets with high-volatility assets.

Still, there are still a lot of risks, like regulatory issues and weaknesses in the ecosystem, so expectations for long-term value growth should be tempered. Because of this, analysts say that $1 is out of reach and suggest that investors focus on shorter-term goals that can be reached in the next market cycles.