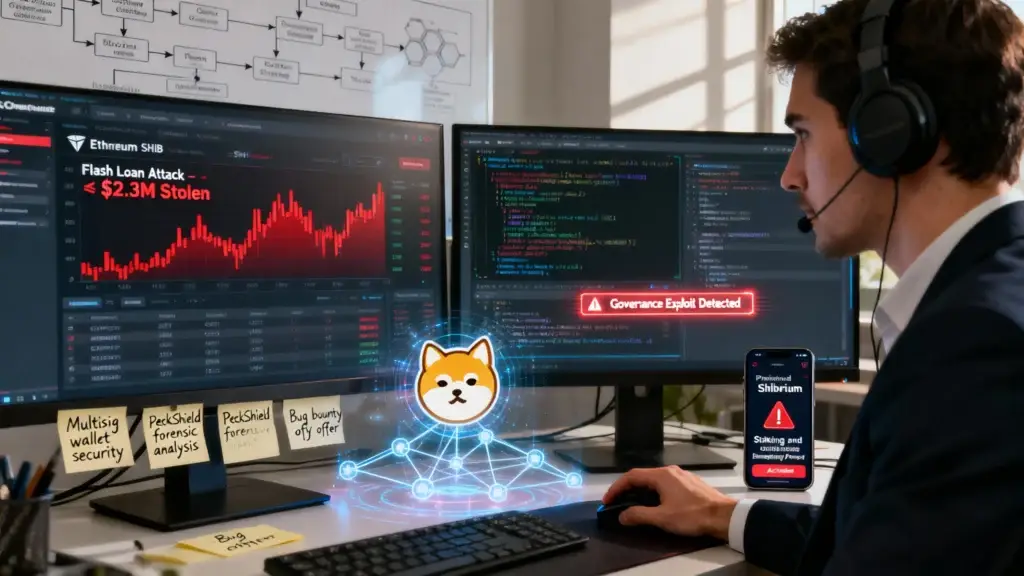

Big Flash Loan Attack Hits Shibarium Network

Shiba Inu’s Layer-2 network, Shibarium, was hit by a flash loan attack that temporarily made it impossible for validators to govern the network and let bad code run. The exploit happened in one transaction block, showing how temporary liquidity changes can change consensus thresholds and get around security protocols.

Attackers used flash loans of BONE tokens to gain temporary control over validators, briefly going over the two-thirds majority needed for governance actions. This sudden change in power made it possible for unauthorized proposals and malicious deployments to happen, which led to asset drains across many connected parts.

Assets Drained From The Bridge Include Ethereum And SHIB

Attackers took 224.57 Ethereum worth $1.03 million and 92.6 billion SHIB worth $1.27 million from Shibarium’s bridge. Other ecosystem tokens, like LEASH, TREAT, and SHIFU, were affected by the breach, but they are still not moving or being sold.

The attacker paid back the flash loan principal with stolen Ether and SHIB, showing how theft can fund ongoing bad behavior. On-chain analytics backed up these movements, and developer communications matched up with community reports to put together the exact order of events.

Flash Loans Exploited to Distort Governance Authority

Flash loans give attackers quick access to a lot of money, which lets them change governance mechanisms by quickly buying a lot of tokens. Attackers pushed proposals and upgrades through without getting permission from the community stakeholders because voting power briefly went over validator thresholds.

This shows that there are trade-offs in the design between decentralized speed and systemic security, where temporary financial power can mess up governance and protocol integrity. Future improvements must focus on balancing fast transaction execution with strong security measures that protect against attacks that are only temporary and based on liquidity.

Recommended Article: Shiba Inu Faces Uncertain Future Amid Market Volatility

Immediate Developer Response To Limit The Breach

In response, developers stopped staking and unstaking functions so they could focus on protecting community assets and quickly put emergency control measures in place. Funds for the validator stake manager were sent to a secure hardware multisig wallet that needed six of nine signatures to approve transactions.

We hired outside companies, like PeckShield, a blockchain security company, to do forensic analysis and make things clear for people in the affected community. The partnership shows that Shiba Inu is committed to quickly responding to crises and making long-term improvements to the security of the ecosystem after major events.

What Ecosystem Leaders Have Said About the Breach

Kaal Dhairya, a developer, said that both Shiba Inu’s internal and external teams are looking into what caused the problem so that it can be fixed for good. He stressed that user safety should come first and assured the ShibArmy that protective measures are still in place.

Dhairya made an unusual offer to the attacker: if they return the money, they might not have to face charges. This offer includes a small bounty, which shows a realistic way to get the money back and reassure the community.

Investor Confidence Impact and Community Reaction

The exploit could hurt investors’ faith in Shibarium’s long-term viability, especially since Shiba Inu is pushing for more people to use it. Security breaches show how important it is for decentralized ecosystems to have strict governance models and proactive ways to talk to each other.

Even though there have been problems, Shiba Inu has a loyal ShibArmy community that wants to help it recover and stay relevant around the world. Community leaders have acted quickly, stressing resilience and encouraging hope while pushing developers to make the platform more secure.

Shiba Inu Breach Exposes Governance Vulnerabilities

The breach at SHIB shows that relying too much on stake-weighted governance without extra layers of systemic defense mechanisms can be dangerous. Time-locked governance, quorum requirements, and circuit breakers that automatically pause important actions are some of the suggested improvements.

Separating governance control from upgrade pipelines could lower the risk of malicious code being deployed without being checked when there is a temporary surge in liquidity. To get investors to trust you again and keep decentralized networks safe from being hacked again, you need to use layered safeguards.