Sharps Technology Broadens Its Approach to Solana

Sharps Technology has revealed a strategic alliance with BONK, utilizing BonkSOL to stake segments of its Solana assets. The agreement integrates treasury management with on-chain liquidity, boosting flexibility while ensuring continued involvement in network consensus. Through the integration of liquid staking, Sharps demonstrates a strong belief in the robustness of Solana’s infrastructure and the resilience of tools developed by the community.

Sharps oversees over two million SOL in its digital asset treasury, indicating significant institutional involvement. With BonkSOL, the company is able to generate staking rewards while maintaining the flexibility of transferable liquidity for trading, hedging, or collateral purposes. This combination enhances both yield generation and operational flexibility, bolstering risk management throughout fluctuating market conditions.

An Overview of BonkSOL Liquid Staking

BonkSOL enables SOL holders to deposit their tokens, obtain a liquid representation, and seamlessly utilize that derivative within various DeFi applications. Participants enjoy staking rewards while maintaining flexibility, sidestepping the potential drawbacks of completely locked validator roles. The tradable nature of the tokenized stake allows participants to adjust their portfolios seamlessly, avoiding unbonding delays and preserving their rewards.

Liquid staking brings predictable returns to treasuries, enhancing capital efficiency and ensuring greater transparency in treasury operations. This also enhances on-chain liquidity as derivative tokens move through lending markets, automated market makers, and structured products. The interplay of these dynamics fosters network effects that enhance price discovery, narrow spreads, and strengthen the overall market microstructure.

Treasury Scale and Institutional Support

Sharps raised over $450 million to acquire SOL, with Cantor Fitzgerald and crypto investors supporting. ParaFi Capital and Pantera Capital strengthened governance expectations and reporting rigor. Institutional validation attracted service providers, auditors, and liquidity partners, expanding counterparties.

Aligning with BONK enhances Sharps’ toolkit and connects to Solana’s economic engine. This allows treasuries to manage redemptions, market disruptions, and macroeconomic news without forced selling, reducing volatility and valuing it in uncertain monetary policy environments.

Recommended Article: Sharps Expands Solana Treasury via BonkSOL Staking Pact

The Ecosystem and Cultural Momentum of BONK

BONK, a memecoin, has evolved from a mere meme to a significant cultural force in Solana. It features BONKBot, creator-centric platforms, and diverse distribution channels. The ecosystem’s variety leads to strategic partnerships and reusable components, enhancing network engagement.

BONK infrastructure transforms memecoins into functional frameworks, benefiting treasuries by directing attention and liquidity. Sharps’ collaboration highlights the interplay between culture and finance, demonstrating how they can mutually enhance in open, programmable settings.

Exploring the Expansion of Staking and Its Impact on Liquidity

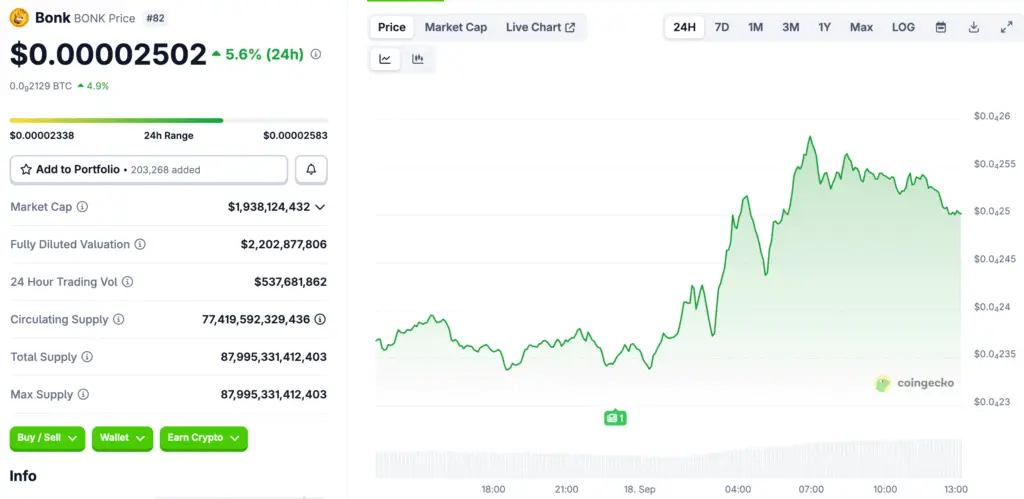

Since the launch of BonkSOL, almost two hundred thousand SOL have been staked, enhancing the depth of circulating liquidity. The market capitalization of BONK continues to be substantial, even in the face of drawdowns, maintaining activity that bolsters the utility of derivative tokens. With the increase in liquidity, the quality of execution enhances, providing advantages for treasuries and retail participants involved in regular portfolio management.

Liquid staking has the potential to alleviate systemic stress during periods of volatility by spreading collateral across various interoperable platforms. This distribution allows for a smoother deleveraging process during price declines, as assets continue to be productive and adaptable. The features contribute to reducing cascading liquidations, thereby enhancing the overall market stability for instruments associated with Solana.

Examining Other Solana Treasury Actions

Sharps’ strategy reflects wider trends seen in Solana-centric treasuries that are seeking partnerships aligned with memecoins. For instance, initiatives involving Dogwifhat implemented validator operations and community reward sharing to ensure alignment of incentives. These programs go further than just branding; they integrate treasuries into the daily user experience and the economics of validators.

Emerging strategies indicate that memecoin ecosystems are now playing essential roles in liquidity provisioning and distribution. As these roles develop, the variety of counterparties grows, and reliance on individual venues diminishes. The outcome is a more robust foundation for developing yield strategies, hedges, and growth experiments that align with community interests.

Aligning Community Values and Future Perspectives

Key contributors emphasize the importance of returning value to grassroots communities through clear processes and collective benefits. This aligns with treasuries aiming for lasting goodwill, developer engagement, and consistent liquidity. Collaborations that enhance cultural influence and financial effectiveness can establish strong barriers across multiple market cycles.

Sharps and BONK’s performance will be evaluated based on execution, risk management strategies, and tangible liquidity results. The current collaboration represents an investment in Solana’s culture, tools, and advanced treasury management, potentially paving the way for additional alliances between established companies and rising meme coin environments.