XRP Rises Above $3 as Hope Grows

Ripple’s XRP has surpassed $3, attracting interest in crypto markets due to its growing partnerships and cross-border payment system. However, investors are acting in unexpected ways, indicating a balance between optimism and caution. Blockchain data shows that money is leaving XRP and moving to new projects, with institutional investors and whales investing in alternative investments.

This trend demonstrates that market leaders can be challenged by new, disruptive companies, despite Ripple’s already strong position. Market analysts believe this demonstrates how traders navigate market changes.

Ripple Takes Advantage of Legal and Regulatory Momentum

The US GENIUS Act bill has clarified rules for stablecoin issuers, benefiting Ripple with its RLUSD stablecoin launch. A U.S. banking license application is ongoing, indicating potential future growth. Clear rules often attract more institutional participation.

Rumors suggest XRP may receive ETF approval, potentially causing new institutional flows. Integrating RLUSD will enhance Ripple’s long-term position in the global financial system, making it a leader in integrating traditional finance and blockchain technology.

Market Limits Weigh on XRP’s Upside

XRP’s potential for growth is still limited by its maturity, even though things are looking good. With a market cap of $178 billion, it is becoming less likely that prices will rise quickly. Investors now think that small gains are the most likely outcome. Experts say that mature assets tend to have fewer price swings than smaller speculative tokens.

Ripple may seem too established for people who want to see their investments grow quickly. Analysts say that its size keeps volatility-driven price spikes from happening. This reality makes investors move their money to new options that have a better chance of making money. Investors say that new projects often lead to faster innovation and better risk-reward ratios.

Recommended Article: Cardano And Remittix Poised For Breakout Moves This Week

Remittix Emerges as XRP 2.0 Challenger

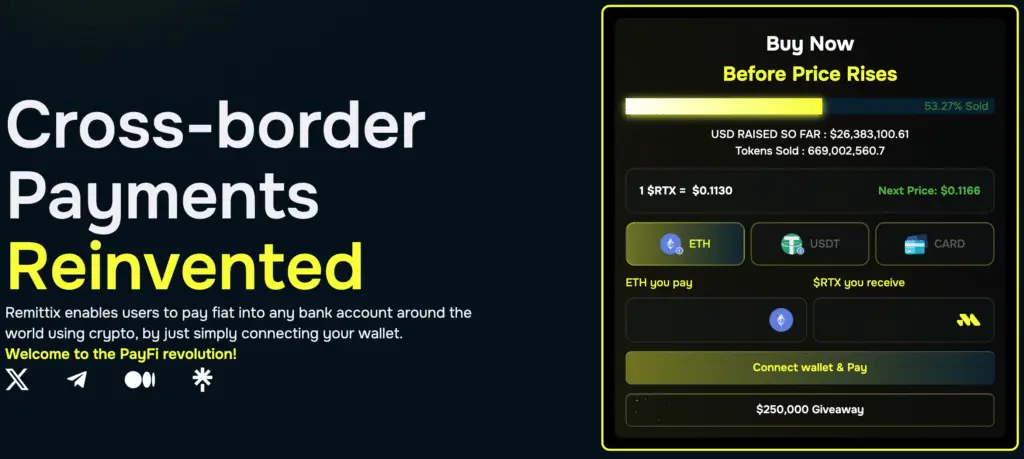

Remittix, also known as “XRP 2.0,” is a platform that focuses on payments and retail transactions, unlike Ripple. It connects blockchain to local bank networks, allowing more users from different groups to participate.

With over 40 cryptocurrencies, it allows money transfers from a cryptocurrency to a bank in over 30 countries. This broad focus opens up opportunities for wider use, making Remittix a more useful everyday solution than a niche platform.

Bridging the $19 Trillion Payment Gap

Remittix claims to be the answer to the $19 trillion global payment gap. It makes cross-border payments easy and cheap by connecting local businesses with people who own crypto. Its technology makes it easy for fiat and digital assets to work together. This bridging role shows that more and more people want global remittance processes to be easier.

Remittix’s APIs let businesses and freelancers add crypto payments to their websites. This ease of access makes it more likely that a lot of people will use it. Market watchers say that this feature sets XRP apart from other cryptocurrencies. Developers say that these integrations give regular businesses the power to use blockchain technology.

Security and Incentives Bolster Investor Confidence

Remittix has undergone a CertiK audit, enhancing trust in its ecosystem. The platform has locked team tokens and liquidity for three years, reducing the risk of rug pulls. This transparency in tokenomics builds trust over time and reduces speculation. Remittix also offers a referral program with 15% USDT bonuses, encouraging network and viral growth.

The platform is open to all, regardless of cryptocurrency experience, and has historically used incentives to encourage early adoption by rewarding community members. This approach has proven successful in attracting more users to Remittix.

Outlook: Will Remittix Outperform XRP?

Ripple is still important to institutions as long as XRP is trading above $3. But more and more investors looking for big returns are turning to Remittix. Early adopters are drawn to it because of its useful solutions and growth incentives. Analysts say that this change shows that investors are more interested in new projects with untapped potential.

Remittix’s appeal to both businesses and people makes it more likely to be used. Some analysts say it could do better than XRP’s slow growth path. In the next few months, we’ll find out if RTX lives up to its “XRP 2.0” name. Future performance will depend on continued growth, clear rules, and steady user adoption.